Global Cancer Therapy Market Analysis by Mordor Intelligence

The cancer therapy market is valued at USD 243.62 billion in 2025 and is forecast to expand to USD 403.99 billion by 2030, reflecting a 10.64% CAGR for 2025-2030. Advancing genomic profiling, faster tumor-agnostic approvals, and the expanding cell- and gene-therapy pipeline are propelling the cancer therapy market toward double-digit growth. Major pharmaceutical companies are prioritizing biomarker-driven portfolios, while Asia’s healthcare investments accelerate regional uptake of innovative regimens. Regulatory agencies are also showing greater flexibility, enabling real-world evidence to shorten approval timelines. Despite these opportunities, the cancer therapy market faces supply-chain limits for viral vectors and persistent financial toxicity, both of which may temper near-term adoption rates.

Key Report Takeaways

- By therapy type, targeted therapy led with 37.0% of the cancer therapy market share in 2024, while cell & gene therapy is forecast to expand at a 12.5% CAGR through 2030.

- By cancer type, breast cancer accounted for 18.2% share of the cancer therapy market size in 2024; respiratory/lung cancer is projected to grow at an 11.1% CAGR between 2025-2030.

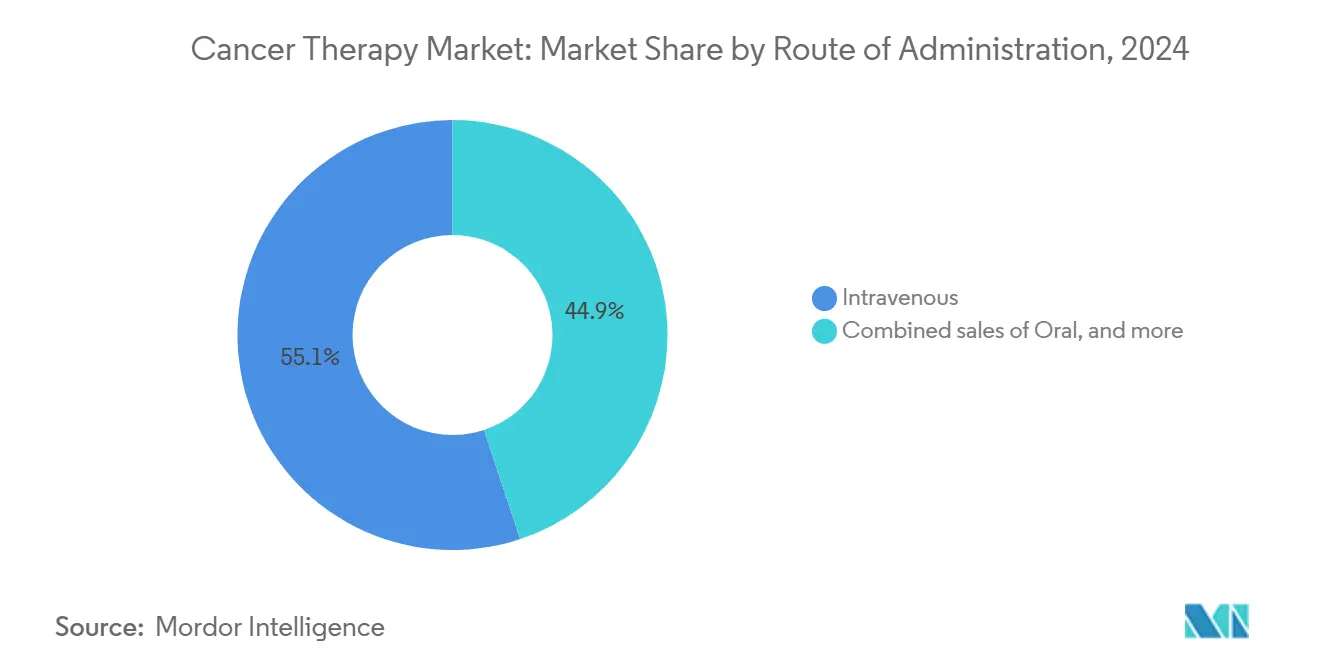

- By route of administration, intravenous delivery captured 55.1% of the cancer therapy market size in 2024, whereas intratumoral delivery is set to rise at a 12.7% CAGR to 2030.

- By end user, hospitals held 62.4% of the cancer therapy market share in 2024, while homecare settings are anticipated to register an 11.7% CAGR through 2030.

- By geography, North America dominated with 43.0% of the cancer therapy market in 2024; Asia-Pacific is expected to post the highest regional CAGR of 11.2% during 2025-2030.

Global Cancer Therapy Market Trends and Insights

Drivers Impact Analysis

| Driver | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Tumor-agnostic approvals expanding indications | +2.5% | Global | Medium term (2-4 years) |

| Cell & gene therapy pipeline surpassing 2,000 trials | +3.0% | Global | Long term (≥4 years) |

| Regulators leveraging real-world evidence in Asia | +1.8% | Asia | Short term (≤2 years) |

| Companion diagnostic co-launches speeding market entry | +1.2% | United States, EU, Asia | Medium term (2-4 years) |

| Oncology drug bundling models gaining traction in US commercial payer systems | +1.5% | United States | Short term (≤2 years) |

| Contract development & manufacturing expansion in APAC driving cost-effective production | +1.7% | Asia-Pacific | Long term (≥4 years) |

Source: Mordor Intelligence

Tumor-agnostic and biomarker-driven therapies

Approvals targeting genomic alterations rather than tissue of origin are reshaping clinical practice, with eight tumor-agnostic agents cleared by 2024, including fam-trastuzumab deruxtecan-nxki and repotrectinib[1]PDQ Adult Treatment Editorial Board, “PDQ Agnostic Cancer Therapies,” National Cancer Institute, cancer.gov. Real-world data show 21.5% of patients as potential candidates, widening the cancer therapy market and encouraging adaptive trial designs. Pharmaceutical firms now prioritize companion diagnostics at early development stages to align with these precision-medicine pathways and to reduce late-stage attrition risk. The approach is also catalyzing cross-tumor combination studies, which may further enlarge the addressable patient pool.

Cell & gene therapies accelerating pipeline growth

Investments in cell- and gene-based modalities jumped 30% in 2024 to USD 15.2 billion. More than 2,000 active trials and 3,000 developers underscore the modality’s momentum. The February 2024 approval of lifileucel (Amtagvi) marked the first tumor-infiltrating lymphocyte therapy for solid tumors, achieving a 31.5% objective response. Thirteen of the 15 largest pharmaceutical firms now report dedicated CGT divisions, reflecting long-term commitment to this disruptive platform.

Real-world evidence fast-tracking regional access

Japan’s Pharmaceuticals and Medical Devices Agency and China’s National Medical Products Administration increasingly accept real-world evidence to support supplemental oncology filings, cutting review times by 20-30% compared with traditional pathways[2]G.W. Sledge et al., “Real-World Evidence Provides Clinical Insights into Tissue-Agnostic Therapeutic Approvals,” Nature Communications, nature.com. The Pan-Asian adapted ESMO guidelines seek to harmonize molecular testing requirements, potentially mitigating existing treatment disparities across Asia. This regulatory pragmatism not only boosts local innovation but also creates reference frameworks for emerging markets in Southeast Asia.

Companion diagnostics improve precision and speed

The FDA underscores that a companion diagnostic (CDx) is mandatory when its absence could lead to serious safety concerns[3]U.S. Food and Drug Administration, “Companion Diagnostics,” fda.gov. Accelerated CDx co-development now reduces the typical drug-diagnostic approval gap from 18 months to under 6 months. Labcorp’s nAbCyte assay supporting Pfizer’s hemophilia B gene therapy highlighted regulators’ willingness to green-light first-in-class assays. However, 10 targeted agents received approval without a matched CDx during 2020-2024, indicating ongoing alignment gaps.

Restraints Impact Analysis

| Restraint | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Financial toxicity driving treatment abandonment | -2.60% | Global | Short term (≤2 years) |

| Viral-vector production bottlenecks limiting supply | -1.90% | United States, EU | Long term (≥4 years) |

| Divergent HTA value-assessment criteria delaying market access | -1.50% | Europe, Canada, Australia | Medium term (2-4 years) |

| Immunotherapy resistance mechanisms undermining long-term efficacy in solid tumors | -2.10% | Global | Long term (≥4 years) |

Source: Mordor Intelligence

Escalating financial toxicity

Seventy-five percent of cancer patients seek copayment assistance, and 42.0% report severe financial strain. In leukemia, 75.0% of transplantation-eligible patients experience distress that can delay or curtail treatment. Younger adults with larger households are disproportionately affected, often reducing medication adherence. Few health systems offer systematic financial-distress screening, leaving room for policy interventions to safeguard access as high-cost regimens become standard of care.

Manufacturing capacity bottlenecks

Eight FDA-approved viral-vector gene therapies and 145 candidates in late-stage development are straining existing production infrastructure. Non-standardized upstream processes and labor-intensive purification steps hamper scale-up, especially for solid-tumor cell therapies that demand higher vector volumes. Sponsors now explore modular facilities and intensified bioreactors to improve yields, yet meaningful capacity relief is unlikely before 2028, moderating the near-term expansion of the cancer therapy market.

Segment Analysis

By Therapy Type: Targeted Modalities Sustain Leadership

Targeted therapies commanded 37.0% of the cancer therapy market in 2024, reflecting strong clinician confidence in agents that inhibit specific molecular drivers. Eight tumor-agnostic approvals since 2017 anchor this dominance, while antibody–drug conjugates and tyrosine kinase inhibitors continue to expand indications. Immunotherapy is the fastest-growing segment, underpinned by breakthroughs such as lifileucel and CAR-T refinements. In contrast, chemotherapy’s role is shifting toward combination backbone in precision regimens, reinforcing the evolution toward molecularly guided care.

The cancer therapy market size for immunotherapies is forecast to rise from USD 58 billion in 2024 to USD 120 billion by 2030, translating to a 14.9% CAGR. Checkpoint inhibitors lead unit sales, yet next-generation bispecific antibodies are adding incremental growth. Competitive intensity is high, with over 500 PD-1/L1 trials ongoing. Companies differentiate through novel targets (e.g., TIGIT, LAG-3) and subcutaneous formulations to extend brand life cycles.

By Cancer Type: Breast Oncology Remains the Nexus

Breast cancer treatments generated 18.2% of the cancer therapy market size in 2024, cementing the category’s position as a bellwether for clinical innovation. Asia accounts for nearly half of global breast-cancer incidence, fueling region-specific trials on hormone-receptor-positive subtypes. Blood cancers follow, propelled by CAR-T and bispecific antibodies. The FDA’s March 2025 approval of obecabtagene autoleucel, which delivered a 63% complete-remission rate in refractory B-cell ALL, illustrates the transformative potential of cell therapies.

In lung cancer, ALK, EGFR, and ROS1 test positivity rates now dictate first-line choice, anchoring a steady shift from empirical chemotherapy to genotype-matched regimens. Tumor mutational burden and KRAS G12C targeting further broaden the precision oncology toolkit, sustaining demand growth in this high-incidence segment of the cancer therapy market.

By Route of Administration: Convenience Gains Ground

Intravenous delivery retained 55.1% of the cancer therapy market in 2024 thanks to entrenched infusion-center networks and a pipeline replete with monoclonal antibodies. The December 2024 approval of subcutaneous nivolumab proved noninferiority to intravenous dosing, offering shorter chair time and fewer infusion reactions. Similar transitions are expected for other checkpoint inhibitors, potentially eroding intravenous share by 450 basis points by 2030.

Intratumoral injections are emerging for oncolytic viruses and localized immunotherapies. Pre-clinical data indicate 2-3-fold higher intratumoral drug concentrations than systemic routes, inspiring sponsors to trial depot formulations. Oral small molecules remain relevant, especially for chronic regimens, yet their growth is constrained by bioavailability challenges for large biologics.

By End User: Specialized Settings Rise

Hospitals controlled 62.4% of cancer therapy market share in 2024 due to their comprehensive infusion capabilities and access to multidisciplinary care teams. The advent of tumor-infiltrating lymphocyte therapy necessitates biosafety-level processing suites, reinforcing large centers’ dominance. Specialty clinics, however, recorded the fastest growth. They leverage lean operating models to deliver standardized infusion services, appealing to payers seeking cost containment.

Hub-and-spoke frameworks are expanding in Asia, where tertiary centers train satellite clinics to administer maintenance cycles locally. This approach mitigates travel burdens and aligns with health-system objectives to decentralize oncology services. Digital care coordination platforms help manage toxicities remotely, supporting safe rollout of complex regimens outside major urban hospitals.

Geography Analysis

North America accounted for 43.0% of the cancer therapy market in 2024, supported by deep clinical-trial pipelines and broad insurance coverage. The United States has led in first-in-class approvals, with FDA clearing 29 oncology applications during 2024 alone. Even so, patient out-of-pocket costs often exceed 20% of household income, intensifying public debate on value-based pricing.

Asia is the fastest-growing region, with the cancer therapy market expected to post an 11.2% CAGR to 2030. China’s oncology research output now surpasses that of the United States. Government incentives, such as priority review vouchers and centralized procurement reforms, aim to accelerate local innovation while containing price inflation. Southeast Asia anticipates 2.03 million new cases annually by 2050, underscoring pressing needs for screening programs and broader molecular testing access.

Europe retains a sizeable share of the cancer therapy industry, aided by universal health systems and collaborative research networks. The European Medicines Agency recently issued harmonized guidance on CDx assessment, facilitating precision-medicine rollouts. Meanwhile, the Middle East, Africa, and South America comprise emerging clusters. These markets invest in technology-transfer partnerships to boost local manufacturing of biologics, thereby enhancing affordability and supply resilience.

Competitive Landscape

The cancer therapy market is highly competitive, anchored by Roche, Bristol Myers Squibb, AstraZeneca, and Novartis, each maintaining multibillion-dollar oncology franchises. Portfolio breadth and companion-diagnostic integration reinforce their scale advantages. To widen modality coverage, these incumbents pursue bolt-on acquisitions; for example, AstraZeneca’s 2024 buyout of an antibody-drug conjugate startup expanded its solid-tumor pipeline.

Specialized biotech firms are disruptive forces, often outpacing larger peers in antibody-drug conjugate, bispecific antibody, and radioligand therapies. Five-year CAGRs for these modalities reach 40-48%, far exceeding the overall cancer therapy market growth. Competitive positioning is increasingly differentiated by manufacturing agility, especially in viral-vector capacity where early movers secure critical supply advantages.

Artificial-intelligence (AI) platforms now underpin target identification and trial-site optimization, shortening discovery timelines. Partnerships between AI companies and mid-cap pharmas illustrate a shift toward data-driven asset generation. Over the next decade, firms capable of integrating AI with wet-lab validation and global manufacturing networks are likely to gain share in the cancer therapy market.

Global Cancer Therapy Industry Leaders

-

F. Hoffmann-La Roche AG

-

Bristol Myers Squibb

-

Johnson & Johnson (Janssen)

-

Merck & Co., Inc.

-

AstraZeneca PLC

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- April 2025: Akeso secured FDA approval for penpulimab-kcqx to treat advanced nasopharyngeal carcinoma, positioning the firm as a transpacific contender for niche indications that carry high unmet need but limited commercial competition

- November 2024: Autolus Therapeutics gained FDA clearance for Aucatzyl (obecabtagene autoleucel) in relapsed or refractory B-cell acute lymphoblastic leukemia, demonstrating a 63 % complete remission rate in pivotal trials.

- March 2025: The FDA approved tislelizumab-jsgr (Tevimbra) for esophageal cancer, reporting a median overall survival of 16.8 months.

- March 2025: Pembrolizumab (Keytruda) added a HER2-positive gastric cancer indication, with 20.1 months median overall survival in registrational studies.

- March 2025: Cabozantinib (Cabometyx) received approval for neuroendocrine tumors, achieving 13.8 months median progression-free survival.

- April 2024: Ciltacabtagene autoleucel (cilta-cel) was cleared for earlier-line treatment in multiple myeloma, showing a 74 % risk reduction for disease progression or death versus standard care.

- December 2024: Subcutaneous nivolumab (Opdivo Qvantig) became the first PD-1 inhibitor available in a subcutaneous formulation across all previously approved adult solid tumor indications, registering non-inferior pharmacokinetics relative to its intravenous counterpart.

Global Cancer Therapy Market Report Scope

According to the scope of the report, cancer therapies are drugs that obstruct the growth and augmentation of cancer by interfering with specific molecules, such as DNA or proteins, that are involved in the development or expansion of cancerous cells. These therapies incorporate surgery, chemotherapy, radiation therapy, immunotherapy, and others.

The cancer therapy market is segmented by therapy type, cancer type, route of administration, end user, and geography. By therapy type, the market is segmented as chemotherapy, targeted therapy, immunotherapy, hormonal therapy, and other treatment types. By cancer type, includes blood cancer, breast cancer, prostate cancer, gastrointestinal cancer, gynecologic cancer, respiratory/lung cancer, and other cancer types. The route of administration includes intravenous, oral, subcutaneous, and intratumoral. By end user, the market is segmented into hospitals, specialty clinics, and cancer and radiation therapy centers. By geography, the market is segmented into North America, Europe, Asia-Pacific, the Middle East & Africa, and South America. For each segment, the market sizing and forecasts have been done based on value (USD).

| By Therapy Type | Chemotherapy | ||

| Targeted Therapy | |||

| Immunotherapy | |||

| Hormonal Therapy | |||

| Other Treatment Types | |||

| By Cancer Type | Blood Cancer | ||

| Breast Cancer | |||

| Prostate Cancer | |||

| Gastrointestinal Cancer | |||

| Gynecologic Cancer | |||

| Respiratory/Lung Cancer | |||

| Other Cancer Types | |||

| By Route of Administration | Intravenous | ||

| Oral | |||

| Subcutaneous | |||

| Intratumoral | |||

| By End User | Hospitals | ||

| Specialty Clinics | |||

| Cancer and Radiation Therapy Centers | |||

| Homecare Settings | |||

| By Geography | North America | United States | |

| Canada | |||

| Mexico | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Italy | |||

| Spain | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| South Korea | |||

| Australia | |||

| Rest of Asia-Pacific | |||

| Middle-East and Africa | GCC | ||

| South Africa | |||

| Rest of Middle East and Africa | |||

| South America | Brazil | ||

| Argentina | |||

| Rest of South America | |||

| Chemotherapy |

| Targeted Therapy |

| Immunotherapy |

| Hormonal Therapy |

| Other Treatment Types |

| Blood Cancer |

| Breast Cancer |

| Prostate Cancer |

| Gastrointestinal Cancer |

| Gynecologic Cancer |

| Respiratory/Lung Cancer |

| Other Cancer Types |

| Intravenous |

| Oral |

| Subcutaneous |

| Intratumoral |

| Hospitals |

| Specialty Clinics |

| Cancer and Radiation Therapy Centers |

| Homecare Settings |

| North America | United States |

| Canada | |

| Mexico | |

| Europe | Germany |

| United Kingdom | |

| France | |

| Italy | |

| Spain | |

| Rest of Europe | |

| Asia-Pacific | China |

| Japan | |

| India | |

| South Korea | |

| Australia | |

| Rest of Asia-Pacific | |

| Middle-East and Africa | GCC |

| South Africa | |

| Rest of Middle East and Africa | |

| South America | Brazil |

| Argentina | |

| Rest of South America |

Key Questions Answered in the Report

What is the current size of the cancer therapy market?

The cancer therapy market stands at USD 243.62 billion in 2025 and is projected to reach USD 403.99 billion by 2030.

Which therapy type holds the largest share?

Targeted therapies lead with a 37.0% cancer therapy market share thanks to their precision in addressing tumor-specific molecular drivers.

Why is Asia the fastest-growing region?

Asia’s 11.2% CAGR is tied to rising cancer incidence, expanding healthcare infrastructure, and regulators’ acceptance of real-world evidence that accelerates drug approvals.

How significant is financial toxicity in cancer care?

Studies show 75% of patients seek copayment help, and 42% suffer severe financial burdens, sometimes resulting in treatment abandonment.

What recent modality innovations have reached the market?

Approvals of lifileucel (tumor-infiltrating lymphocyte therapy) and subcutaneous nivolumab highlight advances in cell therapy and patient-convenient formulations.

Which routes of administration are gaining popularity beyond IV?

Subcutaneous and intratumoral delivery are rising; subcutaneous nivolumab demonstrated noninferior efficacy with shorter clinic visits compared with IV dosing.