Egypt Paints and Coatings Market Analysis

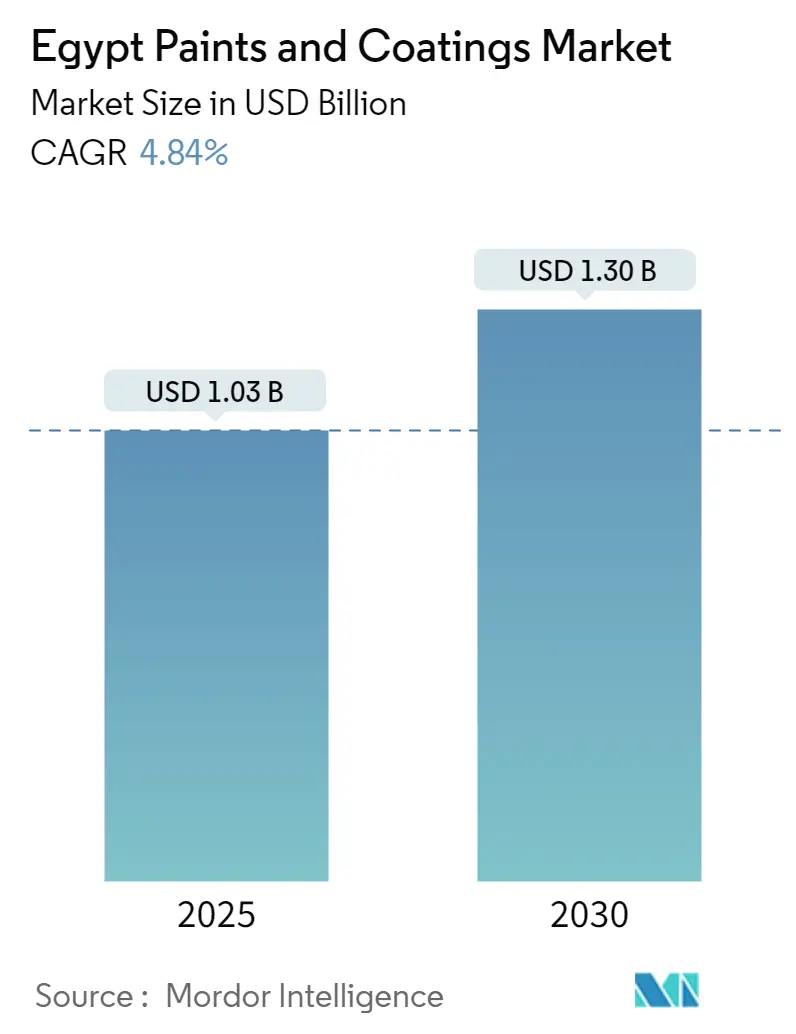

The Egypt Paints and Coatings Market size is estimated at USD 1.03 billion in 2025, and is expected to reach USD 1.30 billion by 2030, at a CAGR of 4.84% during the forecast period (2025-2030).

Egypt's robust economic landscape continues to drive industrial development and infrastructure growth across multiple sectors. The oil and gas industry remains a cornerstone of the economy, accounting for 15% of the country's GDP and attracting 31% of foreign direct investments. This industrial expansion has created substantial opportunities for protective coatings applications, particularly in infrastructure development and industrial facilities. The government's focus on economic diversification and industrial modernization has led to increased demand for high-performance industrial coatings across various applications.

The industry is witnessing a significant shift towards environmentally sustainable products, driven by stringent regulations and increasing environmental awareness. Manufacturers are investing in research and development to create low-VOC and waterborne coatings solutions that meet both regulatory requirements and performance standards. This transition is particularly evident in the architectural and industrial segments, where eco-friendly alternatives are gaining prominence. The development of green building codes and certification programs has further accelerated the adoption of sustainable coatings solutions.

Raw material price volatility continues to present challenges for industry participants, impacting production costs and pricing strategies. According to the British Coatings Federation, solvent prices experienced a significant increase of 78% in late 2021, affecting manufacturing costs and profit margins. Industry players are responding by implementing strategic pricing mechanisms and exploring alternative raw material sources to maintain competitiveness while ensuring product quality and performance standards.

The power sector is emerging as a significant growth driver for protective coatings, supported by substantial investments in both conventional and renewable energy infrastructure. Egypt has set ambitious targets to increase its renewable energy contribution, aiming to generate 42% of its electricity from renewable sources by 2035. This transformation of the energy sector, coupled with ongoing investments in power generation and distribution infrastructure, is creating new opportunities for specialized coating solutions designed for power generation equipment and facilities.

Egypt Paints and Coatings Market Trends

Increasing Oil and Gas Projects in the Country

The oil and gas industry represents one of the most dynamic sectors in Egypt, serving as the largest single industrial activity and accounting for 15% of the country's total gross domestic product and 31% of foreign direct investment. The industry's robust growth is evidenced by the extensive production network across different regions, with the Western Desert representing 56% of crude oil production, followed by the Gulf of Suez with 23%, the Eastern Desert with 12%, and the Sinai Peninsula with 9%. Major international companies operating in the sector include American Apache Corporation, Italian Eni, Emirati Dragon Oil, and Dutch Shell, alongside domestic players like Khaleda Petroleum Company and Belayim Petroleum Company.

The sector continues to attract substantial investments and development projects. As of 2022-2023, the Egyptian Natural Gas Holding Company (EGAS) planned investments reaching USD 900 million for exploration, development, and production activities. Eight exploration blocks spread across 12,300 sq km were awarded to various companies including Apex International, Eni, BP, and others, with a minimum investment commitment of USD 250 million and plans for at least 33 exploration wells. Additionally, the country has announced plans to invest approximately USD 1.3 billion to search for oil and natural gas at nine new sites in the Mediterranean and Red Seas, demonstrating the government's commitment to expanding its hydrocarbon resources and production capabilities.

Expanding Construction Industry

Egypt's construction industry has emerged as one of the largest in the African region, with projections indicating a robust growth rate of 9% between 2020 and 2024, driven by active public-private partnerships and green building expansion. The sector's dynamism is exemplified by the development of the New Administrative Capital, located 30 miles east of Cairo, which represents a significant infrastructure project with USD 20 billion invested in its first phase alone. The government's ambitious plans extend beyond this flagship project, with intentions to construct up to 14 additional smart cities across the country, supported by completed infrastructure projects worth approximately USD 106.25 billion in less than two years.

The construction sector's expansion is further bolstered by the government's Urban Development 2052 program, which aims to double the urban area from 7% to 14% by 2030. The New Urban Communities Authority (NUCA) is actively developing new cities equipped with comprehensive facilities including schools, hospitals, shopping malls, and entertainment venues, while encouraging private sector participation through infrastructure provision. This development surge is complemented by significant investments in the residential sector, with the Ministry of Housing indicating a requirement for 500,000 to 600,000 new homes annually to meet housing demands, creating substantial opportunities for the construction industry's continued growth. In this context, the demand for industrial coatings and protective coatings is expected to rise, as these materials are essential for the durability and longevity of infrastructure projects. Additionally, the use of construction paints is critical in enhancing the aesthetic and functional aspects of these new urban developments.

Segment Analysis: Resin Type

Acrylic Segment in Egypt Paints and Coatings Market

The acrylic segment dominates the Egypt paints and coatings market, holding approximately 36% market share in 2024. Acrylic resins have gained widespread adoption due to their exceptional properties, including transparency, high colorability, and superior UV resistance in coating solutions. These resins are frequently utilized in water-borne systems, resulting in low VOC emissions, which align with growing environmental regulations. Acrylic paints have become the most widely used architectural coatings due to their versatility and performance characteristics. The segment is also experiencing the fastest growth in the market, driven by increasing demand from construction applications where acrylic coatings provide high surface hardness and durability. When combined with certain fluids, acrylic coatings deliver elastomeric finishes that enhance UV resistance in applications such as walls, decks, and roofing.

Remaining Segments in Resin Type

The other significant resin types in the Egypt paints and coatings market include alkyd, polyurethane, epoxy, polyester, and other specialty resins. Alkyd resins form the second-largest segment, valued for their good weathering properties and versatility in synthetic paints. Polyurethane coatings are preferred in applications requiring high durability and resistance to extreme conditions, particularly in automotive coatings and industrial coatings applications. Epoxy resins are crucial for protective coatings due to their excellent adhesion and chemical resistance properties. Polyester resins serve various applications, including automotive OEM, aviation, and household appliances, while specialty resins cater to specific niche applications requiring unique performance characteristics.

Segment Analysis: By Technology

Waterborne Segment in Egypt Paints and Coatings Market

The waterborne coatings segment dominates the Egypt paints and coatings market, commanding approximately 48% market share in 2024. This significant market position is primarily driven by increasing environmental regulations and growing consumer awareness about VOC emissions. Waterborne coatings are particularly preferred in Egypt for various architectural and automotive applications due to their eco-friendly nature and lower VOC content. These coatings offer favorable properties, including low odor, enhanced durability, and superior block resistance. Major players in Egypt have launched waterborne decorative and automotive coatings to meet the rising demand for environmentally sustainable solutions. The segment's growth is further supported by green building initiatives in Egypt, where construction companies are seeking LEED or EDGE certification, necessitating the use of eco-friendly materials, including low-VOC paints and coatings.

Solvent-borne Segment in Egypt Paints and Coatings Market

The solvent-borne segment represents a significant portion of the market, with growth driven by its specific advantages in certain applications. These coatings are particularly valued for their rapid drying properties and ability to perform effectively across a wide range of environmental conditions. Solvent-borne coatings demonstrate superior performance in challenging environmental conditions, being less susceptible to temperature and humidity variations during the curing phase compared to water-based alternatives. They find extensive applications in coating doors, cabinets, furniture, metal doors, railings, and industrial equipment. The segment continues to maintain its importance in industrial coatings applications where performance requirements are particularly demanding, though its growth is moderated by the increasing shift toward environmentally friendly alternatives.

Remaining Segments in Technology

Other technologies in the Egypt paints and coatings market, including powder coatings and radiation-curable formulations, play a crucial role in specific applications. Powder coatings are gaining prominence due to their eco-friendly nature, producing no VOCs during application, and their superior quality finish. These technologies are particularly valuable in the automotive, woodwork, furniture, building and construction, and domestic appliances industries. Radiation-curable technology offers advantages such as low energy consumption, reduced environmental impact, minimal waste generation, faster curing time, and compact application equipment footprint, making it suitable for wood, paper, optics, electronics, and plastic applications. The segment is witnessing increased adoption as industries seek innovative and environmentally responsible coating solutions.

Segment Analysis: By End User Type

Architectural Segment in Egypt Paints and Coatings Market

The architectural coatings segment dominates the Egypt paints and coatings market, commanding approximately 65% market share in 2024. This segment's prominence is driven by extensive construction activities across Egypt, including the development of new cities and urban spaces to address housing shortages and growing middle-class demand for improved residential options. The segment is also experiencing the fastest growth rate in the market, projected to expand at around 7% during 2024-2029, fueled by major government initiatives like the Urban Development 2052 program, which aims to double the urban area from 7% to 14% by 2030. The growth is further supported by increasing investments in construction projects, with the Egyptian construction sector reaching significant investment levels of LE 600 billion. Additionally, the adoption of green building certifications through programs like LEED and EDGE is driving the demand for eco-friendly architectural coatings with low VOC content.

Remaining Segments in End User Type

The other significant segments in the Egypt paints and coatings market include automotive coatings, wood coatings, protective coating, general industrial, and other end-user types. The automotive coatings segment is gaining traction due to increasing vehicle production and the government's focus on developing the domestic automotive industry. The wood coatings segment serves the furniture manufacturing sector, particularly in Damietta City, which is a major furniture production hub. Protective coatings find extensive applications in oil and gas, power generation, and infrastructure projects, while the general industrial segment caters to various manufacturing industries, including electrical equipment and appliances. Each of these segments contributes uniquely to the market's growth, driven by specific industry requirements and technological advancements in coating resins solutions.

Egypt Paints and Coatings Industry Overview

Top Companies in Egypt Paints and Coatings Market

The Egyptian paints and coatings market is characterized by strong product innovation across various segments, with companies focusing on developing eco-friendly solutions and specialized specialty coatings for different applications. Market leaders are investing significantly in research and development to create advanced formulations, particularly in waterborne coatings technologies and low-VOC products. Operational excellence is being achieved through the modernization of manufacturing facilities and the implementation of efficient distribution networks, with many companies establishing extensive dealer networks across the country. Strategic initiatives include backward integration into raw material production, particularly for resins and additives, to maintain cost competitiveness and ensure supply chain stability. Companies are also expanding their presence through new manufacturing facilities and increasing their production capacities to meet growing demand from the construction and industrial sectors.

Local Players Dominate Egyptian Coatings Landscape

The Egyptian paints and coatings market exhibits a highly consolidated structure dominated by established local manufacturers, with PACHIN, SCIB Paints, and Sipes Egypt holding significant market positions. These domestic players leverage their deep understanding of local market dynamics, established distribution networks, and long-standing relationships with key stakeholders to maintain their competitive edge. International players like AkzoNobel, Jotun, and Hempel maintain their presence through strategic partnerships, acquisitions, and specialized product offerings in premium segments.

The market has witnessed several strategic acquisitions and partnerships, particularly involving international companies seeking to strengthen their foothold in the Egyptian market. Local manufacturers are increasingly focusing on expanding their manufacturing capabilities and modernizing their facilities to compete more effectively with global players. The competitive dynamics are further shaped by the strong presence of family-owned businesses that have built robust brand equity over decades of operation in the Egyptian market, while also maintaining close relationships with local distributors and contractors.

Innovation and Distribution Drive Market Success

Success in the Egyptian paints and coatings market increasingly depends on companies' ability to develop innovative products that meet specific local requirements while adhering to international quality standards. Market leaders are investing in developing specialized products for the construction sector, which represents the largest end-user segment. Companies are also focusing on strengthening their distribution networks, particularly in emerging urban areas and new cities being developed across Egypt. The ability to offer comprehensive technical support and after-sales services has become crucial for maintaining customer loyalty and gaining market share.

Future growth opportunities lie in developing eco-friendly products and establishing strong relationships with key stakeholders in the construction and industrial sectors. Companies need to focus on price optimization strategies while maintaining product quality, given the price-sensitive nature of the market. The regulatory environment is becoming more stringent regarding environmental compliance and VOC emissions, making it essential for companies to invest in sustainable technologies. Market players must also consider the increasing importance of color customization and digital color matching services to meet evolving customer preferences in both decorative paints and industrial coatings segments.

Egypt Paints and Coatings Market Leaders

-

Sipes Egypt

-

MIDO Coatings

-

PACHIN

-

GLC Paints

-

Scib Paints (Asian Paints)

- *Disclaimer: Major Players sorted in no particular order

Egypt Paints and Coatings Market News

- In September 2022, Hempel launched a new protective coating, Hempablade Edge 171, for leading-edge protection (LEP) on wind turbine rotor blades. The product has the highest rain erosion performance data for a liquid LEP, and some of the lowest dry film thicknesses provide long-term protection against rain erosion and reduce time and costs during application.

- In June 2022, Hempel launched a new product, Hemaprime CUI 275, which is a fast-drying CUI coating. This coating is highly resistant to corrosion and temperature. The product is made to increase production and provide protection against corrosion in the energy segment and oil and gas stations.

Egypt Paints and Coatings Industry Segmentation

The Egyptian paints and coatings market is segmented by resin type, technology, and end user. By resin type, the market is segmented into acrylic, alkyd, polyurethane, epoxy, polyester, and other resin types), technology (waterborne, solvent-borne, and other technologies. By end user, the market is segmented by architectural, automotive, wood, protective, general industrial, and other end users. The report offers market size and forecasts for Egypt's paints and coatings market in revenue (USD million) for all these segments.

| Resin Type | Acrylic |

| Alkyd | |

| Polyurethane | |

| Epoxy | |

| Polyester | |

| Other Resin Types | |

| Technology | Waterborne |

| Solvent-borne | |

| Other Technologies | |

| End User | Architectural |

| Automotive | |

| Wood | |

| Protective Coating | |

| General Industrial | |

| Other End Users |

| Acrylic |

| Alkyd |

| Polyurethane |

| Epoxy |

| Polyester |

| Other Resin Types |

| Waterborne |

| Solvent-borne |

| Other Technologies |

| Architectural |

| Automotive |

| Wood |

| Protective Coating |

| General Industrial |

| Other End Users |

Egypt Paints and Coatings Market Research FAQs

How big is the Egypt Paints and Coatings Market?

The Egypt Paints and Coatings Market size is expected to reach USD 1.03 billion in 2025 and grow at a CAGR of 4.84% to reach USD 1.30 billion by 2030.

What is the current Egypt Paints and Coatings Market size?

In 2025, the Egypt Paints and Coatings Market size is expected to reach USD 1.03 billion.

Who are the key players in Egypt Paints and Coatings Market?

Sipes Egypt, MIDO Coatings, PACHIN, GLC Paints and Scib Paints (Asian Paints) are the major companies operating in the Egypt Paints and Coatings Market.

What years does this Egypt Paints and Coatings Market cover, and what was the market size in 2024?

In 2024, the Egypt Paints and Coatings Market size was estimated at USD 0.98 billion. The report covers the Egypt Paints and Coatings Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Egypt Paints and Coatings Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.