Canada Bunker Fuel Market Size

Canada Bunker Fuel Market Analysis

The Canada Bunker Fuel Market size is estimated at USD 1.46 billion in 2025, and is expected to reach USD 1.69 billion by 2030, at a CAGR of greater than 2.93% during the forecast period (2025-2030).

- In the medium period, factors such as rising demand for cleaner bunker fuels due to implementing more restrictive environmental regulations and the growing trade of LNG for the power sector in the regions are expected to drive the market during the forecast period.

- On the other hand, changes in the cost of bunker fuel and crude oil are expected to hinder the market's growth.

- Nevertheless, the number of ships in service and the demand for maritime transportation are expected to create several future market opportunities during the forecast period.

Canada Bunker Fuel Market Trends

The Very Low Sulphur Fuel Oil (VLSFO) Segment is to Witness Significant Growth During the Forecast Period

- Bunker fuels have a high sulfur content and may emit harmful fumes. Different methods can be employed to lower the sulfur concentration, though. Ultra-low-sulfur fuel oil is one of the varieties of this kind of fuel. With an IMO regulation going into effect in January 2020, there is a growing need for VLSFO, which has a sulfur concentration of less than 0.5%.

- Most of the high-sulfur fuel oil (HSFO) bunker fuel market is anticipated to be replaced soon by low-sulfur substitutes. The majority of VLSFO sold on the market consists of residual and distillate components combined with different cutters with different viscosities and sulfur contents to produce a product that meets specifications.

- Refinery capacity and throughput have risen significantly, with the demand for very low-sulfur fuel oil over the past years. According to the Statistical Review of World Energy Data, in 2023, the refinery throughput was 1,715.52 thousand barrels daily, an increase of 1.13% compared to 2022. The capacity is likely to increase in the upcoming years as many oil projects significantly expand crude oil production during the forecast period.

- For instance, in December 2023, ExxonMobil announced the new Canada oil project, which will produce 30,000 barrels daily after completion. The company will significantly expand its Hebron oilfield offshore Newfoundland and Labrador and boost the production of the eastern Canadian province in the upcoming years. These projects will likely increase the production of VLSFO during the forecast period.

- The government focuses on refineries by increasing capacity and fulfilling the demand for VLSFO. It is also planning to increase exploration and development in the region. For instance, in November 2023, the oil and gas producer organization announced that the company is expected to drill 8% more wells in Canada from 2024. The Canadian Association of Energy Contractors (CAOEC) expected the country to increase drilling by nearly 500 wells and 6,229 projects by 2024.

- Hence, these projects are expected to increase the production of VLSFO during the forecast period.

Expanding Import and Exports in the Country is Driving the Market's Growth

- Canada's major trading partner is the United States, which dominates Canada's imports and exports. Canada and the United States share a land boundary. Hence, most trade happens through roadways, trains, and pipelines. As a result, the ratio of the size of the maritime industry to the size of imports and export trade for Canada is low compared to the global average.

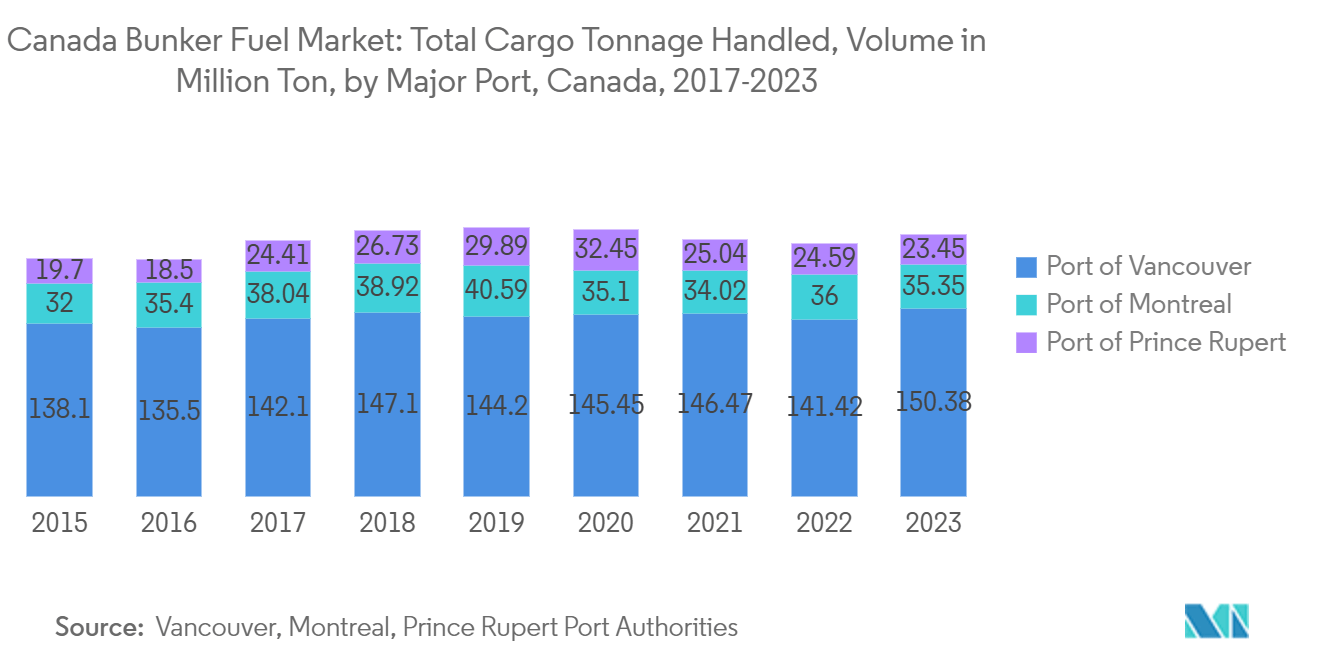

- Canada's strategic geographic position, with access to the Atlantic, Pacific, and Arctic Oceans, positions it as a critical player in global maritime trade routes. Major ports such as Vancouver, Montreal, Halifax, and Prince Rupert are crucial hubs for international shipping, particularly for trade with Asia, Europe, and the United States.

- These ports facilitate the movement of goods and act as primary centers for bunker fuel supply. The robust port infrastructure supports a steady demand for bunker fuel as vessels refuel during their voyages across the world.

- From 2021 to 2023, Canada's imports from the United States increased by approximately 20%. Hence, the increase in imports positively affected the maritime industry, manifested by an increase in the amount of cargo handled by the Port of Vancouver, the biggest port in the country.

- The Canadian economy is deeply connected to maritime trade as one of the world's leading exporters of natural resources, including oil, gas, minerals, and agricultural products. The volume of goods transported by sea directly influences the demand for bunker fuel.

- Furthermore, the United States is expected to impact the country's maritime industry indirectly positively. Oil is Canada's major export and revenue generator, and most of the country's petroleum exports are to the United States.

- In 2023, Canada's crude oil exports amounted to USD 139 billion, with natural gas exports reaching USD 13 billion. Between 2010 and 2021, the combined value of crude oil and natural gas exports fluctuated between roughly USD 50 billion and USD 120 billion annually, influenced by commodity prices, before hitting a record high of approximately USD 188 billion in 2022.

- Thus, the increasing oil exports are expected to positively impact the country's expenditure capacity and increase the net imports of significant goods, such as vehicles and machinery, from overseas destinations. This factor, in turn, is positively impacting the bunker fuel market in the country.

Canada Bunker Fuel Industry Overview

The Canadian bunker fuel market is moderately fragmented. Some of the major players in this market are PetroChina Company Limited, TotalEnergies SE, Peninsula Petroleum Ltd, A.P. Møller – Maersk AS, and World Kinect Corporation.

Canada Bunker Fuel Market Leaders

-

PetroChina Company Limited

-

Peninsula Petroleum Ltd

-

TotalEnergies SE

-

A.P. Møller – Mærsk A/S

-

World Kinect Corporation

- *Disclaimer: Major Players sorted in no particular order

Canada Bunker Fuel Market News

- May 2024: CSL Group, a Canadian company, announced that its gearless bulk carrier, CSL Welland, will once again operate on B100 biodiesel for the upcoming season, signaling the revival of its biofuel initiative. In collaboration with Canada Clean Fuels Inc., the company is fueling eight of its vessels with B100 biodiesel sourced from North America and produced from waste plant materials.

- February 2024: Cryopeak LNG Solutions signed an agreement to merge operations with Ferus Natural Gas Fuels to develop a new liquefied natural gas (LNG) production and distribution organization across Canada. The company also manages three LNG production facilities through this expansion in Western Canada and operates the country's most significant LNG transportation.

Canada Bunker Fuel Industry Segmentation

Bunker fuel is any fuel pumped into a ship's bunkers to power combustion engines. Deep-sea cargo ships often burn the heavy, residual oil that remains after gasoline, diesel, and other light hydrocarbons are removed from crude oil during the refining process.

The Canadian bunker fuel market is segmented by capacity and vessel type. By type, the market is segmented into high sulfur fuel oil (HSFO), very low sulfur fuel oil (VLSFO), marine gas oil (MGO), liquefied natural gas (LNG), and other fuel types. By vessel type, the market is segmented into containers, tankers, general cargo, bulk carriers, and other vessel types.

For each segment, the market sizes and forecasts were made based on revenue (USD).

| By Fuel Type | High Sulfur Fuel Oil (HSFO) |

| Very-low Sulfur Fuel Oil (VLSFO) | |

| Marine Gas Oil (MGO) | |

| Liquefied Natural Gas (LNG) | |

| Other Fuel Types | |

| By Vessel Type | Containers |

| Tankers | |

| General Cargo | |

| Bulk Carrier | |

| Other Vessel Types |

| High Sulfur Fuel Oil (HSFO) |

| Very-low Sulfur Fuel Oil (VLSFO) |

| Marine Gas Oil (MGO) |

| Liquefied Natural Gas (LNG) |

| Other Fuel Types |

| Containers |

| Tankers |

| General Cargo |

| Bulk Carrier |

| Other Vessel Types |

Canada Bunker Fuel Market Research FAQs

How big is the Canada Bunker Fuel Market?

The Canada Bunker Fuel Market size is expected to reach USD 1.46 billion in 2025 and grow at a CAGR of greater than 2.93% to reach USD 1.69 billion by 2030.

What is the current Canada Bunker Fuel Market size?

In 2025, the Canada Bunker Fuel Market size is expected to reach USD 1.46 billion.

Who are the key players in Canada Bunker Fuel Market?

PetroChina Company Limited, Peninsula Petroleum Ltd, TotalEnergies SE, A.P. Møller – Mærsk A/S and World Kinect Corporation are the major companies operating in the Canada Bunker Fuel Market.

What years does this Canada Bunker Fuel Market cover, and what was the market size in 2024?

In 2024, the Canada Bunker Fuel Market size was estimated at USD 1.42 billion. The report covers the Canada Bunker Fuel Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Canada Bunker Fuel Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Canada Bunker Fuel Industry Report

Statistics for the 2025 Canada Bunker Fuel market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Canada Bunker Fuel analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.