Global Electric Motor Market Analysis by Mordor Intelligence

The Global Electric Motor Market size is estimated at USD 146.40 billion in 2025, and is expected to reach USD 222.02 billion by 2030, at a CAGR of 8.69% during the forecast period (2025-2030).

Growth is anchored in the worldwide push for electrification, stricter minimum-efficiency regulations, and rising demand from electric vehicles, HVAC upgrades, and renewable-energy projects. Tighter IEC efficiency classes, combined with the EU Ecodesign Directive and comparable rules in North America and Asia, are accelerating replacement sales of legacy motors. Simultaneously, sustained expansion of manufacturing in China, India, and Southeast Asia is raising unit volumes in industrial machinery, while IoT-enabled predictive-maintenance platforms shorten replacement cycles. The resulting shift toward IE4 and IE5 designs, permanent-magnet architectures, and integrated drives is heightening R&D competition and driving consolidation among suppliers.

Key Report Takeaways

• By motor type, AC motors led with 73.34% of electric motor market share in 2024; DC motors are forecast to post the fastest 9.4% CAGR through 2030.

• By output power, fractional-horsepower units (<1 HP) accounted for 52% share of the electric motor market size in 2024, while high-power motors (>500 HP) are on track for the highest 8% CAGR to 2030.

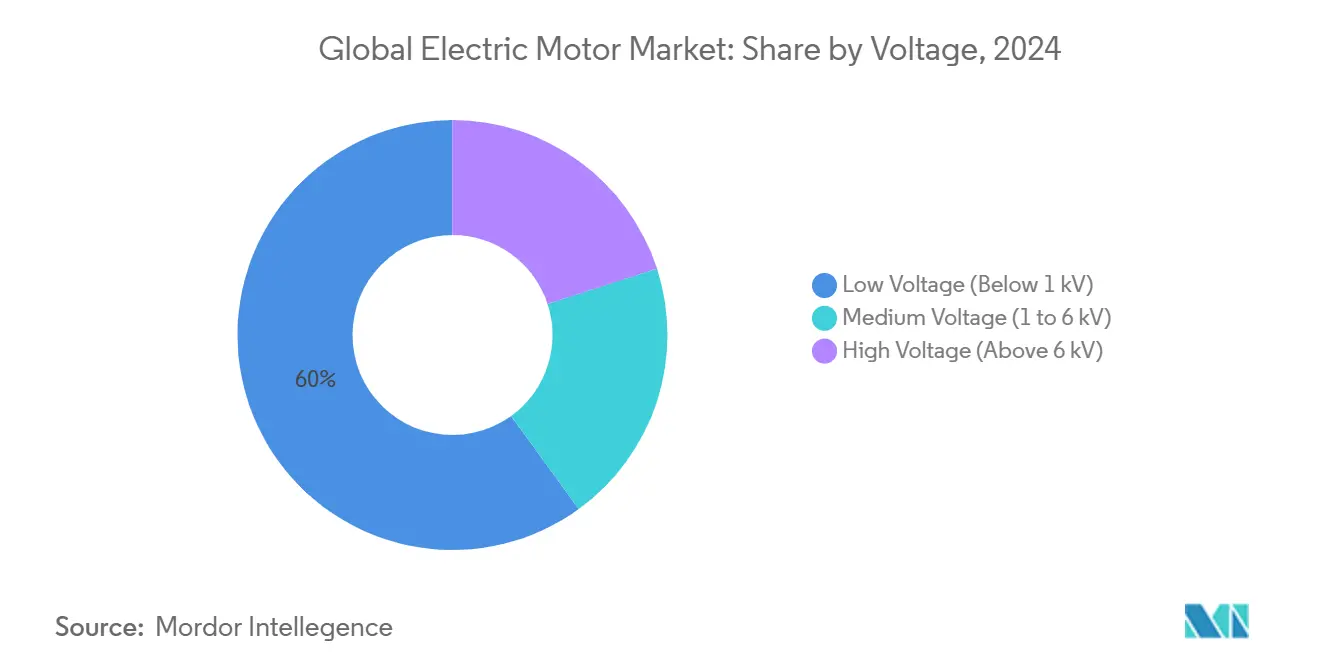

• By voltage, low-voltage models (<1 kV) controlled about 63% of 2024 revenue; medium-voltage motors (1-6 kV) are projected to expand at an 8.5% CAGR.

• By application, industrial machinery held 42.9% of 2024 revenue; automotive and transportation is advancing at an 11.83% CAGR.

• By end-use industry, the industrial sector captured 64.74% of 2024 sales and is advancing at a 9.06% CAGR.

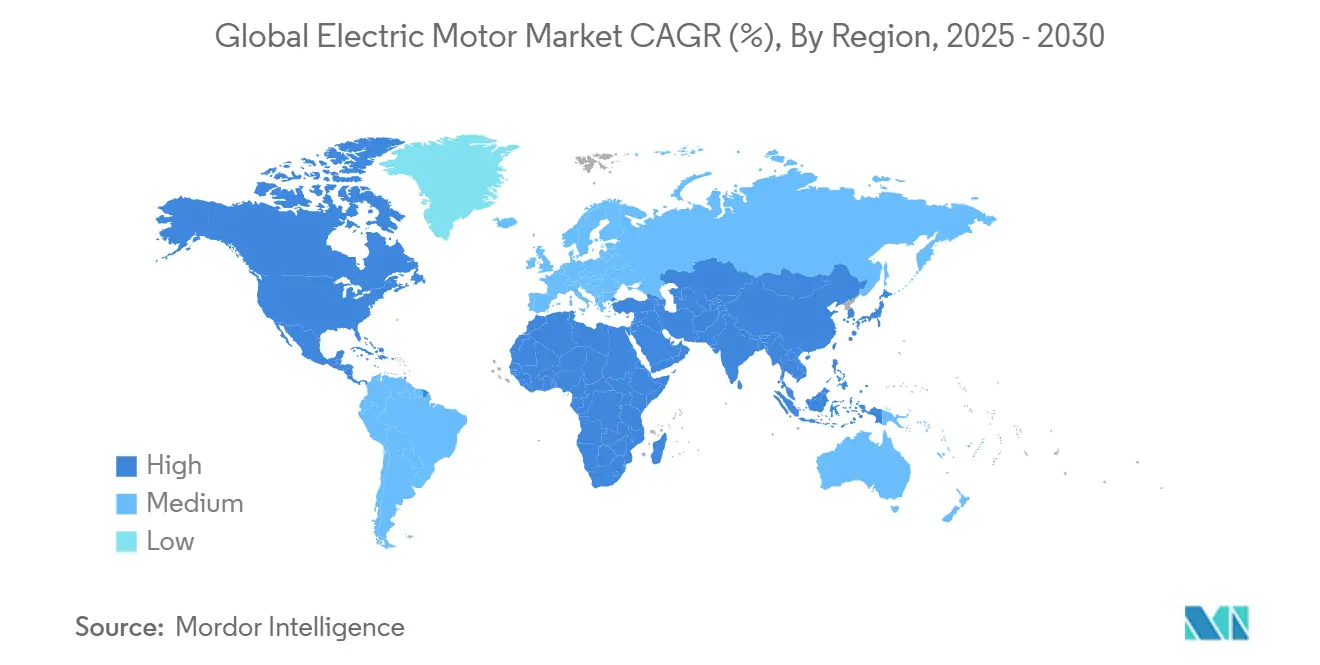

• Asia-Pacific led with roughly 42.6% market share in 2024, and the region is forecast for a 10.7% CAGR through 2030.

Global Electric Motor Market Trends and Insights

Drivers Impact Analysis

| Driver | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Rapid electrification of Asia’s discrete manufacturing | 0.90% | Asia-Pacific; spill-over in North America | Medium term (2-4 years) |

| HVAC retrofits in US housing stock | 1.20% | North America (US) | Short term (≤2 years) |

| Offshore wind build-out demanding high-power PM motors | 1.50% | Europe (UK, Poland) | Long term (≥4 years) |

| China’s BEV powertrain scale-up | 0.80% | Asia-Pacific (China) | Medium term (2-4 years) |

Source: Mordor Intelligence

Rapid Electrification of Manufacturing Automation in Asia’s Discrete Industries

Robot density in Chinese factories reached 322 units per 10,000 workers in 2024, each robot integrating 6-12 servo motors.(1)International Energy Agency, “Global EV Outlook 2025,” iea.org Vietnam and India are replicating this automation curve to attract supply-chain diversification, spurring localized demand for precision motors with tighter speed-torque envelopes. End users now make procurement choices on lifetime efficiency rather than upfront cost, lifting premium-efficiency unit penetration rates across tier-2 Asian industrial parks. Digital twins for servo-driven cells cut commissioning time and signal an emerging service revenue pool for motor OEMs. As automation migrates to small-batch production, configurability and rapid motor-drive tuning have become decisive buying factors in the electric motor market.

Accelerating HVAC Adoption in US Residential Retrofits Driven by Federal Energy Standards

The latest SEER mandates rendered millions of legacy HVAC systems non-compliant, opening a 15% annual replacement channel through 2027.(2)International Electrotechnical Commission, “Efficiency Classes for Low-Voltage AC Motors,” iec.ch Variable-speed motors trim residential electricity demand by up to 40%, and cold-climate heat-pump launches in late 2024 expanded viability into northern states. Utilities sweeten the economics with time-of-use tariffs that reward inverter-driven compressors, reinforcing a steady pull for IE4-grade fan and blower motors. Contractors now bundle connected controls that report real-time load profiles, feeding analytics platforms that refine sizing for future retrofits. This regulatory-enabled shift keeps North America firmly on the growth path of the electric motor market.

Surging Offshore Wind Turbine Installations Requiring High-Power Permanent-Magnet Motors in Europe

The UK targets 43-51 GW of offshore wind by 2030, while Poland eyes 18 GW by 2040, together underwriting multi-billion-dollar demand for direct-drive generators. Gearbox-less architectures mandate giant permanent-magnet machines exceeding 10 MW per nacelle, driving a specialist supplier tier for corrosion-resistant stators and high-density cooling. Floating platform prototypes tilt torque density requirements even higher as designers pursue lighter nacelles. Maintenance windows at sea average 5-7 years, embedding a recurrent aftermarket stream for rewind kits and bearing upgrades. European climate policy thus anchors a long-duration growth leg in the electric motor market.

Battery Electric Vehicle Powertrain Ramp-Up in China Catalyzing High-Efficiency Traction Motors Demand

China built 12.4 million electric cars in 2024, more than 70% of global output. Automakers shifted decisively to permanent-magnet synchronous motors for their superior power-to-weight ratios, while range-extended EV sales leapt 79% to 1.2 million units. R&D teams slash rare-earth intensity through novel flux paths and grain-optimized magnets, with leading OEMs claiming 20% neodymium cuts. Thermal-management breakthroughs extend peak power windows, letting compact 6-in-1 e-axles serve heavier vehicle classes. Competitive intensity among Chinese Tier-1s now pivots on torque-density roadmaps, amplifying overall momentum in the electric motor market.

Restraints Impact Analysis

| Restraint | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Volatile neodymium prices | –0.6% | Global (strongest in Asia-Pacific) | Medium term (2-4 years) |

| Tight supply of IGBT modules | –0.5% | Global, concentrated in EV hubs | Short term (≤2 years) |

Source: Mordor Intelligence

Volatile Neodymium Prices Pressuring Permanent-Magnet Motor Economics

Neodymium spot prices slid 42% in the past 12 months after earlier spikes, complicating BOM forecasts for traction-motor programs.(3)Bunting Magnetics, “Rare-Earth Market Update 2025,” buntingmagnetics.com EV platforms require up to 5 kg of magnet material, so price swings ripple through entire model portfolios. OEMs hedge by dual-sourcing and experimenting with magnet-reduced topologies such as ferrite-assisted synchronous motors. Parallel research on synchronous-reluctance designs offers magnet-free torque maps but demands tight air-gap machining. The uncertainty nudges procurement teams toward long-term offtake contracts, yet sustained volatility could still shave growth from the electric motor market.

Supply Constraints of IGBT Modules Limiting High-Voltage Motor Production

Surging demand for automotive power electronics pushed IGBT lead times past 40 weeks for certain 1200 V packages(4)Arrow Electronics, “Power Electronics Market Forecast 2025,” arrow.com. High-voltage drives in EVs, rail locomotives, and megawatt-class pumps rely on these modules for switching efficiency. Some OEMs redesign inverters around silicon-carbide MOSFETs, enjoying higher switching speeds but contending with cost and thermal hurdles. Vertical integration strategies—ranging from captive fabs to joint ventures—aim to insulate critical projects from allocation cycles. Until capacity ramps stabilize, the component bottleneck trims near-term output and restrains segments of the electric motor market.

Segment Analysis

By Motor Type: AC Dominance Deepens Amid Efficiency Upgrades

AC units generated 73.34% of global revenue in 2024, and their 9.4% compound growth will keep them central to the electric motor market size narrative through 2030. Induction models remain the default for conveyors, pumps, and fans, while synchronous variants proliferate where speed precision matters. Digital drives now auto-tune rotor flux to squeeze extra kilowatt-hours, making IE4 induction systems a drop-in swap for IE2 legacy fleets. On the DC side, brushless designs extend service intervals in drones and e-bikes, carving defensible niches without threatening overall AC share.

Mature tooling, abundant spare parts, and simplified installation secure AC motors’ hold on brownfield retrofits, yet emerging axial-flux topologies hint at fresh competitive stakes. Servo grades feed advanced robotics, fusing feedback encoders with edge computing for millisecond-level motion control. Against this backdrop, the electric motor market continues to reward suppliers that blend scale economics with platform-ready modularity.

Note: Segment share of all individual segment available on report purchase

DC Motor Segment in Electric Motor Market

Fractional-horsepower units cornered 50-55% of 2024 shipments as smart appliances, HVAC blowers, and handheld devices multiplied. Tight packaging constraints spur emphasis on miniaturization, with halogen-free insulation films and powder-metal gears lifting thermal limits. In contrast, >500 HP machines will post a 7.5-8% CAGR, creating outsized revenue impact despite modest volumes. Large-frame permanent-magnet motors now propel 14-MW offshore wind nacelles, while mining conveyors demand rugged TEFC housings rated for desert climates.

Integral-horsepower brackets (1-500 HP) remain the backbone of process lines, benefitting from variable-frequency drives that unlock 20-30% energy savings. As OEMs broaden their IE4 catalogs, segment cross-over formats blur, blending compact stator geometries of small motors with the cooling strategies of their high-power cousins. All told, divergent growth dynamics within power classes reinforce the complexity of sizing opportunities across the electric motor market.

By Voltage: Low-Voltage Versatility Meets Medium-Voltage Momentum

Low-voltage (<1 kV) models secured a dominant 60-65% share in 2024 thanks to straightforward wiring protocols and mass-market component availability. Every escalator motor or chilled-water pump callout sustains this base, while IE3 and IE4 appellations shore up lifetime cost arguments. Semiconductor shortages have delayed a minority of retrofit projects, yet pent-up demand is rolling into 2025 orders.

Medium-voltage (1-6 kV) equipment is forecast to outpace the headline growth at an 8-8.5% CAGR as desalination plants, large-scale agriculture, and city metro lines expand. These motors offer step-change efficiency without the insulation and switchgear complexity of >6 kV systems, attracting EPC contractors in emerging markets. The resulting uptake lifts the medium-voltage slice of electric motor market size, although high-voltage (>6 kV) units keep their critical foothold in petrochemical and utility applications where megawatt ratings are non-negotiable.

Note: Segment share of all individual segment available on report purchase

By Application: Industry Rules, Mobility Surges

Industrial machinery accounted for 42.9% of revenue in 2024, anchoring the electric motor market size and replacement cycles. Process intensification, coupled with predictive maintenance platforms, pushes factories to swap out IE1 fossils for premium-efficiency equivalents on an opportunistic basis. Simultaneously, advanced motion controllers maximise output per square foot, embedding another tranche of servo-drive sales into brownfield upgrades.

Automotive and broader transportation use cases are scaling fastest at an 11.83% CAGR through 2030. Each battery electric SUV integrates traction, steering, thermal, and auxiliary motors tallying upward of 40 units per vehicle. Bus and truck electrification adds higher continuous-power requirements, lengthening the value ladder for suppliers. HVAC and refrigeration remain evergreen, driven by building-code mandates that force staged compressor retrofits and electrified heat pumps.

By End-Use Industry: Industrial Plants Dominate Value and Innovation

Industrial enterprises consumed 64.74% of global shipments in 2024, and the segment’s 9.06% CAGR will cement its pole position over the forecast. Factory digitization leans on synchronized, feedback-rich motors to balance throughput and energy budgets. Utilities and mining operators seek upgraded ingress-protection ratings that withstand abrasives, acids, and voltage sags, supporting premium-price elasticity.

Commercial real estate ranks second, with motors driving chillers, elevators, and escalators in increasingly electrified building envelopes. Portfolio owners bundle sensor-enabled drives to capture operating-cost savings via central dashboards. The residential slice contributes scale rather than margin, yet smart-home penetration is nudging incremental ASP gains through brushless, ultra-quiet fan motors. Consequently, sectoral diversity guarantees sustained depth in the electric motor market.

Geography Analysis

Asia-Pacific led with 42.6% of 2024 revenue and will clock a 10.7% CAGR to 2030 as China maintains volume leadership and India accelerates Make-in-India initiatives. Guangdong-based motor clusters integrate end-to-end casting, winding, and drive electronics, compressing lead times for domestic EV customers. Vietnam’s industrial parks lure contract manufacturers that back-source motors to regional suppliers, widening supply webs. Government incentives on high-efficiency equipment encourage swift adoption of IE4 grades across textile and semiconductor fabs.

North America holds the second-largest stake, energized by federal HVAC efficiency laws and a vibrant automation ecosystem. Predictive-maintenance retrofits in Midwest auto plants cut downtime by up to 45%, nudging continuous replacement orders. The US battery-plant build-out funnels traction-motor R&D spend into joint labs that test rotor laminations under high-speed duty cycles. Canada’s on-shore wind repowering schemes shift procurement toward lighter direct-drive units, enriching the electric motor market.

Europe sustains growth on dual pillars of offshore wind and stringent Ecodesign rules. Ports on the North Sea expand nacelle staging capacity to manage 15-MW turbines outfitted with direct-drive PM generators. Manufacturers centralize service hubs in Poland and Spain to satisfy 5-year overhaul contracts. EU energy-price volatility pushes industrial users to prioritise IE4 retrofits, shortening payback horizons.

The Middle East and Africa, though smaller in absolute terms, post above-trend growth from water-desalination plants and gas booster stations. UAE EPC contracts specify explosion-proof motors with IECEx certification, creating pockets of high-margin demand. South America’s industrial restarts in Brazil and Chile reignite orders for medium-voltage pump drives and sugar-mill crushers. Across all regions, regulatory convergence on efficiency keeps demand momentum intact for the electric motor market.

Competitive Landscape

Industry structure is moderately fragmented, with incumbent giants ABB, Siemens, and Nidec defending share through vertical integration and modular platform rollouts. ABB’s 2023 purchase of a US NEMA portfolio deepened its low-voltage range, while Siemens’ 2025 acquisition of ebm-papst’s IDT arm bolstered high-efficiency ventilation lines. Nidec leverages high-speed motor expertise to enter aerospace propulsion, exemplified by its 2025 Airbus fuel-cell contract.

Chinese challengers scale aggressively, investing in automated rotor-stack winding and in-house power-electronics packaging. Provincial subsidies underwrite capacity expansions that target European OEMs seeking dual sourcing. Specialist disruptors pursue axial-flux geometry, promising 30% higher torque density for next-gen e-axles. Intellectual-property depth around magnetic-flux models and thermal pathways has emerged as the main moat rather than manufacturing cost alone.

Digital services now differentiate offerings; cloud-based dashboards track vibration signatures and energy KPIs, feeding predictive-maintenance algorithms. Subscription revenues from analytics bundles augment traditional hardware margins, making software capability a top agenda item. Sustainability metrics join price and delivery in tender scoring as buyers weigh embodied carbon. Collectively, these forces intensify competition while broadening the scope of value creation within the electric motor market.

Global Electric Motor Industry Leaders

-

ABB Ltd.

-

Siemens AG

-

Nidec Corporation

-

Regal Rexnord Corporation

-

WEG S.A.

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- January 2025: ABB unveiled the AMI 5800 modular induction motor, surpassing IE4 efficiency and delivering up to 40% energy savings in retrofit scenarios.

- April 2025: Hyundai’s INSTER EV clinched the 2025 World Electric Vehicle award, spotlighting its 370 km range made possible by high-density traction motors.

- May 2025: Nidec secured a contract with Airbus to supply electric motors for hydrogen fuel-cell propulsion, extending its reach into aviation.

- December 2024: WEG opened a new Indian motor plant, boosting regional output for industrial and infrastructure projects.

Global Electric Motor Market Report Scope

The electric motors are operated through interaction between the magnetic field of the motor and the winding currents, producing rotation. Electric motors can convert electrical energy to mechanical energy, so they have widespread applications in fans, pumps, compressors, elevators, and refrigerators. Electric motors are a major piece of equipment used across industrial, commercial, and residential sectors. The demand for electric motors in the industrial industry arises from developing new industrial projects and needs due to the refurbishment of old infrastructure.

The market is segmented based on motor type, voltage, application, and geography. By motor type, the market is segmented into DC and AC. The market is segmented by voltage into less than 1 kV, between 1-6 kV, and higher than 6 kV. The market is segmented by application into residential, commercial, industrial, and automotive. The report also covers the market size and forecasts for the electric motor market across major regions. The market sizing and forecasts have been done for each segment based on revenue (USD).

| By Motor Type | AC Motor (Induction (Asynchronous), Synchronous) | ||

| DC Motor (Brushed, Brushless (BLDC)) | |||

| Others (Hermetic Motor, Stepper Motor) | |||

| By Output Power Rating | Fractional Horsepower (Below 1 HP) | ||

| Integral Horsepower (1 to 500 HP) | |||

| High-Power (Above 500 HP) | |||

| By Voltage | Low Voltage (Below 1 kV) | ||

| Medium Voltage (1 to 6 kV) | |||

| High Voltage (Above 6 kV) | |||

| By Application | Industrial Machinery | ||

| HVAC and Refrigeration | |||

| Automotive and Transportation | |||

| Residential Appliances | |||

| Utilities and Energy | |||

| Others (Agriculture, Oil and Gas, Mining) | |||

| By End-Use Industry | Residential | ||

| Commercial | |||

| Industrial | |||

| By Geography | North America | United States | |

| Canada | |||

| Mexico | |||

| Europe | United Kingdom | ||

| Germany | |||

| France | |||

| Spain | |||

| Nordic Countries | |||

| Russia | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| India | |||

| Japan | |||

| South Korea | |||

| Malaysia | |||

| Thailand | |||

| Indonesia | |||

| Vietnam | |||

| Australia | |||

| Rest of Asia-Pacific | |||

| South America | Brazil | ||

| Argentina | |||

| Colombia | |||

| Rest of South America | |||

| Middle East and Africa | United Arab Emirates | ||

| Saudi Arabia | |||

| South Africa | |||

| Egypt | |||

| Rest of Middle East and Africa | |||

| AC Motor (Induction (Asynchronous), Synchronous) |

| DC Motor (Brushed, Brushless (BLDC)) |

| Others (Hermetic Motor, Stepper Motor) |

| Fractional Horsepower (Below 1 HP) |

| Integral Horsepower (1 to 500 HP) |

| High-Power (Above 500 HP) |

| Low Voltage (Below 1 kV) |

| Medium Voltage (1 to 6 kV) |

| High Voltage (Above 6 kV) |

| Industrial Machinery |

| HVAC and Refrigeration |

| Automotive and Transportation |

| Residential Appliances |

| Utilities and Energy |

| Others (Agriculture, Oil and Gas, Mining) |

| Residential |

| Commercial |

| Industrial |

| North America | United States |

| Canada | |

| Mexico | |

| Europe | United Kingdom |

| Germany | |

| France | |

| Spain | |

| Nordic Countries | |

| Russia | |

| Rest of Europe | |

| Asia-Pacific | China |

| India | |

| Japan | |

| South Korea | |

| Malaysia | |

| Thailand | |

| Indonesia | |

| Vietnam | |

| Australia | |

| Rest of Asia-Pacific | |

| South America | Brazil |

| Argentina | |

| Colombia | |

| Rest of South America | |

| Middle East and Africa | United Arab Emirates |

| Saudi Arabia | |

| South Africa | |

| Egypt | |

| Rest of Middle East and Africa |

Key Questions Answered in the Report

What is the current size of the electric motor market?

The electric motor market was valued at USD 135.18 billion in 2024 and is projected to rise to USD 146.40 billion in 2025.

Which segment holds the largest electric motor market share?

AC motors led with 73.34% of electric motor market share in 2024 thanks to their versatility and mature supply chains.

How fast is the automotive application segment growing?

Motors for automotive and transportation applications are forecast to expand at an 11.83% CAGR between 2025 and 2030, driven by global EV adoption.

Why are IE4 and IE5 efficiency classes important?

They meet or exceed new minimum-efficiency performance standards, cutting operational energy use and ensuring compliance with regulations in over 40 countries.

Which region will see the fastest expansion through 2030?

Asia-Pacific is expected to post a 10.7% CAGR due to strong EV production in China, industrial growth in India, and broader manufacturing upgrades across Southeast Asia.

What key challenge could limit near-term supply?

A tight supply of IGBT power modules is constraining production of high-voltage drives essential for EVs and heavy-industry applications, potentially slowing shipments in 2025-2026.