Africa Air Filter Market Size

Africa Air Filter Market Analysis

The Africa Air Filter Market size is estimated at USD 0.33 billion in 2025, and is expected to reach USD 0.46 billion by 2030, at a CAGR of 6.85% during the forecast period (2025-2030).

- Over a short span, rising automobile numbers and the expansion of industries, notably petrochemicals and refining, have spurred emissions. This surge has made the adoption of air filtration systems imperative for meeting environmental standards, a trend poised to bolster the market during the forecast period.

- On the other hand, small and medium-sized enterprises, often operating on tight budgets, find the substantial financial investment required for advanced air filtration systems to be a significant barrier. are expected to restrain the air filter market during the forecast period.

- Nevertheless, manufacturers are seizing the opportunity to develop and market eco-friendly air filters, and responding to the global push for sustainability is expected to create market opportunities for the air filter market.

- South Africa is expected to dominate the market in the forecast period owing to the use of air filters in growing industrial sector.

Africa Air Filter Market Trends

HEPA filters are Expected to Witness Significant Demand

- As urban centers and industrial bases expand across Africa, air pollution has emerged as a critical challenge. In response, the demand for HEPA (High Efficiency Particulate Air) filters is surging in the continent's air filtration market. Capable of trapping 99.97% of particles sized 0.3 microns and above, HEPA filters are becoming essential for enhancing air quality.

- IQAir, a Swiss air quality technology firm, reports that in 2024, half of Africa's top ten most polluted countries, based on annual average PM2.5 concentrations, are in the continent. Chand leads with an annual average PM2.5 concentration of 91.8 μg/m³, trailed by the Democratic Republic of Congo at 58.2 and Uganda at 41. Given this escalating pollution, there's a heightened push for air filtration units, especially HEPA filters, across the region.

- HEPA filters play a crucial role in hospitals and clinics striving to uphold sterile environments. With African nations channeling investments into healthcare infrastructure, the demand for medical-grade air purification systems is on the rise. As of February 2024, the African Medical Centre of Excellence (AMCE) has embarked on a USD 750 million venture in Abuja, Nigeria's capital. The ambitious project aims to establish a 500-bed hospital, poised to serve both secondary and tertiary healthcare needs, signaling a likely surge in demand for air filtration systems in the near future.

- Further, In a bid for cleaner industrial emissions and improved indoor air standards, several African nations are rolling out new regulations. Meeting these standards frequently necessitates the adoption of advanced filtration systems, such as HEPA.

- Data from the National Institutes of Health highlights a pressing concern: as of 2024, over 80% of Africa's populace grapples with household air pollution. This challenge disproportionately affects women and children. Limited exposure-response studies underscore household air pollution as a predominant factor driving both acute and chronic respiratory ailments across the continent. Given this backdrop, the demand for HEPA filters is set to escalate in the coming years.

- In summary, the Africa air filtration market is poised for a surge in demand for HEPA (High Efficiency Particulate Air) filters in the coming years.

South Africa to Witness Significant Growth

- South Africa's air filtration market is witnessing a surge, driven by factors such as industrialization, urbanization, and heightened awareness of the health impacts of air pollution.

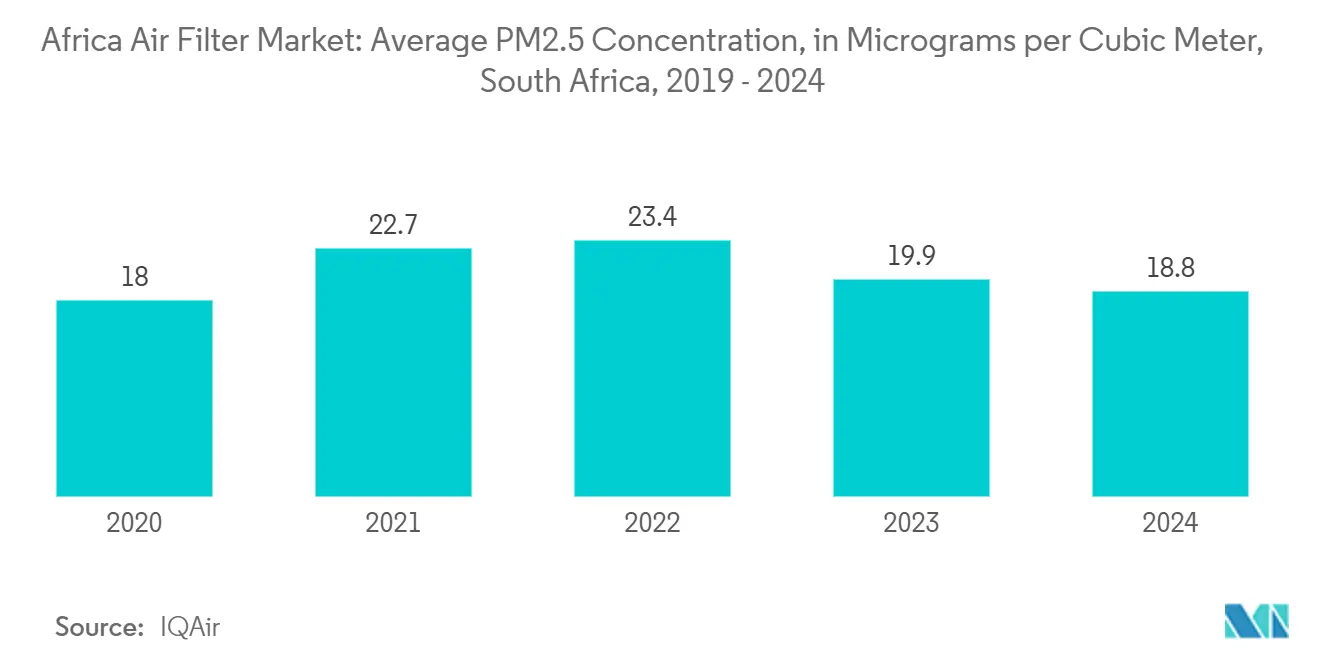

- As reported by IQAir, a Swiss air quality technology firm, in 2024, South Africa ranks as the 47th most polluted nation globally, with an annual average PM2.5 concentration of 18.8 μg/m³. While this concentration has seen a decline from previous years, it remains elevated, underscoring the country's growing need for air filtration units.

- In a bid to enhance air quality, the South African government has rolled out regulations targeting pollution reduction. These initiatives have prompted industries to embrace advanced filtration technologies. Moreover, the burgeoning growth of sectors like manufacturing, healthcare, and construction, coupled with an increasing emphasis on environmental stewardship, has amplified the demand for these technologies.

- In July 2024, South African President has enacted a comprehensive climate change law, imposing emission caps on major polluters and mandating every municipality to devise an adaptation strategy. This pivotal legislation not only sets emission thresholds for significant polluters but also compels local governments to formulate strategies for climate adaptation. By introducing carbon budgets for sectors with high emissions, the law seeks to resonate with the objectives of the Paris Agreement.

- Morover, Environmental concerns, especially about urban air quality, have spurred businesses and consumers alike to invest in air filtration systems, catering to both industrial and residential needs. A leading air filtration firm has rolled out several initiatives and made strategic acquisitions, aiming to bolster its presence in the industrial and mobile filtration arenas.

- Take, for instance, on November 21, 2024, Hifi Filter sealed the deal to acquire FILVENT Holdings, a prominent name in South Africa's filtration market. This move underscores Hifi Filter's ambition to broaden its global footprint, marking its inaugural venture into Africa. Founded in 1991 and headquartered in eMalahleni (Witbank Mpumalanga) close to Pretoria, FILVENT's acquisition paves the way for Hifi Filter to tap into the burgeoning Southern African market. By bringing FILVENT into the fold, Hifi Filter is bolstering its distribution network, seamlessly integrating a pivotal player from the industrial and mobile filtration domain.

- In summary, South Africa's air filtration market has indeed been experiencing significant growth during the forecast period.

Africa Air Filter Industry Overview

The African air filter market is semi-consolidated. Some of the major players in the market (in no particular order) include Cummins Inc., Panasonic Corporation, Daikin Industries, Ltd., Honeywell International Inc., and MANN+HUMMEL Group, among others.

Africa Air Filter Market Leaders

-

Cummins, Inc

-

Panasonic Corporation

-

Honeywell International Inc.

-

MANN+HUMMEL Group

-

Daikin Industries, Ltd.

- *Disclaimer: Major Players sorted in no particular order

Africa Air Filter Market News

- February 2025: Thermo Fisher Scientific Inc. inked a definitive deal to acquire Solventum's Purification & Filtration business, shelling out around USD 4.1 billion in cash. This Purification & Filtration unit, which offers filters and membranes pivotal for biopharmaceutical and medical technology manufacturing, boasts a global presence, with operations spanning continents, including a facility in Pretoria, South Africa.

- March 2025: MANN+HUMMEL, a leading filtration specialist, proudly unveiled its newest manufacturing plant in Kempton Park, just outside Johannesburg. The company offers a diverse range of filtration solutions catering to industries such as water, agriculture, mining, medical, food and beverage, as well as healthcare and pharmaceuticals.

Africa Air Filter Industry Segmentation

Air filters, made from fibrous or porous materials, effectively eliminate solid particles like dust, pollen, mold, and bacteria from the air. Additionally, filters with adsorbents or catalysts, such as charcoal, can remove odors and gaseous pollutants, including volatile organic compounds and ozone. These filters play a crucial role in applications prioritizing air quality, especially in building ventilation systems and engines.

The African air filter market is segmented by type, end-users, and geography. By type, the market is segmented into cartridge filters, dust collectors, HEPA filters, baghouse filters, and other types. By end users, the market is segmented into residential, commercial, and industrial. The report also covers the market size and forecasts for the air filters market across major countries in the region.

For each segment, the market sizing and forecasts have been done based on revenue (USD).

| Type | Cartridge Filters |

| Dust Collectors | |

| HEPA Filters | |

| Baghouse Filters | |

| Others | |

| End User | Residential |

| Commercial | |

| Industrial | |

| Geography | Algeria |

| Nigeria | |

| Angola | |

| South Africa | |

| Egypt | |

| Kenya | |

| Rest of Africa |

| Cartridge Filters |

| Dust Collectors |

| HEPA Filters |

| Baghouse Filters |

| Others |

| Residential |

| Commercial |

| Industrial |

| Algeria |

| Nigeria |

| Angola |

| South Africa |

| Egypt |

| Kenya |

| Rest of Africa |

Africa Air Filter Market Research Faqs

How big is the Africa Air Filter Market?

The Africa Air Filter Market size is expected to reach USD 0.33 billion in 2025 and grow at a CAGR of 6.85% to reach USD 0.46 billion by 2030.

What is the current Africa Air Filter Market size?

In 2025, the Africa Air Filter Market size is expected to reach USD 0.33 billion.

Who are the key players in Africa Air Filter Market?

Cummins, Inc, Panasonic Corporation, Honeywell International Inc., MANN+HUMMEL Group and Daikin Industries, Ltd. are the major companies operating in the Africa Air Filter Market.

What years does this Africa Air Filter Market cover, and what was the market size in 2024?

In 2024, the Africa Air Filter Market size was estimated at USD 0.31 billion. The report covers the Africa Air Filter Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Africa Air Filter Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Africa Air Filter Industry Report

Statistics for the 2025 Africa Air Filter market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Africa Air Filter analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.