Fuel Cell Electric Bus Market Size

Fuel Cell Electric Bus Market Analysis

The Fuel Cell Electric Bus Market is expected to register a CAGR of 28.07% during the forecast period.

Like its impact on nearly every other sector of the market, COVID-19 had an unavoidable impact on the fuel cell vehicle market. However, the electric vehicle (EV) industry is experiencing significant expansion as a result of the worldwide rapid adoption rate of mild-hybrid electric vehicles. Additionally, fuel cell vehicle sales worldwide decreased significantly as a result of the pandemic. The market, on the other hand, is anticipated to gain momentum in the years to come as life returns to normal.

Over the long term, it is anticipated that factors such as rising fuel prices and global government efforts to raise awareness of fuel cell electric vehicles will drive the use of electric buses. Countries like China, which have a well-established supply chain for components like traction motors, fuel cells, and others, continue to lead the urban bus segments. Additionally, infrastructure for hydrogen stations continues to improve.

The demand for fuel-efficient, high-performance, and low-emission automobiles is driving the growth of the fuel cell electric vehicle market. Other factors contributing to this expansion include tighter regulations regarding vehicle emissions, lower battery costs, and rising fuel costs.

Electric Buses are gaining attention from governments all over the world.Market expansion is anticipated to be aided by government regulations to phase out vehicles powered by fossil fuels, government expenditures to improve public EV charging infrastructure, and measures like subsidies and tax refunds to encourage the adoption of EVs.Various governments are making investments in the infrastructure for fuel cell electric vehicles, including hydrogen filling stations, both directly through public filing stations and through subsidies.

Fuel Cell Electric Bus Market Trends

Emission Concerns and Increasing Hydrogen Bus Testing Fueling Market Demand

Fuel-cell-powered electric vehicles are becoming increasingly common in the automotive industry. They are a means of reducing pollution and other greenhouse gas emissions while also improving energy efficiency. Governments and environmental agencies are enacting stringent emission standards and laws in response to growing environmental concerns. These standards and laws are expected to raise the cost of manufacturing fuel-efficient IC engines, which will increase the demand for electric powertrains in the coming years.

In many nations, government initiatives are anticipated to be crucial in promoting fuel cell electric vehicles. In an effort to cut down on emissions and encourage the sale of fuel cell vehicles, a number of nations are enacting plans to outlaw gasoline and diesel automobiles between 2030 and 2040. In addition, a number of tax breaks and incentives for EVs are being implemented to boost sales. The demand for electric vehicles is anticipated to rise as a result of these initiatives, supporting the expansion of the Fuel Cell Vehicle market.

For instance, European and American regulations on CO2 emissions are getting more stringent.Europe has established emission limits of 59 g/km with 95 g/km by 2020 and a further 37.5% reduction by 2030.In accordance with the Passenger Vehicle Corporate Average Fuel Economy (CAFE) standards for 2025, North America has established emission limits of more than 99 g/km.In the coming years, OEMs will have to market more electrified vehicles in order to meet pollution standards and avoid penalties, which is expected to boost market growth.

The atmosphere has been polluted as a result of an increase in the volume of vehicle exhaust emissions from all kinds of cars that run on fossil fuels.Numerous serious respiratory illnesses have increased as a result of poor air quality.In Europe, vehicle pollution, which includes NOx, volatile organic compounds, PM2.5, PM10, and other pollutants, makes up about 30% of all air pollution.

The fuel cell bus market is expected to expand during the forecast period thanks to the rise in government initiatives and regulations aimed at restricting or banning the sale of buses powered by IC.

Europe is Leading the Market

The European Union has put forth some of the world's most stringent emission norms with a view to reducing the use of conventional fuel vehicles and encouraging the use of alternative fuel vehicles in the region.

These emission norms are expected to drive the market and manufacturers towards zero-emission vehicles. The global rush toward lithium-ion mineral for battery manufacturing will gradually shift the market towards hydrogen fuel cell powered electric buses once the lithium battery market is saturated.

European Union funding has made it possible to introduce variety of modern public transport technologies, including buses fueled by alternative energy sources. Several projects have been launched in order to research and develop suitable solutions to the vehicular emissions problem. This has increased the use of hydrogen vehicles by over 23% in 2020 as compared to 2019. For instance,

Project CHIC was launched in October 2020. The project's primary objective was to cater to the increasing demand for zero-emission vehicles and in line with this, introduced a largest number of hydrogen powered buses to the streets of Europe in October 2020. These buses are currently used in 7 major European cities present in UK, Switzerland, Italy, Germany, and Norway. The project included 36 buses that are piloting the project of testing the viability of this technology across the region.

Several countries of the European region have taken the steps towards transitioning their public transport fleet to hydrogen fuel powered vehicles in order to meet their own emission targets. For instance,

In June 2020, Germany adopted the National Hydrogen Strategy after the approval from its federal cabinet. The policy extends a total investment of EUR 7 Billion by the country into ramping up the existing public transport fleet to hydrogen technologies in the future. The funding will be available for utilization or both vehicles and infrastructure development.

The Austrian government has initiated the Underground Sun Storage 2030 project that explores the safe, seasonal and large volume storage of renewable energy in the form of hydrogen that is expected to be used to cater to the country's energy needs including the use in public transport. The country also invested a huge EUR 3.3 million in 2019, to fund the new Graz Hydrogen and Electric buses project that emphasized on urban transport development.

In November 2021, Belgium announced the Belgian Hydrogen Vision and Strategy after its approval by the Council of Ministers. The policy mainly focused on 3 sectors for electrification by hydrogen that included the country's transportation sector. With this, the country expects to be reliable on hydrogen and go fully carbon neutral in transport by 2050.

The implementation of stringent emission norms coupled with targets set for adoption of hydrogen buses and other alternative fuel powered vehicles are likely to drive the adoption of hydrogen buses during the forecast period.

Fuel Cell Electric Bus Industry Overview

The major players in the market for fuel cell buses include Tata Motors Limited, Fuji Electric, SAFRA, Nuvera, and Proton Motor Fuel Cell GmbH. IVECO Group, Cummins Inc., Ballard Power Systems, NovaBus Corporation, New Flyer Industries Ltd., EvoBus, MAN, Van Hool, Hino Motors Ltd., and SunLine Transit Agency.

Many other players are partnering with players to develop fuel cell electric vehicle technology. For instance,

- In July 2022, Hyundai partnered with truck and bus maker Iveco Group to provide hydrogen fuel-cell systems for buses in Europe. According to the bus business unit of Iveco, the company planned to produce more than 3,000 zero- and low-emission buses at its plant in Foggia, southern Italy, beginning in 2023.

Fuel Cell Electric Bus Market Leaders

-

Ballard Power Systems

-

Nuvera Fuel Cells LLC

-

New Flyer Industries

-

Tata Motors Ltd

-

EvoBus GmbH

- *Disclaimer: Major Players sorted in no particular order

Fuel Cell Electric Bus Market News

- In September 2022, The Xcelsior CHARGE FC fuel cell bus model from New Flyer, which features a fuel cell module from Ballard Power Systems and a Siemens ELFA 3 driveline, was unveiled . The model is similar to the Xcelsior CHARGE H2, and it comes in both 40-foot and 60-foot lengths. Both of these models pass the Federal Transit Administration Model Bus Testing Program in Altoona, Pennsylvania.

- In September 2022, Guangdong Sino-Synergy Hydrogen Technology Co., Ltd. (hereinafter "Sinosynergy") introduced the first "Hydrogen Fuel Cell Journey Coach" in Europe.Allenbus, Feichi, Marcopolo, and Danfoss jointly developed the "Hydrogen Fuel Cell, Journey Coach."The coach is made specifically for the European market in accordance with EU regulations. It can carry up to 53 passengers, travel more than 500 kilometers, and regularly refuel in as little as 5 minutes.

- In September 2022, Marcopolo showcased its first hydrogen-powered bus at IAA Transportation 2022 in Hanover, Germany. The homologation stage of the prototype hydrogen fuel cell is currently underway. The Audace 1050 model bus body was created by Marcopolo and is produced at its unit in China.Feichi Bus/Allenbus supplies the bus's fuel cell chassis, while Sinosynergy supplies the core of the fuel cell technology, including the membranes and the Fuel Cell drive.

Fuel Cell Electric Bus Industry Segmentation

Fuel cell-powered buses are buses that utilize fuel cell technology. Hydrogen and oxygen are combined in a fuel cell to generate heat, electricity, and water. The bus's electric motor is powered by the generated electricity thus propelling the bus.

The Fuel Cell Electric Bus Market is segmented based on Application, Bus Type, and Geography.

Based on Application, the market is segmented as Intercity and Intracity.

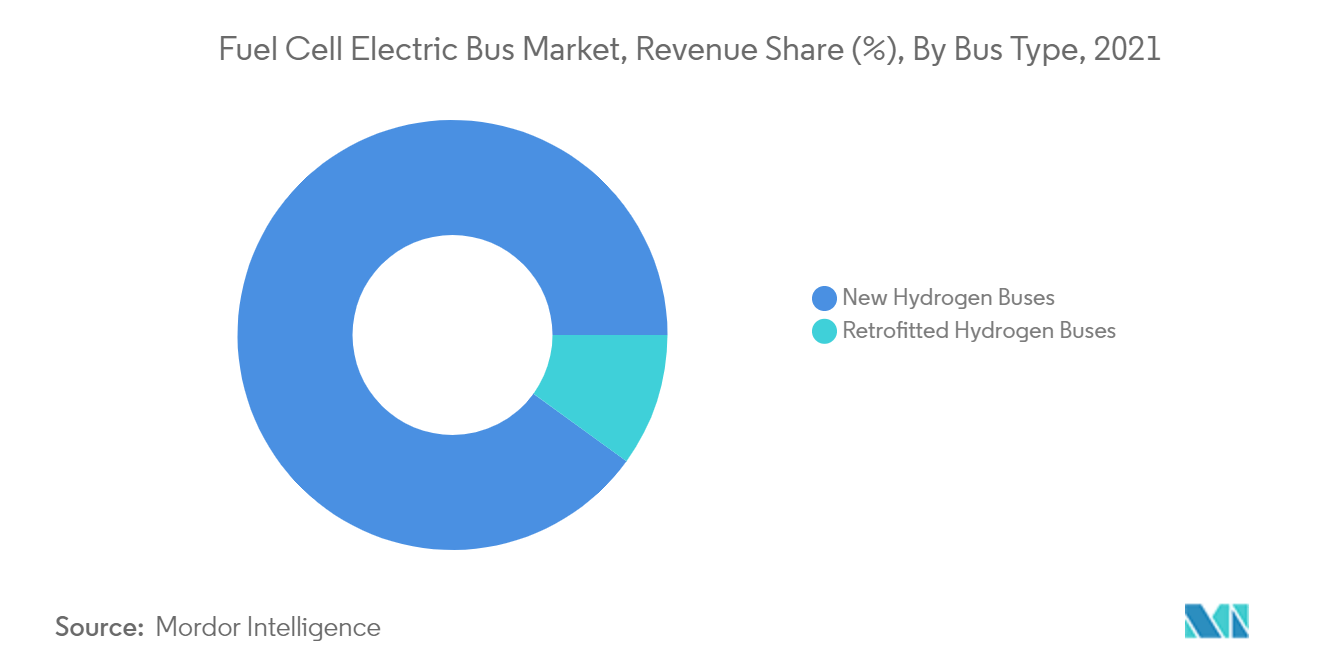

By Bus Type, the market is segmented as New Hydrogen Buses and Retrofitted Hydrogen Buses.

By Geography, the market is segmented into North America, Europe, Asia-Pacific, and the Rest of the world.

The report also provides market sizing and forecast for all the above-mentioned segments.

| Application | Intercity | ||

| Intracity | |||

| Bus Type | New Hydrogen Buses | ||

| Retrofitted Hydrogen Buses | |||

| Geography | North America | United States | |

| Canada | |||

| Mexico | |||

| Rest of North America | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Italy | |||

| Spain | |||

| Rest of Europe | |||

| Asia Pacific | India | ||

| China | |||

| South Korea | |||

| Japan | |||

| Rest of Asia-Pacific | |||

| Rest of the World | South America | ||

| Middle-East and Africa | |||

| Intercity |

| Intracity |

| New Hydrogen Buses |

| Retrofitted Hydrogen Buses |

| North America | United States |

| Canada | |

| Mexico | |

| Rest of North America | |

| Europe | Germany |

| United Kingdom | |

| France | |

| Italy | |

| Spain | |

| Rest of Europe | |

| Asia Pacific | India |

| China | |

| South Korea | |

| Japan | |

| Rest of Asia-Pacific | |

| Rest of the World | South America |

| Middle-East and Africa |

Fuel Cell Electric Bus Market Research FAQs

What is the current Fuel Cell Electric Bus Market size?

The Fuel Cell Electric Bus Market is projected to register a CAGR of 28.07% during the forecast period (2025-2030)

Who are the key players in Fuel Cell Electric Bus Market?

Ballard Power Systems, Nuvera Fuel Cells LLC, New Flyer Industries, Tata Motors Ltd and EvoBus GmbH are the major companies operating in the Fuel Cell Electric Bus Market.

Which is the fastest growing region in Fuel Cell Electric Bus Market?

Asia-Pacific is estimated to grow at the highest CAGR over the forecast period (2025-2030).

Which region has the biggest share in Fuel Cell Electric Bus Market?

In 2025, the Europe accounts for the largest market share in Fuel Cell Electric Bus Market.

What years does this Fuel Cell Electric Bus Market cover?

The report covers the Fuel Cell Electric Bus Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Fuel Cell Electric Bus Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

Our Best Selling Reports

Fuel Cell Electric Bus Industry Report

Statistics for the 2025 Fuel Cell Electric Bus market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. Fuel Cell Electric Bus analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.