Automotive Wheel Market Size and Share

Automotive Wheel Market Analysis by Mordor Intelligence

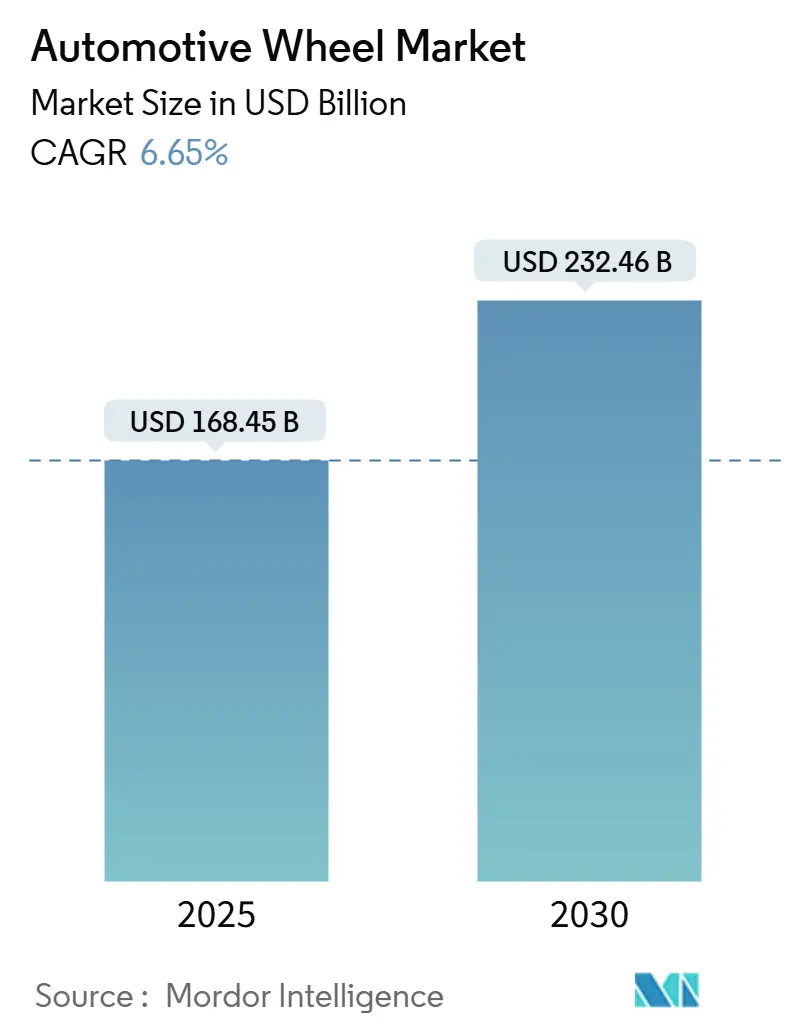

The automotive wheel market size is valued at USD 168.45 billion in 2025 and is projected to reach USD 232.46 billion by 2030, advancing at a 6.65% CAGR. Rising electric vehicle adoption, stricter emissions ceilings, and a flourishing custom-wheel aftermarket collectively expand procurement budgets for advanced materials and processes. Suppliers with expertise in weight-optimized designs and tight supply-chain control are steadily increasing their automotive wheel market share as OEMs pursue efficiency and styling gains. Continued consolidation is likely, yet technology-rich specialists in carbon fiber, smart sensors, or surface treatments still command premium valuations in this evolving automotive wheel industry.

Key Takeaways

- Passenger cars will retain the largest automotive wheel market share, at 57% in 2024, while battery-electric passenger cars will post the fastest segment CAGR of 8.8 % to 2030.

- Aluminum alloy wheels command the highest material market share at 46%, whereas carbon fiber wheels accelerate quickly with a 12.6% CAGR.

- Casting dominates manufacturing processes with 68% market share, yet flow-forming outpaces all other processes at a 9.4% CAGR.

- The 16-18-inch rim class leads with a 37% share, while wheels larger than 21 inches expand at the fastest 6.6% CAGR.

- In 2024, the internal combustion engine (ICE) had a 78% share of the automotive wheel market. Battery Electric Vehicles (BEVs) are the fastest-growing propulsion segment, with an estimated CAGR of 17.5% from 2025 to 2030.

- OEMs dominated the sales channel with an 84% market share in 2024, whereas the aftermarket segment is growing fastest at a CAGR of 6.3% from 2025 to 2030.

- Powder-coated wheels held a 62% share of the automotive wheel market in 2024, while diamond-cut/machined finishes are the fastest-growing segment, with an estimated CAGR of 9.8% from 2025 to 2030.

- Asia-Pacific remains the production stronghold with a 53% share, but the Middle East region witnessed the steepest 7.1% CAGR, reflecting rising luxury-SUV demand.

Global Automotive Wheel Market Trends and Insights

Drivers Impact Analysis

| Driver | Qualitative Impact | (~) Percentage Point Impact on Market CAGR | Geographic Relevance | Impact Timeline |

|---|---|---|---|---|

| EV Lightweighting Needs | Strong | + 1.8 | Global, early adoption in Europe and North America | Medium term (3-4 years) |

| Custom-Wheel Aftermarket Boom | Moderate | + 1.2 | North America, Europe | Short term (≤ 2 years) |

| EU CO₂ Compliance | Moderate | + 0.9 | Europe, spill-over to global markets | Long term (≥ 5 years) |

| Low-Pressure Casting Scaling | Strong | + 1.5 | Asia-Pacific, particularly China | Short term (≤ 2 years) |

| Autoclave-Free RTM | Moderate | + 0.8 | Global, early gains in Australia and North America | Medium term (3-4 years) |

| Advanced Wheel Sensor Integration | Moderate | + 1.0 | Global, led by premium segments in North America and Europe | Medium term (3-4 years) |

Source: Mordor Intelligence

EV Lightweighting Accelerates Advanced Material Adoption

Battery-electric vehicles add significant mass, so manufacturers are racing to trim unsprung weight, and wheels present a logical starting point. Carbon fiber wheels improve vehicle range by roughly 5% to 8% compared with cast aluminum, and that tangible benefit has amplified their marketing appeal in premium EV nameplates. Production ramp-ups at specialist suppliers demonstrate that scale economics are beginning to erode the historical cost gap, hinting that mid-luxury adoption may arrive sooner than anticipated. A further implication is that alloy wheel makers invest in hybrid composite designs to defend their share, blending aluminum hubs with carbon fiber barrels to achieve intermediate performance gains.

Custom-Wheel Aftermarket Boom Driven by North American Pickup and SUV Owners

A surge in personalization spending among pickup and SUV owners is expanding the aftermarket’s revenue pool, particularly for 16-18-inch and larger-than-21-inch rim categories. Consumers increasingly equate wheel upgrades with both status signaling and functional gains such as off-road durability, nudging retailers to widen their SKU assortments. This trend has already convinced several established foundries to install flexible flow-forming lines capable of quick design swaps, an operational shift that shortens replenishment cycles for fashion-driven styles. An immediate knock-on effect is that wheel e-commerce platforms now carry deeper inventories, strengthening price transparency and subtly compressing retailer margins.

Flow-Forming Technology Revolutionizes Mid-Market Wheel Production

Flow-forming, which combines casting and forging steps, yields wheels that are 15% to 20% lighter than standard cast alternatives at a modest cost premium [1]

. The process produces a refined grain structure that increases strength, allowing thinner rim sections and lower material input. As major suppliers publicize double-digit weight savings under proprietary trade names, OEM engineering teams are re-specifying flow-formed wheels on upcoming trims, particularly for volume EV platforms. The commercial takeaway is that flow-forming is no longer a niche method; it is rapidly becoming mainstream for mid-priced vehicles that still target ambitious efficiency targets.

Autoclave-Free Manufacturing Reduces Carbon Fiber Wheel Costs

High-pressure resin transfer molding (HP-RTM) removes expensive autoclave steps, cutting energy use by roughly one-third and slashing cycle times to minutes. Early production data show that these savings translate into about 20% annual cost reductions, materially improving the payback calculus for carbon fiber investments. The technique also shortens design validation loops because temperature-controlled presses offer tighter process repeatability, enticing OEMs that value consistent surface aesthetics. An inferred consequence is that tooling amortization schedules are falling, letting suppliers launch limited-edition designs more frequently without jeopardizing profitability.

Restraints Impact Analysis

| Restraint | Qualitative Impact | (~) Percentage Point Impact on Market CAGR | Geographic Relevance | Impact Timeline |

|---|---|---|---|---|

| Volatile Aluminum Prices | Strong | -1.2% | Global | Short term (≤ 2 years) |

| EU Particulate Regulations | Moderate | -0.7% | Europe, potential expansion elsewhere | Medium term (3-4 years) |

| Carbon Fiber Tooling CAPEX | Weak | -0.4% | Global | Long term (≥ 5 years) |

| Supply Chain Disruptions for Specialty Alloys | Moderate | -0.8% | Global, acute in Asia-Pacific | Short term (≤ 2 years) |

Source: Mordor Intelligence

Volatile Aluminum Prices Challenge OEM Margin Planning

Aluminum spot prices have swung by as much as 30% within single-year windows, forcing wheel makers to hedge metals positions and renegotiate supply contracts more frequently. Larger integrated producers cushion volatility through captive smelters, but smaller firms carry higher working-capital risk, an imbalance that invites consolidation. Some OEMs respond by adding steel or hybrid material options in entry trims to protect transaction prices, which subtly repositions aluminum wheels as a mid-tier upsell. The ongoing uncertainty also stimulates interest in recycled aluminum feedstock, which can enhance price-competitive and green credentials.

EU Particulate Regulations Impact Wheel Coating Technologies

Euro 7 rules now cover non-exhaust particulate emissions, so wheel finishes must demonstrate lower abrasion and particulate shedding. Powder coating, already known for durability, is gaining ground because it satisfies the new standard with only a modest 5% to 10% cost increase. Diamond-cut and chrome finishes face steeper compliance expenses, causing some manufacturers to re-engineer surface treatments to avoid future retrofit costs. The policy shift indirectly promotes innovation in low-VOC chemistry, suggesting coating suppliers will become more integral to wheel development programs.

Segment Analysis

By Vehicle Type: EVs Drive Innovation in Passenger Car Wheel Design

Market size data indicate that passenger cars held a 57% automotive wheel market share in 2024, and the sub-segment of battery-electric passenger cars is projected to post an 8.8% CAGR to 2030. These electric models require wheels with higher load ratings yet lower mass, spurring design blueprints that integrate aerodynamic covers and heat-dissipating spoke patterns. OEMs also specify narrow face profiles to reduce drag, a preference that trickles down to crossover and compact-SUV designs faster than historical platform cycles. Notably, the replacement interval for EV wheels is lengthening because regenerative braking lessens thermal stress, which may slightly temper aftermarket demand.

Light commercial vehicles display a growth uptick that parallels e-commerce parcel traffic, and many fleet operators now favor flow-formed aluminum over steel to improve payload efficiency without sacrificing robustness. Heavy trucks remain anchored to steel platforms, but pilot programs exploring forged aluminum rims on long-haul tractors suggest an incremental shift could capture fuel savings at scale. Off-highway machinery demands thicker flanges and reinforced bead seats, so suppliers often cross-license agricultural tread patterns, illustrating how wheel developers borrow features across verticals. These dynamics imply that segment-specific engineering talent will become a hiring priority for manufacturers.

Note: Segment shares of all individual segments available upon report purchase

By Material Type: Carbon Fiber Emerges as Premium Alternative to Aluminum

In 2024, aluminum alloy wheels commanded 46% of the automotive wheel market share, reflecting their cost-to-performance sweet spot. However, carbon fiber wheels post a rapid 12.6% CAGR that outpaces every other material class. The relative advantage in unsprung mass reduction drives discernible gains in acceleration and ride quality, ensuring early adopters are willing to pay four-digit price premiums. Suppliers also tout corrosion resistance and design freedom as selling points, which helps justify premium positioning even when fuel savings alone do not close the cost gap. One subtle effect is that magnesium alloys have lost momentum once seen as the next lightweight step because carbon fiber captures the halo narrative more effectively.

Steel wheels retain importance in emerging markets and commercial fleets, partly because ruggedness and repairability override weight concerns where road infrastructure is variable. Hybrid composite designs are surfacing in niche sports models, pairing aluminum centers with carbon fiber barrels; this blend lowers cost while capturing most of the rotational-mass advantage. The trend hints that future material competition may center on modular construction rather than monolithic compositions, extending product life through replaceable outer rings.

By Manufacturing Process: Flow-Forming Bridges Performance and Affordability Gap

Casting accounted for 71% of the automotive wheel market size in 2024, yet flow-forming’s 9.4 % CAGR signals that process selection is shifting toward methods that balance volume economics with weight targets [2]“Cast vs Flow Formed vs Forged Wheels,” Velgen Wheels, velgenwheels.com. Low-pressure casting upgrades basic gravity techniques by improving metallurgical integrity, which grants OEMs higher structural margins without a dramatic capex lift. Forging still dominates ultra-performance categories, and its extreme strength allows radical spoke geometries that enhance brake cooling; this benefit keeps forged wheels aspirational even when cost pressures mount. An interesting side effect is that 3D-printed titanium inserts appear in wheel centers, providing localized strength around lug holes while keeping the outer rim lighter.

Tooling versatility has become a competitive differentiator, as manufacturers that can re-index dies quickly accommodate shorter vehicle refresh cycles, especially in China. Automation investments also usher in tighter runout tolerances, reducing balancing weights and therefore marginally trimming additional grams from total wheel-tire assemblies. Process innovation is lowering the barrier between concept sketches and factory output, enabling limited-edition wheels to launch in previously uneconomical volumes.

By Rim Size: Larger Diameters Command Premium Positioning

The 16-18-inch class captured 37% of the automotive wheel market share in 2024, balancing cost, handling, and ride comfort for mainstream sedans and crossovers. Growth momentum, however, is tilting toward rims over 21 inches, which are advancing at a brisk 6.6% CAGR driven by luxury SUVs and style-centric pickup trims. Larger diameters provide visual scale that consumers associate with prestige, but they also introduce engineering challenges around curb impact resilience, prompting suppliers to thicken inner lips selectively. Manufacturers counter the weight penalty through hollow-spoke designs and advanced materials, which keep unsprung mass from ballooning.

Smaller 13-15-inch wheels continue to serve compact cars in cost-sensitive markets, though rising steel prices are nudging OEMs to evaluate aluminum even in entry segments. The 19-21-inch bracket now acts as a transition zone where buyers weigh cosmetic impact against tire replacement costs, and its balance of aesthetics and practicality reinforces mid-luxury positioning. As tire makers roll out low-rolling-resistance compounds tailored to larger sizes, vehicle dynamics engineers recalibrate suspension tunes, a cross-disciplinary task that deepens collaboration between wheel and tire suppliers.

Note: Segment shares of all individual segments available upon report purchase

By Sales Channel: OEMs Dominate While Aftermarket Customization Grows

Original equipment channels represented 93% of the automotive wheel market size in 2024, underscoring the importance of direct OEM relationships and high-volume contracts. Automakers increasingly embed wheel design in brand identity, leading to co-creation workshops where suppliers act as stylists as much as engineers. Certified supplier programs guarantee dimensionally repeatable parts that integrate seamlessly with advanced driver-assistance systems, which demand precise wheel speed sensing for algorithms. Consequently, tier-one vendors that can integrate sensors or provide ready-to-calibrate wheels enjoy preferred-vendor status.

The aftermarket, though smaller, is expanding faster in percentage terms as e-commerce opens global distribution. Online configurators let buyers visualize fitment, encouraging impulsive purchases of premium finishes, and the phenomenon indirectly pushes OEMs to offer factory-approved upgrades to retain accessory income. Wheel refurbishment services are also gaining traction, suggesting that circular-economy pressures could reshape aftermarket value propositions by emphasizing repair over replacement in mature markets. These shifts imply that the clear demarcation between OE and aftermarket design language is blurring.

By Finishing / Coating: Customization Trends Reshape Material Aesthetics

Powder-coated wheels continue to dominate the finishing segment due to their durability, cost-efficiency, and compatibility with high-volume manufacturing. OEMs prefer this method for standard models because it offers strong corrosion resistance while minimizing environmental impact through solvent-free curing. As automakers pursue lighter and thinner wheels, powder coating complements aluminum alloy surfaces well, especially in fleet and mass-market categories. Its consistent texture and ease of automation also make it suitable for ADAS-compliant wheel specs where surface integrity must not distort sensor alignment.

Diamond-cut and machined finishes are gaining traction in the premium and performance segments, offering a high-gloss, multi-texture aesthetic that appeals to younger demographics and EV buyers. These wheels involve precision CNC processes that expose a raw metallic sheen beneath a clear lacquer, giving vehicles a dynamic and upscale appearance. Manufacturers are now bundling these finishes with high-end trims, and aftermarket players are offering diamond-cut refurbishment services, especially in urban markets where curb damage is frequent. However, the susceptibility of lacquer layers to chipping makes them more maintenance-intensive than powder-coated options.

Note: Segment shares of all individual segments available upon report purchase

By Vehicle Propulsion: Electrification Alters Wheel Design and Demand

Internal Combustion Engine (ICE) vehicles still lead in wheel volume, supported by a global installed base and ongoing production in markets where electrification is lagging. Wheels for ICE vehicles prioritize load durability and thermal resilience, especially for models that use drum or disc brakes generating high heat. The design language here tends to be conservative, aligned with long product cycles and wide part standardization across regions. However, cost pressure is intense, and OEMs rely heavily on established suppliers with optimized steel and aluminum forging capabilities.

Battery Electric Vehicles (BEVs) are redefining wheel architecture by emphasizing weight reduction, aerodynamic efficiency, and advanced material integration. Unlike ICE vehicles, BEVs face unique challenges like heavier curb weights due to battery packs and greater torque at low speeds. As a result, wheel suppliers are developing reinforced alloys, hollow-spoke geometries, and airflow-optimized designs. Additionally, EVs use regenerative braking, which reduces heat buildup and allows for thinner brake-compatible wheels. Many premium BEVs now offer custom wheel options with integrated aero discs, marking a shift where wheels act as both performance and branding assets.

Geography Analysis

Asia accounted for 53% of the global automotive wheel market in 2024, supported by integrated aluminum supply chains and competitive labor costs. China alone contributes over 50% of Asian wheel output, and its clusters in Shandong and Guangdong provinces host vertically aligned smelters, foundries, and finishing plants, which reduces logistics overhead [3]. Japan and South Korea maintain reputations for ultra-tight tolerances, supplying alloy wheels that often benchmark NVH performance in global quality audits. India is scaling capacity rapidly, and several new facilities are installing automated x-ray inspection to meet export standards, signaling a drive to move up the value chain. The regional ecosystem’s depth allows rapid prototyping and cost-effective production runs, an advantage that positions Asian suppliers to capture incremental demand from global EV launches.

The Middle East posted the fastest regional CAGR at 7.1%, propelled by rising disposable income and a strong preference for premium SUVs and pickups. Saudi Arabia’s expanding dealership networks now routinely offer diamond-cut wheels as factory options, reflecting a consumer willingness to pay for visual flair. Local distributors also report heightened interest in chrome and machined finishes, pushing importers to diversify sourcing beyond traditional European suppliers. Infrastructure investments, particularly in high-speed road corridors, indirectly lift demand for performance-oriented wheels that can withstand sustained heat cycles. This appetite suggests that wheel makers able to certify products for harsh desert conditions may command pricing leverage in future tenders.

North America maintains a robust share in the custom aftermarket, a dynamic linked to a cultural affinity for personalization and a large population of pickup trucks requiring higher load index wheels. Flow-forming uptake is rapidly expanding among domestic manufacturers, who promote lighter wheels as tools for fuel savings in commercial fleets. Emissions legislation heavily influences Europe’s wheel demand, placing a premium on lightweight alloys and high-recycled-content aluminum; German OEMs are especially aggressive in specifying aerodynamically optimized designs. South America remains largely a replacement market due to aging vehicle fleets, yet regional assembly plants increasingly specify low-pressure cast aluminum over steel to meet tightening efficiency rules. Africa’s wheel demand is small but rising, concentrated in durable steel products suited to mixed-surface roads. This observation points to long-range opportunities for cost-effective aluminum alternatives as infrastructure improves.

Competitive Landscape

The top five companies control about 25% of the automotive wheel market share, evidencing moderate concentration but leaving ample room for regional challengers. Maxion Wheels leads the global automotive wheel market with a commanding share of 8.68%, highlighting its strong OEM relationships, diverse manufacturing footprint, and balanced portfolio across steel and aluminum wheels. The company benefits from strategic alliances with major automakers across North America, Europe, and South America, and its early investments in lightweight wheel technologies have positioned it as a reliable partner for fuel-efficiency-focused platforms. Maxion's scale allows it to weather fluctuations in regional demand, and its expanding electric vehicle (EV) wheel offerings are helping the company maintain leadership as the industry transitions toward electrification.

Topy Industries Ltd follows as a key player, leveraging its deep integration with Japanese automakers and its reputation for quality and reliability in steel wheel manufacturing. The company has maintained long-standing relationships with major OEMs, particularly in Japan and Southeast Asia, where demand for durable steel wheels remains robust in both passenger and commercial vehicle segments. Topy’s strategic focus on operational efficiency and cost-effective production gives it a competitive edge in mass-market applications, while its recent efforts to expand into alloy wheels and international markets reflect a broader push to stay relevant amid shifting industry dynamics.

The remaining top players — Zhejiang Wanfeng Auto Wheel, Steel Strips Wheels Limited, and BORBET GmbH — reflect a competitive and regionally diversified market where no single manufacturer holds double-digit dominance. Zhejiang Wanfeng benefits from its deep ties to Chinese OEMs and a growing export business, particularly in the aluminum segment. Steel Strips Wheels, based in India, capitalizes on the booming domestic auto production and aftermarket segments, while BORBET GmbH has carved out a strong niche in Europe with its high-end alloy wheels, favored by premium car manufacturers. The close clustering of shares in the 2–3% range reveals ample opportunity for consolidation, product innovation, and geographical expansion to gain competitive ground.

Automotive Wheel Industry Leaders

-

Maxion Wheels

-

Topy Industries Ltd

-

Zhejiang Wanfeng Auto Wheel

-

Steel Strips Wheels Limited

-

BORBET GmbH

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- April 2025: Maxion Wheels announced it will begin serial production of forged aluminum wheels in Türkiye in the second half of 2025 through its joint venture with Inci Holding.

- April 2025: Steel Strips Wheels Limited (SSWL) announced a USD 5 million steel wheel order from a global OEM, with production set to begin in FY 2026 at its Chennai plant.

- December 2024: SSWL received a nomination for a EUR 15 million steel wheel business from a European OEM, with supplies expected to start by end-2026.

- March 2024: Topy Industries announced plans to invest several JPY billions to introduce aluminum wheel production across plants in India, North America, and Europe.

Global Automotive Wheel Market Report Scope

A wheel with a tire, rim, and hubcap propels the car. Automotive wheels are manufactured using steel, carbon fiber, or a composite of lightweight metal alloys, such as aluminum or magnesium.

The automotive wheel market is segmented by vehicle type, material type, sales channel, and geography. By vehicle type, the market is segmented into passenger cars and commercial vehicles. By material type, the market is segmented into steel, alloy, and carbon fiber. By sales channel, the market is segmented into original equipment manufacturers (OEMs) and aftermarket. By geography, the market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. For each segment, the market sizing and forecasts have been done based on value (USD).

| By Vehicle Type | Passenger Car | Hatchback | |

| Sedan | |||

| SUV / Crossover | |||

| Sports & Luxury | |||

| Light Commercial Vehicle | |||

| Heavy Commercial Vehicle | Trucks | ||

| Buses & Coaches | |||

| Off-Highway Vehicle | Construction & Mining Equipment | ||

| Agricultural Tractors | |||

| By Material Type | Steel | ||

| Aluminium Alloy | |||

| Magnesium Alloy | |||

| Carbon-Fiber | |||

| Hybrid Composite (Al-CF) | |||

| By Manufacturing Process | Casting | Gravity Cast | |

| Low-Pressure Cast | |||

| High-Pressure / Die-Cast | |||

| Forging | |||

| Flow-Forming / Spin-Forged | |||

| Others (Spinning, 3-D Printed) | |||

| By Rim Size | 13-15 inch | ||

| 16-18 inch | |||

| 19-21 inch | |||

| >21 inch | |||

| By Finishing / Coating | Powder-Coated | ||

| Diamond-Cut / Machined | |||

| Chrome / Polished | |||

| Painted | |||

| By Vehicle Propulsion | Internal Combustion Engine (ICE) | ||

| Hybrid Electric Vehicle (HEV / PHEV) | |||

| Battery Electric Vehicle (BEV) | |||

| Fuel-Cell Electric Vehicle (FCEV) | |||

| By End-Use / Sales Channel | Original Equipment Manufacturer (OEM) | ||

| Aftermarket | Replacement | ||

| Performance / Customization | |||

| By Geography | North America | United States | |

| Canada | |||

| Rest of North America | |||

| South America | Brazil | ||

| Argentina | |||

| Rest of South America | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Italy | |||

| Spain | |||

| Rest of Europe | |||

| Middle East | Turkey | ||

| Saudi Arabia | |||

| UAE | |||

| Rest of Middle East | |||

| Africa | South Africa | ||

| Nigeria | |||

| Rest of Africa | |||

| Asia-Pacific | China | ||

| India | |||

| Japan | |||

| South Korea | |||

| Rest of Asia-Pacific | |||

| Passenger Car | Hatchback |

| Sedan | |

| SUV / Crossover | |

| Sports & Luxury | |

| Light Commercial Vehicle | |

| Heavy Commercial Vehicle | Trucks |

| Buses & Coaches | |

| Off-Highway Vehicle | Construction & Mining Equipment |

| Agricultural Tractors |

| Steel |

| Aluminium Alloy |

| Magnesium Alloy |

| Carbon-Fiber |

| Hybrid Composite (Al-CF) |

| Casting | Gravity Cast |

| Low-Pressure Cast | |

| High-Pressure / Die-Cast | |

| Forging | |

| Flow-Forming / Spin-Forged | |

| Others (Spinning, 3-D Printed) |

| 13-15 inch |

| 16-18 inch |

| 19-21 inch |

| >21 inch |

| Powder-Coated |

| Diamond-Cut / Machined |

| Chrome / Polished |

| Painted |

| Internal Combustion Engine (ICE) |

| Hybrid Electric Vehicle (HEV / PHEV) |

| Battery Electric Vehicle (BEV) |

| Fuel-Cell Electric Vehicle (FCEV) |

| Original Equipment Manufacturer (OEM) | |

| Aftermarket | Replacement |

| Performance / Customization |

| North America | United States |

| Canada | |

| Rest of North America | |

| South America | Brazil |

| Argentina | |

| Rest of South America | |

| Europe | Germany |

| United Kingdom | |

| France | |

| Italy | |

| Spain | |

| Rest of Europe | |

| Middle East | Turkey |

| Saudi Arabia | |

| UAE | |

| Rest of Middle East | |

| Africa | South Africa |

| Nigeria | |

| Rest of Africa | |

| Asia-Pacific | China |

| India | |

| Japan | |

| South Korea | |

| Rest of Asia-Pacific |

Key Questions Answered in the Report

What is the current automotive wheel market size?

The automotive wheel market is valued at USD 168.45 billion in 2025.

How fast is the automotive wheel industry expected to grow?

The market is forecast to expand at a 6.65% CAGR between 2025 and 2030.

Which material leads the automotive wheel market share?

Aluminum alloy wheels hold the largest share due to their balance of cost, weight, and strength.

Which rim size segment is growing fastest?

Wheels larger than 21 inches are expanding at about a 6.6% CAGR, driven by demand in luxury SUVs and pickups.