Europe Industrial Waste Management Market Size

Europe Industrial Waste Management Market Analysis

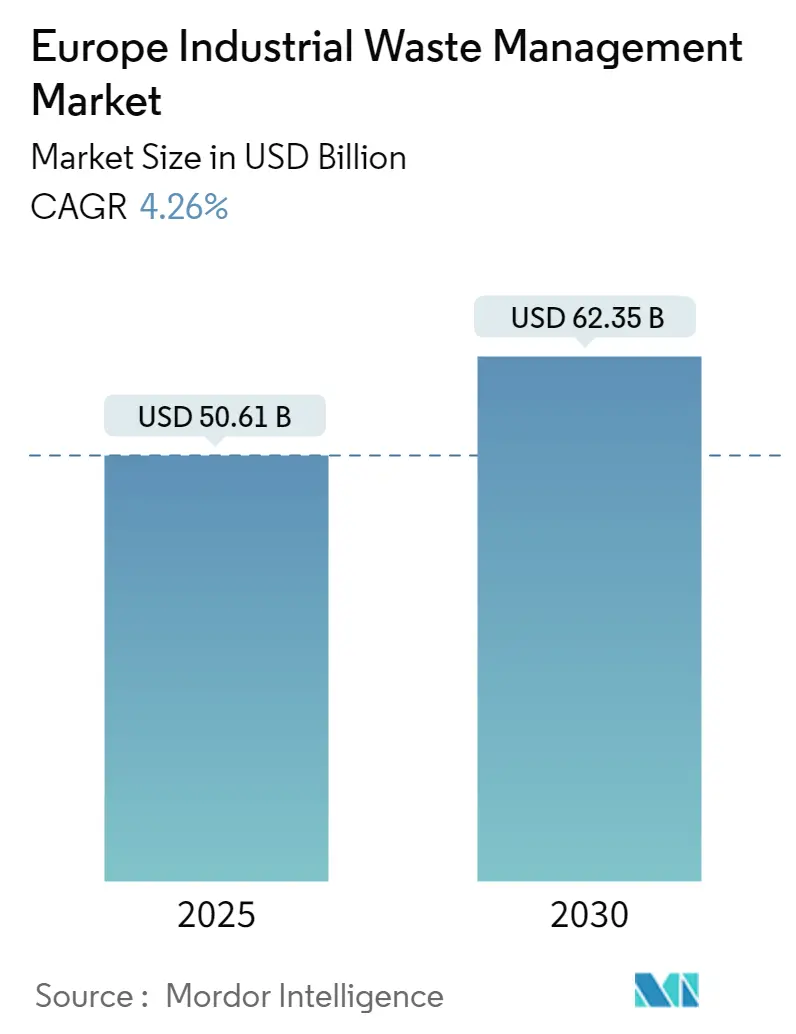

The Europe Industrial Waste Management Market size is estimated at USD 50.61 billion in 2025, and is expected to reach USD 62.35 billion by 2030, at a CAGR of 4.26% during the forecast period (2025-2030).

- The European Union has been recognized for its worldwide leadership in waste management. Some of the world's highest recycling rates for municipal waste are reported by EU Member States, such as Germany, Italy, and Austria. The waste management sector shall be responsible for all aspects of the waste cycle, which includes collection, transport, processing, disposal, and recycling of materials destroyed. French businesses Veolia and Suez and UK-based Biffa PLC are all among the largest waste management companies worldwide based on revenue.

- In its Member States, the European Union has different practices for the management of waste. The EU waste policy is aimed at contributing to the recycling economy by resource extraction of quality resources from waste. The EU would like to promote the prevention of waste and the re-utilization of products as much as possible. Recycling, including composting, is preferred by the EU if recycling is not possible, followed by the use of waste to generate energy.

- The recycling rate of urban waste in the EU has slowly improved over a number of years and now stands at 49%, as indicated by industry reports published in 2024. Nevertheless, 24% of municipal waste is disposed of in landfills. The recycling rates for other specific waste streams vary, from 64% of total packaging to 39% in electrical and electronic waste.

- In order to support a more Circular Economy in the European Union, a number of bold recycling targets have been set over the next decades. At 60% of municipal waste generated by 2030, EU Member States are now legally obliged to recycle or prepare for reuse. In accordance with the European Commission's Waste Framework Directive, residual municipal waste should be reduced by 50% in that same year to approximately 56.5 million tonnes.

Europe Industrial Waste Management Market Trends

Germany Leads the Highest Contribution in the Waste Generation

- Several sectors, such as manufacturing, construction, and healthcare, have a high level of waste production. The manufacturing sector is responsible for the production of different types of waste, e.g., chemical waste, packaging waste, and electronics waste. The large-scale production of goods and the use of chemicals and raw materials in manufacturing processes are reasons for this.

- Around 340 million tonnes of waste are produced each year. Construction and demolition waste, which can be reused for building measures, is the vast majority of that waste, i.e., approximately two-thirds of the total. The recycling of 50 million tonnes of municipal waste is carried out each year.

- Since the EU Battery Directive entered into force in 2006, the separate collection and recycling of all batteries has been mandatory in the EU member states. A collection rate of 45% has been applied in all EU member states since 2016. Every year, more than 60,000 tonnes of portable batteries and accumulators are placed on the market in Germany.

- Although the amount of portable batteries sold continues to increase every year, Germany consistently complies with the applicable EU-wide collection provisions. Containers for waste portable batteries are available in shops and at municipal collection points. Automotive and industrial batteries are also collected and consigned to recycling.

- Mineral waste is the largest waste stream in Germany, amounting to an annual volume of more than 275 million tonnes, as well as construction and demolition waste and excavated soil, which includes slag and ash from incineration processes in the energy and metals industries. Mineral waste holds enormous potential for recycling. Around 90% of mineral waste can currently be recovered.

Construction and Demolition Segment Occupying the Largest Market Share

- The construction and demolition (C&D) waste in Europe has witnessed significant growth in recent years due to rapid urbanization, construction activities, and stringent regulations promoting sustainable waste management practices. Construction and demolition waste accounts for more than one-third of the total waste generated in the European Union. C&D waste includes a wide variety of waste materials such as concrete, bricks, wood, glass, metals, and plastic. It includes all the waste produced by the construction and demolition of buildings and infrastructure, as well as road planning and maintenance.

- In the EU, the level of recycling and material recovery of construction and demolition waste varies widely, ranging from less than 10% to more than 90%. The different definitions of construction and demolition waste applied by EU countries make it difficult to compare them across borders.

- According to the news released by the European Union in March 2023, the waste generated by construction and demolition activities in the European Union (EU-27) in 2020 amounted to well over 37% of all waste. Since 2012, when the construction industry accounted for 32.5% of all waste, this percentage has increased. However, in 2018, the recovery rate of construction and demolition waste was more than 90% for most EU countries.

Europe Industrial Waste Management Industry Overview

The European industrial waste management market is highly competitive, with several players focusing on innovative technologies to recycle and reuse waste generated in different sectors and households around the world. There are also several startups coming up in the industry that are continuously focusing on waste reduction following the Zero Waste - 3R (Reduce, Reuse, and Recycle) philosophy. Veolia. BIFFA LLC, Suec, Clean Harbours, and Cleanaway Germany are the other major market players.

Europe Industrial Waste Management Market Leaders

-

Veolia

-

Suez

-

BIFFA LLC

-

Cleanaway Germany

-

Clean Harbours

- *Disclaimer: Major Players sorted in no particular order

Europe Industrial Waste Management Market News

- October 2023: Veolia opened the doors of more than 100 sites operated by the group in France. The sites include drinking water production plants, wastewater treatment plants, waste sorting centers, or energy recovery units, enabling the general public to go behind the scenes of ecological transformation. A unique opportunity to discover the group's innovative solutions and expertise in its core businesses of water, energy, and waste management.

- September 2023: In order to secure the supply of End-of-life mattress foams, Evonik entered into an agreement with Remondis Group, one of the world's most prominent recyclers. As Evonik develops its chemical recycling process to the next level, this cooperation would be beneficial for it. In the production of new mattresses, it is possible to recover core components of polyurethane foam and use them as premium-quality block-building materials with Evonik's innovative material and hydrolysis technology. The recycling process is currently being tested at a pilot plant in Hanau and will be tested at a larger demonstration plant in the future.

Europe Industrial Waste Management Industry Segmentation

Industrial waste management is the process of collecting, transporting, treating, and disposing of industrial waste. This waste can include contaminated soil, dry pesticides, and chemical waste.

The European industrial waste management market is segmented by type (construction and demolition waste, manufacturing waste, oil and gas waste, and other waste (chemical waste, mining waste, agriculture waste, nuclear waste), service (recycling, landfill, incineration, and other services), and country (Germany, France, United Kingdom, Spain, and Italy). The report offers market sizes and forecasts in value (USD) for all the above segments.

| By Type | Construction and Demolition |

| Manufacturing Waste | |

| Oil and Gas Waste | |

| Other Waste (Chemical Waste, Mining Waste, Agriculture Waste, Nuclear Waste) | |

| By Service | Recycling |

| Landfill | |

| Incineration | |

| Other Services | |

| By Country | Germany |

| France | |

| Italy | |

| United Kingdom | |

| Spain | |

| Rest of Europe |

| Construction and Demolition |

| Manufacturing Waste |

| Oil and Gas Waste |

| Other Waste (Chemical Waste, Mining Waste, Agriculture Waste, Nuclear Waste) |

| Recycling |

| Landfill |

| Incineration |

| Other Services |

| Germany |

| France |

| Italy |

| United Kingdom |

| Spain |

| Rest of Europe |

Europe Industrial Waste Management Market Research Faqs

How big is the Europe Industrial Waste Management Market?

The Europe Industrial Waste Management Market size is expected to reach USD 50.61 billion in 2025 and grow at a CAGR of 4.26% to reach USD 62.35 billion by 2030.

What is the current Europe Industrial Waste Management Market size?

In 2025, the Europe Industrial Waste Management Market size is expected to reach USD 50.61 billion.

Who are the key players in Europe Industrial Waste Management Market?

Veolia, Suez, BIFFA LLC, Cleanaway Germany and Clean Harbours are the major companies operating in the Europe Industrial Waste Management Market.

What years does this Europe Industrial Waste Management Market cover, and what was the market size in 2024?

In 2024, the Europe Industrial Waste Management Market size was estimated at USD 48.45 billion. The report covers the Europe Industrial Waste Management Market historical market size for years: 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Europe Industrial Waste Management Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Europe Industrial Waste Management Industry Report

Statistics for the 2025 Europe Industrial Waste Management market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Europe Industrial Waste Management analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.