India Furniture Market Analysis by Mordor Intelligence

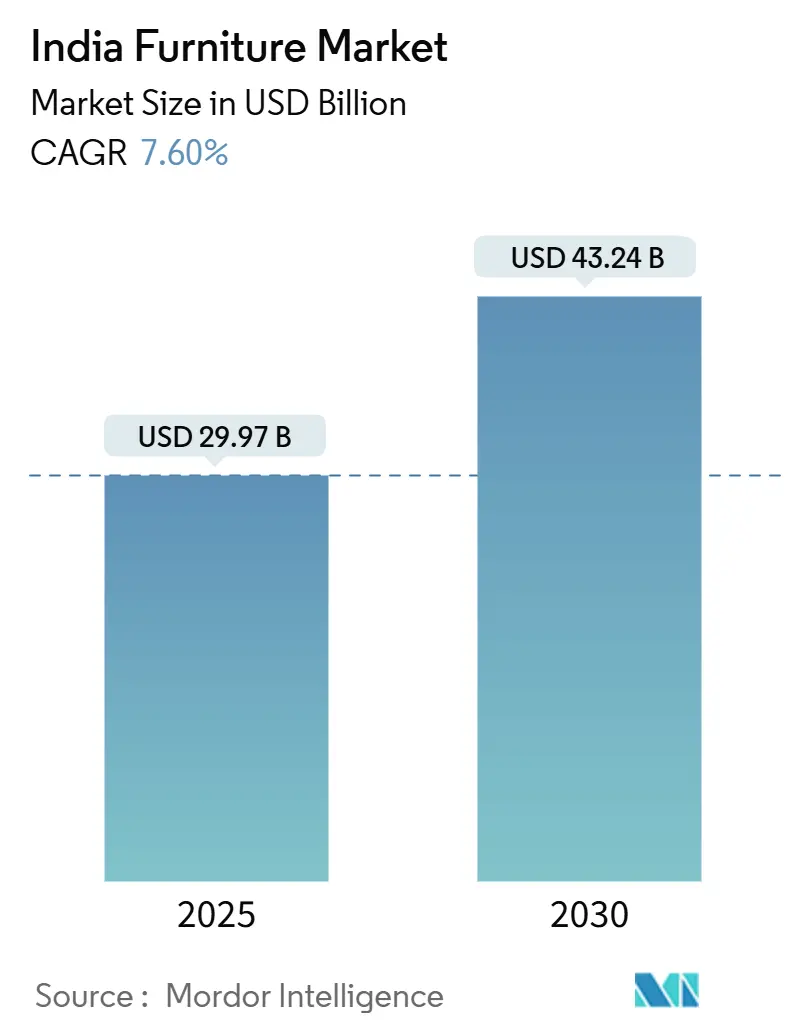

The India furniture market size stands at USD 29.97 billion in 2025 and is projected to reach USD 43.24 billion in 2030, translating to a 7.6% CAGR. Urban migration, steady real-estate completion, and government housing schemes combine with rising digital adoption to keep demand on a healthy upward path. Sustainability ambitions encourage engineered wood, certified timber, and hybrid material use, while ergonomic specifications from commercial and hospitality projects push metal demand. Organized retailers strengthen brand trust by pairing deep in-store ranges with augmented-reality visualizers that reduce product returns and support profitable e-commerce. At the same time, the largely informal vendor base sustains price competition, prompting formal players to expand mid-range assortments and local assembly to hold costs.

Key Report Takeaways

• By application, home furniture led with 62% India furniture market share in 2024, and office furniture is forecast to grow at a 7.8% CAGR between 2025 and 2030.

• By material, wood held 61% share of the India furniture market in 2024, while metal furniture is expected to post the fastest 8.4% CAGR through 2030.

• By price range, the mid-range tier accounted for 45% of the India furniture market size in 2024, and the premium tier is advancing at an 8% CAGR to 2030.

• By distribution channel, B2C/retail produced 78% of the India furniture market size in 2024 and will extend its lead at a 7.4% CAGR during the forecast window.

• By geography, South India dominated with a 30% share of the India furniture market in 2024, while East India is poised for an 8.6% CAGR through 2030.

India Furniture Market Trends and Insights

Drivers Impact Analysis

| Driver | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Rapid Urban Migration Elevating Demand for Furniture | +1.8 | National, with early gains in Tier 1 and emerging Tier 2 cities | Medium term (~ 3-4 years) |

| Surge in Omnichannel Platforms Leveraging AR/VR for 'See-in-Room' Visualization | +1.2 | Urban centers with high digital penetration | Short term (≤ 2 years) |

| Government Housing Push (PMAY) Triggering Mass Residential Furniture Uptake | +1.5 | National, with a focus on affordable housing zones | Medium term (~ 3-4 years) |

| Sustainability Preference Spurring Engineered-Wood & Eco-Labelled Products | +0.8 | Urban metros and high-income pockets | Long term (≥ 5 years) |

| Rise in Commercial and Hospitality Sectors | +1.1 | Major business hubs and tourist destinations | Medium term (~ 3-4 years) |

Source: Mordor Intelligence

Rapid Urban Migration Elevating Demand for Furniture

India’s urban share of population is set to cross 40% by 2030. New city dwellers gravitate toward space-saving sofa-beds, modular wardrobes, and fold-away dining sets because average apartment sizes are shrinking. With limited urban space, consumers are increasingly preferring multi-functionality furniture. Such furniture for small spaces has grown in popularity in recent years, as space conservation is becoming increasingly crucial as living space shrinks in urban metropolitan areas. For instance, a sofa is the most popular multifunctional furniture that can be converted into a bed or a table that can be transformed into a dining area. These shifts keep the India furniture market growing across both premium and value points.

Surge in Omnichannel Platforms Leveraging AR/VR for “See-in-Room” Visualization

Furniture remains a tactile purchase, yet digital discovery is now embedded in the buyer journey. Retailers that embed AR applications report online return rates dropping from more than 30% to below 15%, bolstering margins. Visualization also speeds customization: buyers experiment with fabrics, handle finishes, and leg styles before visiting showrooms, shortening sales cycles. For instance, Livspace's online platform facilitates 3D visualization of modular kitchen layouts through its virtual design consultation service. Customers can collaborate with designers in real-time, adjusting elements like cabinets and color schemes. The 3D tool enhances confidence, allowing consumers to preview their kitchen before installation.

Rise in Commercial and Hospitality Sectors

Furniture is widely used in various commercial places. Growing commercial construction activities in India are increasingly surging the demand for furniture. Contracts specify sit-stand desks, collaborative pods, and acoustic walls, driving a steady order pipeline for ergonomic and metal-frame solutions. In 2024, India's hospitality sector welcomed a record influx of 47,000 new hotel rooms. Simultaneously, commercial construction boomed, completing over 52 million sq. ft of Grade A office space, fueled by surging demands from tourism, IT, and co-working sectors. Suppliers therefore operate B2B divisions side by side with retail channels, balancing lumpy project revenues with steady consumer demand and stabilizing cash flow across the India furniture market.

Sustainability Preference Spurring Engineered-Wood & Eco-Labelled Products

Eco-friendly materials and sustainable manufacturing processes are emerging as pivotal competitive differentiators among organized retailers in India's evolving furniture market. A 2,450-responder survey by Hafele India in Q1 2024 shows that 73% of millennials are willing to pay an 18-24% premium for certified sustainable furniture, with willingness peaking at 86% among earners above INR 15 lakh per year. The study uncovers an “action gap”; while 68% of shoppers spend 45-60 minutes researching green claims, sustainability still trails design (62%) and price (53%) as the primary purchase trigger, ranking first for only 47% of buyers. Material sourcing tops environmental concerns for 84% of respondents, ahead of non-toxic finishes (76%) and end-of-life recyclability (71%), mirroring life-cycle assessments that place 76% of embedded carbon in pre-production. Certification awareness is uneven, as 58% of metro shoppers recognize the FSC label compared with just 29% in Tier 3 cities, signaling the need for targeted education campaigns in growth markets.

Restraints Impact Analysis

| Restraint | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Price sensitivity and 18% GST slab limit premium penetration | −1.2% | Tier 2 and Tier 3 cities | Short term (≤ 2 years) |

| Supply-chain bottlenecks in certified timber | −0.9% | Nationwide premium wood lines | Medium term (2–4 years) |

| High reverse-logistics cost for bulky e-commerce deliveries | −0.7% | Urban e-commerce hubs | Short term (≤ 2 years) |

| Dominance of the fragmented unorganized sector | −1.0% | Rural and semi-urban areas | Long term (≥ 4 years) |

Source: Mordor Intelligence

Price Sensitivity & GST Slab Curtailing Premium Category Penetration

Furniture draws an 18% GST rate that lifts sticker prices enough to deter many aspirational buyers outside major metros. Brands respond with “bridge” collections that match premium looks using engineered substrates, keeping unit margins slim. Organized players also roll out easy-EMI schemes, yet discretionary spending in smaller cities remains elastic to price swings. Until policy changes occur, the GST burden will restrain top-tier growth within the India furniture market.

Supply-Chain Bottlenecks in Certified Timber Raising Input Volatility

Limited domestic certified timber output forces many manufacturers to import teak and oak, exposing them to freight cost swings and currency risk. Producers hedge by mixing plantation rubberwood, acacia, and metal frames; however, retooling adds lead time. These constraints raise BOM costs for premium wooden ranges and spark experimentation with recycled materials, an adaptive yet capital-intensive route for the India furniture market.

Segment Analysis

By Application: Workspace Demand Injects New Design Energy

Home furniture keeps its lead, accounting for 62% of 2024 volume and underpinning baseline orders across living, dining, and bedroom suites. The office category, tracking a 7.8% CAGR for 2025-2030, outpaces overall India furniture market growth as employers retrofit hybrid layouts and freelancers outfit home offices. Corporate buyers specify height-adjustable desks and modular wall systems that support hot-desking, while remote workers favor compact ergonomic chairs. Hospitality, education, and healthcare remain smaller slices, yet each fuels niche innovation in antimicrobial coatings and quick-assembly fittings, broadening supplier skill sets.

An additional growth lever comes from dual-use pieces bridging home and office functions, such as desks that flip into console tables. Manufacturers bundle power units and cable channels into table legs, integrating tech invisibly. These features deepen differentiation and inflate average selling prices without stepping far from mid-range bands that dominate the India furniture market.

Note: Segment shares of all individual segments are available upon report purchase

By Material: Wood’s Cultural Hold Meets Metal’s Acceleration

Wood maintained a 61% share of the India furniture market in 2024, rooted in cultural affinity for solid teak and sheesham. Formal brands upgrade timeless designs with concealed hinges, scratch-resistant varnishes, and knock-down joints that fit modern logistics. Certified sources and veneer-over-engineered cores allow cost containment and forest stewardship. Metal furniture climbs fastest at 8.4% CAGR as offices, quick-service restaurants, and hostels value resilience and slim profiles. Powder-coated steel, aluminum extrusions, and mixed-material frames offer long life at a competitive price per use.

Hybrid builds that splice metal under-frames with wooden tops gain favor because they ship flat, resist humidity, and satisfy both traditional and contemporary tastes. Plastic and polymer lines cover budget outdoor uses, while bamboo composites deliver a sustainable twist aimed at eco-aware millennials. Material choice is widening, letting the India furniture market respond flexibly to style shifts and resource constraints.

By Price Range: Mid-Range Anchors, Premium Gains Ground

Mid-range lines held 45% of the India furniture market size in 2024, balancing aesthetics and affordability for the expanding middle class. Private-label sourcing clusters in Rajasthan, Tamil Nadu, and Telangana produce uniform quality at scale, supporting reliable warranties that appeal to cautious shoppers. The premium tier, while smaller, is rising at 8% CAGR: urban consumers exposed to global trends desire bespoke finishes, dovetailed drawers, and limited-edition collections. Luxury showrooms now feature virtual walkthroughs and interior styling services to substantiate higher prices.

The economy band remains critical for first-time furniture buyers in aspirational towns. Unorganized carpenters adapt designs to local tastes and structural quirks, providing flexible payment terms. As disposable income rises, many households climb the value ladder, and brands court this migration with “accessible luxury” lines that apply veneer surfaces and soft-close hinges on engineered-wood carcasses. This laddering strategy keeps the India furniture market inclusive while nudging average revenue per user upward.

Note: Segment shares of all individual segments are available upon report purchase

By Distribution Channel: B2C Retail Dominates a Converging Landscape

B2C/retail routes delivered 78% of the India furniture market size in 2024, with organized stores blending tactile display and digital configurators. Big-box retailers position café corners and mock apartments to inspire shoppers, while specialty boutiques curate Scandinavian, industrial, or ethnic themes for narrowed audiences. E-commerce gross merchandise value grows double digits as improved last-mile networks shorten delivery from regional hubs.

Project-driven B2B orders for offices, hospitality, and public spaces contribute fewer units yet larger invoice sizes. Suppliers invest in bid-management teams, CAD libraries, and installation crews to serve this segment. Channel lines blur as consumer brands secure bulk orders from co-working firms and contract specialists open retail galleries for walk-ins. Integrated ERP platforms sync inventory across outlets, warehouses, and factory floors, enhancing agility across the India furniture market.

Geography Analysis

South India led with 30% India furniture market share in 2024, anchored by Bangalore, Chennai, and Hyderabad, where tech professionals drive demand for modular interiors and quick delivery. Bangalore’s Sadar Bazar hosts hundreds of showrooms, many offering same-week assembly on custom laminates. The region’s woodworking clusters in Karnataka and Tamil Nadu support flexible production, letting brands roll out localized finishes such as teak-tone veneers that resonate with cultural décor preferences.

In North India, Delhi-NCR’s Kirti Nagar cluster supplies everything from carpenter-made sofas to CNC-cut wardrobes, acting as a sourcing hub for adjoining states. Government schemes under PMAY catalyze mid-priced bedroom purchases, while younger households lean toward lighter engineered-wood frames that fit elevators in high-rise projects. Western India is driven by Mumbai and Pune, where premium apartments, mall-based experience centers, and coastal climate fuel interest in moisture-resistant veneers and powder-coated metal furniture.

East India is set for the fastest 8.6% CAGR through 2030. Rising urbanization in Kolkata, Bhubaneswar, and Guwahati brings branded showrooms into markets historically served by bazaars. Improved highways allow ready-to-assemble shipments from furniture parks in Uttar Pradesh and Andhra Pradesh to reach the region within three days, reducing stock-outs. Local artisans weave cane and bamboo accents into modern silhouettes, supporting a fusion style that differentiates regional lines. This rapid progress adds a new volume engine for the India furniture market.

Competitive Landscape

The majority of transactions still flow through unorganized carpenters and local workshops, leaving formal brands with ample headroom. Godrej Interio leverages vertically integrated metal, wood, and upholstery plants plus 300+ showrooms to anchor its mid-to-premium portfolio. Nilkamal Limited, synonymous with molded chairs, now scales “Nilkamal Homes” to widen décor assortment while controlling costs via backward-integrated plastics. IKEA invests INR 850 crore to open compact city outlets and expands e-commerce reach, using local sourcing partnerships to align price points with Indian budgets.

Digital-native Urban Ladder and Pepperfry continue asset-light, design-first approaches, relying on partner warehouses and last-mile crews for delivery and assembly. Start-ups focused on sustainability, such as Bamboo House India, market certified bamboo lines for eco-aware buyers. Machinery supplier Biesse India targets 80% localization, enabling domestic factories to upgrade to CNC precision and shorten lead times. Skill training captures strategic interest: the Furniture & Fittings Skill Council added new members in 2025 to expand certification programs for finish carpenters and upholsterers, an investment critical to quality consistency in the India furniture market.

India Furniture Industry Leaders

-

Zuari Furniture

-

IKEA

-

Godrej Interio

-

Nilkamal Limited

-

Zuari Furniture

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- November 2024: Biesse India allocated INR 200 crore to enlarge its Bengaluru plant, aiming for 80% localization.

- October 2024: Nilkamal rolled out the “Nilkamal Homes” retail concept with a plan for 60 stores.

- August 2024: Durian Industries Ltd, a leading luxury furniture brand from India, inaugurated its debut store in Kerala, specifically in Thiruvananthapuram. Spanning a generous 4,500 sq. ft., the store showcases an extensive collection of premium furniture for both homes and offices, featuring items like sofas, beds, dining sets, and office furnishings

- July 2024: Government extended the Production-Linked Incentive scheme to furniture manufacturing.

India Furniture Market Report Scope

Furniture refers to moveable items that are used to make a space appropriate for living or working. Beds, sofas, desks, tables, and chairs are examples of furniture. The market's background is thoroughly examined, covering industry trends, growth factors, market shares, market size and forecast, and suppliers. The research also includes qualitative and quantitative evaluations based on an analysis of data collected from market participants and industry analysts at significant stages in the industry's value chain.

The Indian furniture market is segmented by material into wood, metal, plastic, and other furniture, by type into home furniture, office furniture, hospitality furniture, and other furniture, and by distribution channels into supermarkets and hypermarkets, specialty stores, online, and other distribution channels. The report offers market sizes and forecasts for the Indian furniture market in terms of value (USD) for the above segments.

| By Application | Home Furniture | Tables (side tables, coffee tables, dressing tables, etc.) | |

| Beds | |||

| Wardrobes | |||

| Sofas | |||

| Dining Tables/Dining Sets | |||

| Kitchen Cabinets | |||

| Other Home Furniture (bathroom furniture, outdoor furniture, etc.) | |||

| Office Furniture | Chairs | ||

| Tables | |||

| Storage Cabinets | |||

| Desks | |||

| Sofas and Other Soft Seating | |||

| Other Office Furniture | |||

| Hospitality Furniture | |||

| Educational Furniture | |||

| Healthcare Furniture | |||

| Other Applications (public places, retail malls, government offices, etc.) | |||

| By Material | Wood | ||

| Metal | |||

| Plastic & Polymer | |||

| Other Materials | |||

| By Price Range | Economy | ||

| Mid-Range | |||

| Premium | |||

| By Distribution Channel | B2C/Retail | Home Centers | |

| Specialty Furniture Stores | |||

| Online | |||

| Other Distribution Channels | |||

| B2B/Project | |||

| By Geography | North India | ||

| West India | |||

| South India | |||

| East India | |||

| Home Furniture | Tables (side tables, coffee tables, dressing tables, etc.) |

| Beds | |

| Wardrobes | |

| Sofas | |

| Dining Tables/Dining Sets | |

| Kitchen Cabinets | |

| Other Home Furniture (bathroom furniture, outdoor furniture, etc.) | |

| Office Furniture | Chairs |

| Tables | |

| Storage Cabinets | |

| Desks | |

| Sofas and Other Soft Seating | |

| Other Office Furniture | |

| Hospitality Furniture | |

| Educational Furniture | |

| Healthcare Furniture | |

| Other Applications (public places, retail malls, government offices, etc.) |

| Wood |

| Metal |

| Plastic & Polymer |

| Other Materials |

| Economy |

| Mid-Range |

| Premium |

| B2C/Retail | Home Centers |

| Specialty Furniture Stores | |

| Online | |

| Other Distribution Channels | |

| B2B/Project |

| North India |

| West India |

| South India |

| East India |

Key Questions Answered in the Report

What is the current value of the India furniture market?

The India furniture market size is USD 29.97 billion in 2025.

How quickly will the India furniture market grow?

Aggregate revenue is expected to compound at 7.6% annually, reaching USD 43.24 billion by 2030.

Which region will grow the fastest between 2025 and 2030?

East & North-East India is projected to expand at a 9.2% CAGR, outpacing every other region.

Why does metal furniture show higher growth than wood?

Offices, hotels, and quick-service restaurants prefer metal frames for durability and slim profiles, lifting metal furniture at an 8.4% CAGR.