Europe Rechargeable Battery Market Size

Europe Rechargeable Battery Market Analysis

The Europe Rechargeable Battery Market size is estimated at USD 26.45 billion in 2025, and is expected to reach USD 49.51 billion by 2030, at a CAGR of 13.36% during the forecast period (2025-2030).

- Over the medium term, factors such as increasing demand for electric vehicles and growing adoption of renewable energy are expected to be among the most significant drivers for the Europe rechargeable battery market during the forecast period.

- Conversely, high supply chain constraints in battery procurement threaten the European rechargeable battery market during the forecast period.

- However, ongoing advancements in battery chemistry development have resulted in more efficient rechargeable batteries, presenting numerous future opportunities for the market.

- Germany is poised to lead the market and is projected to achieve the highest growth during the forecast period, driven by a burgeoning consumer electronics segment and swift renewable energy installations.

Europe Rechargeable Battery Market Trends

Automobile to Witness Significant Growth

- In recent years, the European Union has implemented stringent measures aimed at curbing greenhouse gas emissions and promoting cleaner energy technologies across the region. These initiatives also emphasize a heightened electrification push within the transportation sector. Individual countries within the EU have mirrored these efforts, rolling out policies that offer tax incentives and subsidies to bolster the adoption of electric vehicle (EV). Consequently, this has led to an anticipated surge in demand for rechargeable batteries, a pivotal component of electric vehicles.

- Additionally, heightened awareness surrounding environmental sustainability and a collective move away from fossil fuel reliance has shifted consumer preferences towards eco-friendly transportation. Electric vehicles, with their zero direct emissions, are increasingly viewed as a sustainable alternative to traditional internal combustion engine vehicles. This rising consumer inclination towards EVs is poised to propel the rechargeable battery market's growth in Europe.

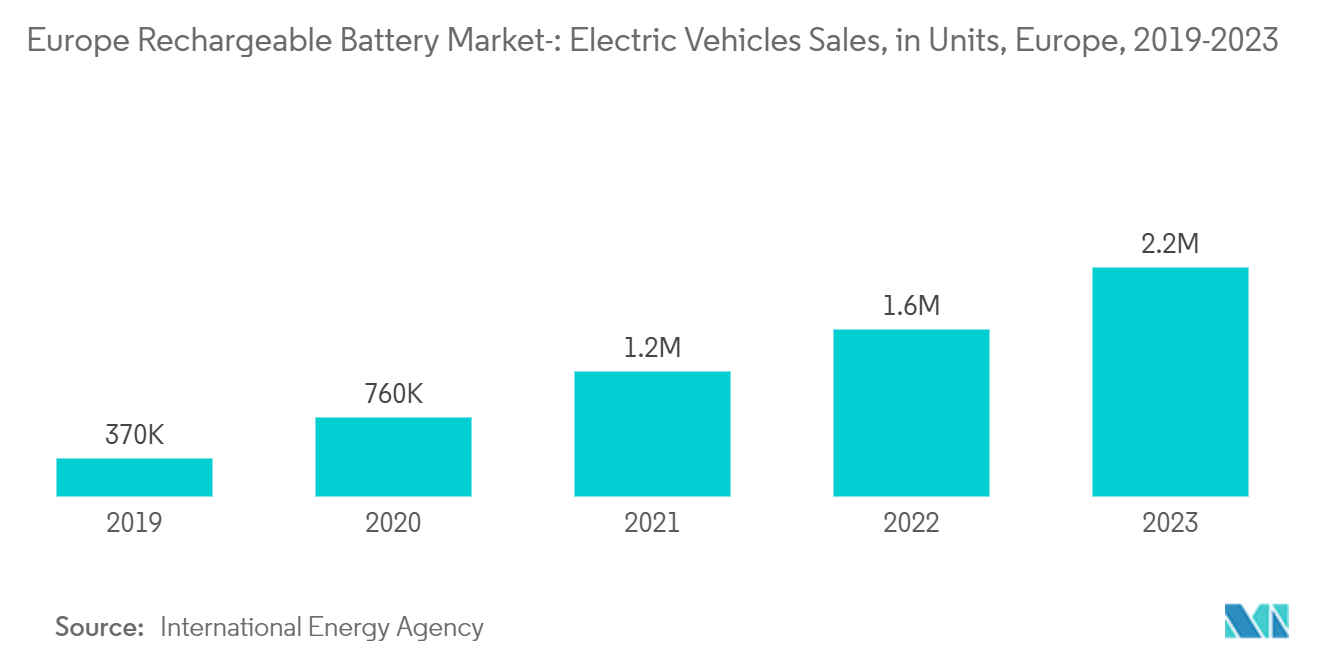

- Data from the International Energy Agency highlights a consistent uptick in electric vehicle sales across Europe. In 2023, sales reached approximately 2.2 million units, a notable increase from 1.6 million units in 2021, marking a growth rate exceeding 37.5%. Such momentum underscores the burgeoning traction of electric vehicles, further fueling the rechargeable battery market.

- Moreover, ongoing technological advancements in battery technology have ushered in enhancements like improved energy density, extended ranges, and expedited charging times for electric vehicles. These advancements have catalyzed increased investments across Europe, particularly in establishing new battery manufacturing facilities.

- For example, in July 2023, Tata Motors, a prominent Indian automobile manufacturer, unveiled plans for a 40 GW annual cell production capacity electric vehicle battery plant in Britain. This facility is poised to fortify the domestic car industry by localizing battery production, ensuring long-term sustainability. Both Tata Motors and government officials disclosed a hefty investment of GBP 4 Billion for the factory.

- Given these developments, the electric vehicle segment of the automobile industry is set for substantial growth in the coming years.

Germany to Dominate the Market

- Germany is poised to lead the European rechargeable battery market, bolstered by its status as an industrial and manufacturing hub and a strong automobile industry. This industry is pivoting towards innovative electric vehicles, aligning with the global energy transition. As Europe's appetite for electric vehicles grows, German automakers are set to significantly boost the demand for rechargeable batteries, solidifying Germany's leadership in this segment.

- Furthermore, Germany's dedication to incorporating renewable energy into its power generation amplifies its need for rechargeable batteries. Given the intermittent nature of renewable sources, energy storage becomes crucial to harness their full potential. With the rising adoption of battery energy storage systems, Germany's renewable energy sector is poised to further fuel the demand for rechargeable batteries.

- Data from the International Renewable Energy Agency highlights Germany's swift embrace of renewables: the nation's installed renewable energy capacity surged by about 12% from 2022 to 2023, outpacing a consistent five-year average growth rate of over 5.6%.

- Moreover, Germany is a leader in battery R&D, due to substantial investments from both government and private entities. Domestic research institutions and companies are pushing the envelope in battery technologies, emphasizing enhancements in energy density, charging speed, and overall efficiency.

- As an illustration, in May 2024, Varta, a prominent German battery supplier, launched a project aimed at pioneering industrial-scale rechargeable sodium-ion battery technology. With a three-year investment of EUR 7.5 million (USD 8.08 million), the initiative seeks to elevate cell chemistry to an industrial scale. The goal is to produce a limited batch of round cells, tailored for electric vehicles and stationary storage. Set to wrap up by mid-2027, the project will undergo a thorough technical, economic, and ecological evaluation.

- Given these developments, Germany's dominance in the European rechargeable battery market appears assured during the forecast period.

Europe Rechargeable Battery Industry Overview

The Europe Rechargeable Battery Market is fragmented. Some of the key players in this market (in no particular order) are BYD Co. Ltd., Contemporary Amperex Technology Co. Ltd., Exide Industries, Panasonic Corporation, and GS Yuasa Corporation.

Europe Rechargeable Battery Market Leaders

-

BYD Co. Ltd.

-

Contemporary Amperex Technology Co. Ltd.

-

Exide Industries

-

Panasonic Corporation

-

GS Yuasa Corporation

- *Disclaimer: Major Players sorted in no particular order

Europe Rechargeable Battery Market News

- November 2023: Northvolt, a European battery manufacturer, unveiled a breakthrough in battery technology by developing a rechargeable battery completely devoid of critical minerals. This innovation aligns with Europe's broader efforts to advance a new generation of batteries. By harnessing Altris's cathode material Fennac, comprised of iron, nitrogen, sodium, and carbon, Northvolt aims to produce a battery-free from highly sought-after finite materials like cobalt, nickel, lithium, manganese, and graphite.

- October 2023: Scientists at High-Performance Battery (HPB), based in Bonn, have reached a groundbreaking milestone in battery and storage technology. They've developed the world's inaugural solid-state battery, boasting remarkable properties and primed for production. Preliminary data suggests that this new battery outperforms the prevailing lithium-ion batteries in key metrics and attributes.

Europe Rechargeable Battery Industry Segmentation

A rechargeable battery is a type of battery that can be charged multiple times by passing an electric current through it in the opposite direction of its discharge. This allows the battery to be reused, reducing waste and cost compared to single-use, disposable batteries.

The Europe Rechargeable Battery Market is segmented by technology, applications, and geography. By technology, the market is segmented into Lead Acid, Lithium-ion, and Others (NiMh, NiCd, etc.). By applications, the market is segmented into Automotive, Industrial Batteries, Portable Batteries, and Other Applications. The report also covers the size and forecasts for the rechargeable battery market across major regions. Market sizing and forecasts were made for each segment based on revenue (USD).

| Battery Type | Lead Acid |

| Lithium-Ion | |

| Others (NiMh, NiCd, etc.) | |

| Applications | Automobiles |

| Industrial Batteries | |

| Portable Batteries | |

| Other Applications | |

| Geography | Germany |

| France | |

| United Kingdom | |

| Italy | |

| Spain | |

| NORDIC | |

| Russia | |

| Turkey | |

| Rest of Europe |

| Lead Acid |

| Lithium-Ion |

| Others (NiMh, NiCd, etc.) |

| Automobiles |

| Industrial Batteries |

| Portable Batteries |

| Other Applications |

| Germany |

| France |

| United Kingdom |

| Italy |

| Spain |

| NORDIC |

| Russia |

| Turkey |

| Rest of Europe |

Europe Rechargeable Battery Market Research FAQs

How big is the Europe Rechargeable Battery Market?

The Europe Rechargeable Battery Market size is expected to reach USD 26.45 billion in 2025 and grow at a CAGR of 13.36% to reach USD 49.51 billion by 2030.

What is the current Europe Rechargeable Battery Market size?

In 2025, the Europe Rechargeable Battery Market size is expected to reach USD 26.45 billion.

Who are the key players in Europe Rechargeable Battery Market?

BYD Co. Ltd., Contemporary Amperex Technology Co. Ltd., Exide Industries, Panasonic Corporation and GS Yuasa Corporation are the major companies operating in the Europe Rechargeable Battery Market.

What years does this Europe Rechargeable Battery Market cover, and what was the market size in 2024?

In 2024, the Europe Rechargeable Battery Market size was estimated at USD 22.92 billion. The report covers the Europe Rechargeable Battery Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Europe Rechargeable Battery Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Europe Rechargeable Battery Industry Report

Statistics for the 2025 Europe Rechargeable Battery market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Europe Rechargeable Battery analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.