Italian Wound Care Management Market Analysis

The Italy Wound Care Management Market size is estimated at USD 513.97 million in 2025, and is expected to reach USD 657.85 million by 2030, at a CAGR of 5.06% during the forecast period (2025-2030).

The Italian wound care management landscape is experiencing significant transformation driven by technological innovation and changing healthcare delivery models. Advanced solutions like smart bandages are revolutionizing wound monitoring capabilities, as evidenced by the University of Bologna's development of sensor-equipped bandages that can transmit wound moisture data directly to smartphones through dedicated applications. This shift towards intelligent wound care management devices represents a broader industry trend of incorporating digital technology into traditional medical devices, enabling more precise and efficient wound management protocols.

The market is witnessing a notable evolution in healthcare delivery methods, particularly through the integration of telemedicine services for wound care management. Healthcare providers are increasingly adopting hybrid care models that combine in-person and remote consultations, allowing for continuous monitoring and adjustment of treatment plans. This approach has proven particularly effective for managing chronic wounds and ulcers, with numerous non-critical cases being successfully managed through remote consultations and home visits by healthcare professionals.

The demographic landscape in Italy presents unique opportunities and challenges for the wound care management sector. According to recent projections, the proportion of Italy's population aged 65 and above is expected to reach 33.7% by 2050, making it one of the countries with the highest elderly populations globally. This demographic shift is driving the development of specialized wound care devices tailored to the specific needs of older patients, who often present with complex wound healing requirements due to multiple comorbidities.

Strategic initiatives and product innovations by market players are reshaping the competitive landscape of Italy's wound care management market. Companies are focusing on developing advanced wound dressing products that offer improved healing outcomes and better patient comfort. The market is seeing increased investment in research and development, particularly in areas such as bioactive dressings and antimicrobial wound care solutions. According to recent studies, chronic leg ulcers affect approximately 1-2% of the Italian population, with an increasing prevalence rate, driving the demand for innovative wound care equipment and creating opportunities for market expansion.

Italian Wound Care Management Market Trends

Increasing Incidences of Chronic Wounds, Ulcers, Diabetic Ulcers, etc.

The rising prevalence of chronic wounds and ulcers represents a significant healthcare challenge in Italy, driven by multiple factors including diabetes, vascular conditions, and prolonged hospitalization. According to the International Diabetic Federation, the number of people with diabetes in Italy is projected to reach 4,699.1 thousand by 2030, significantly increasing the risk of diabetic foot ulcers in the population. This is particularly concerning as chronic leg ulcers currently affect approximately 1-2% of the Italian population, with vascular genesis accounting for 51.2% of cases, followed by inflammation (15.3%) and trauma (9.3%). The total annual incidence of new or recurrent deep venous disease-related venous leg ulcers in Italy was estimated at 253,000 cases, with incidence rates ranging from 0.73 to 3.12 per 1,000 persons per year.

The burden of chronic wounds is further amplified by their impact on specific patient populations and healthcare resources. For instance, studies have shown that the incidence of pressure ulcers in cancer patients reaches 17.3%, with risk factors including age, proximity to death, and duration of stay in hospice care. The complexity of chronic wound management is evident in the varying causes and manifestations, with postoperative complications and trauma-related injuries contributing to the overall burden. The increasing prevalence of comorbidities such as cardiovascular disease and diabetes significantly impacts wound healing processes, necessitating comprehensive wound care management approaches and driving the demand for advanced wound dressings products and solutions. The adoption of negative pressure wound therapy is also gaining traction as an effective method to promote healing in complex wound cases.

Rising Burden of Geriatric Population

Italy faces a significant demographic shift with one of the highest elderly populations globally, creating increased demand for wound care management solutions. Current statistics indicate that 23.61% of Italy's population is aged 65 and above, with this proportion expected to rise dramatically to 33.7% by 2050. Notably, Italy maintains the highest proportion of individuals aged 75 and above in the European Union at 11.7%, presenting unique healthcare challenges particularly in wound care management. This demographic trend is particularly significant as older adults are more susceptible to chronic wounds, pressure ulcers, and delayed healing processes due to reduced mobility and increased prevalence of comorbidities.

The impact of aging on wound care needs is further emphasized by the high comorbidity rates among the elderly population, reaching over 40% in persons between the ages of 75 and 85. This is particularly significant as multiple comorbidities and risk factors that increase wound chronicity are much more common in older people, including diabetes mellitus, cardiovascular disease, inadequate nutrition, and declining cognitive function. The average life expectancy in Italy remains among the highest in Europe, with the number of centenarians having tripled over the last 15 years, indicating a continued growth in the elderly population requiring specialized wound care services. This demographic trend, combined with the complex healthcare needs of the elderly, is driving increased demand for advanced bioactive wound care products and management solutions, including moist wound therapy and compression therapy devices to enhance healing outcomes.

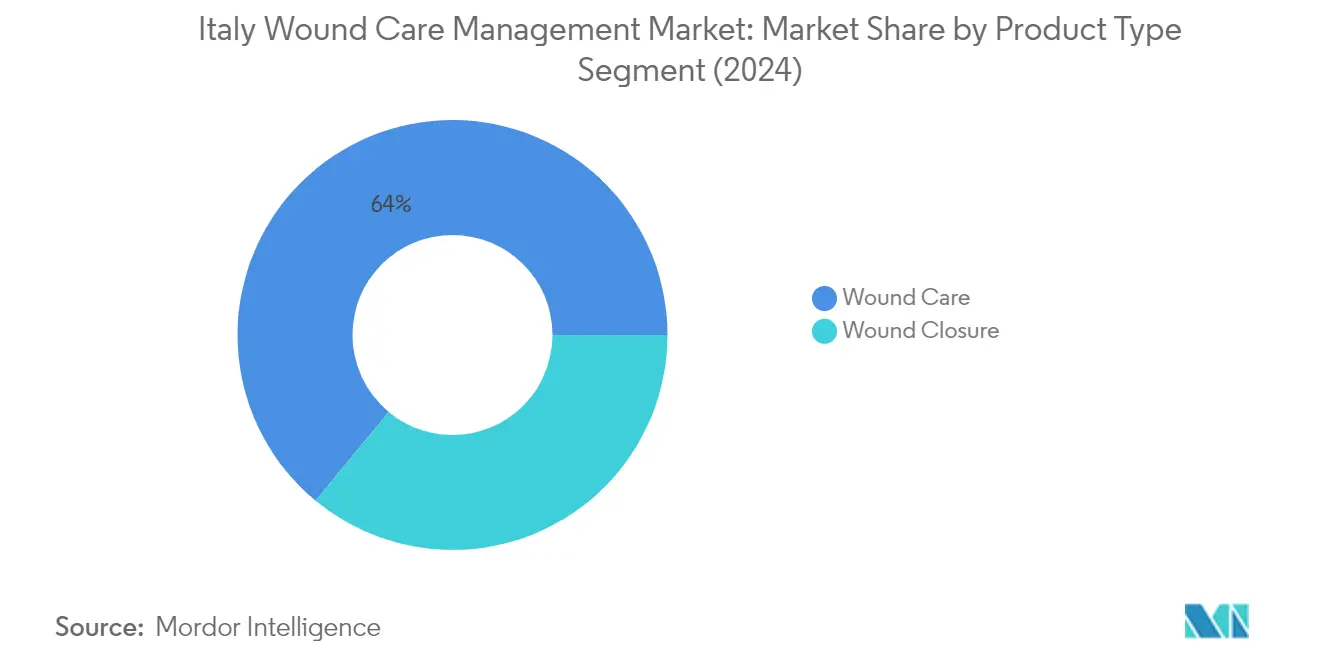

Segment Analysis: By Product Type

Wound Care Segment in Italy Wound Care Management Market

The Wound Care segment dominates the Italian wound care management market, holding approximately 64% market share in 2024. This segment encompasses various essential products, including wound dressings, wound care devices, topical agents, and other wound care products. The segment's strong performance is driven by the increasing incidence of chronic wounds, ulcers, and diabetic foot ulcers in Italy. The growing adoption of advanced wound care device technologies, particularly in managing complex wounds, has further strengthened this segment's position. Additionally, the rising geriatric population in Italy, which is more susceptible to chronic wounds and requires ongoing wound care management, continues to fuel the demand for wound care products. The segment's comprehensive product portfolio, ranging from basic dressings to sophisticated wound healing devices, enables healthcare providers to address diverse wound management needs effectively.

Wound Closure Segment in Italy Wound Care Management Market

The Wound Closure segment is emerging as the fastest-growing segment in the Italian wound care management market, projected to grow at approximately 6% CAGR from 2024 to 2029. This robust growth is primarily attributed to the increasing number of surgical procedures and trauma cases requiring advanced wound closure device solutions. The segment's growth is further supported by technological advancements in wound closure devices, including innovative sutures, staplers, and other closure devices that offer better healing outcomes and reduced recovery time. The rising adoption of minimally invasive surgical procedures in Italy has also created a strong demand for specialized wound closure devices. Additionally, the growing awareness among healthcare professionals about the importance of proper wound closure techniques in preventing post-operative complications and improving patient outcomes is driving the segment's expansion.

Segment Analysis: By Wound Type

Chronic Wounds Segment in Italy Wound Care Management Market

The Chronic Wounds segment dominates the Italy wound care management market, holding approximately 61% market share in 2024. This substantial market presence is driven by the increasing prevalence of chronic conditions such as diabetic foot ulcers, pressure ulcers, and arterial and venous ulcers in the Italian population. The segment's growth is particularly supported by Italy's aging population, with nearly 24% of citizens aged 65 and above, who are more susceptible to chronic wounds. The rising incidence of diabetes, with over 4.4 million cases in Italy, further contributes to the segment's dominance. Additionally, the segment benefits from advanced wound care technologies and increasing awareness among healthcare professionals about specialized treatment protocols for chronic wounds.

Acute Wounds Segment in Italy Wound Care Management Market

The Acute Wounds segment is emerging as the fastest-growing category in the Italian wound care management market, projected to grow at approximately 6% during 2024-2029. This accelerated growth is primarily driven by the increasing number of surgical procedures and traumatic injuries requiring immediate wound care intervention. The segment's expansion is further supported by the rising incidence of road accidents, with over 151,000 cases reported in recent years, creating a substantial demand for acute wound care products. The adoption of advanced wound closure technologies, improved surgical techniques, and the growing focus on reducing post-operative complications are also contributing to the segment's rapid growth. Additionally, the increasing investment in healthcare infrastructure and the implementation of better emergency care protocols across Italian healthcare facilities are expected to sustain this growth momentum.

Italian Wound Care Management Industry Overview

Top Companies in Italy Wound Care Management Market

The Italian wound care management market features prominent global players like B. Braun SE, Paul Hartmann, Smith & Nephew, Coloplast Group, and Convatec leading the competitive landscape. These companies are increasingly focusing on technological advancement in wound care devices, particularly in developing smart materials and contemporary wound dressings. The industry is witnessing a strong trend toward regenerative medicine and cell therapies for wound healing applications. Companies are investing heavily in research and development to create innovative products like smart bandages with moisture-sensing capabilities and AI-powered wound assessment devices. Strategic partnerships with healthcare institutions and distributors remain crucial for market penetration, while companies are also expanding their product portfolios through both organic development and acquisitions. The emphasis on professional education and clinical evidence generation demonstrates the industry's commitment to building credibility and market acceptance.

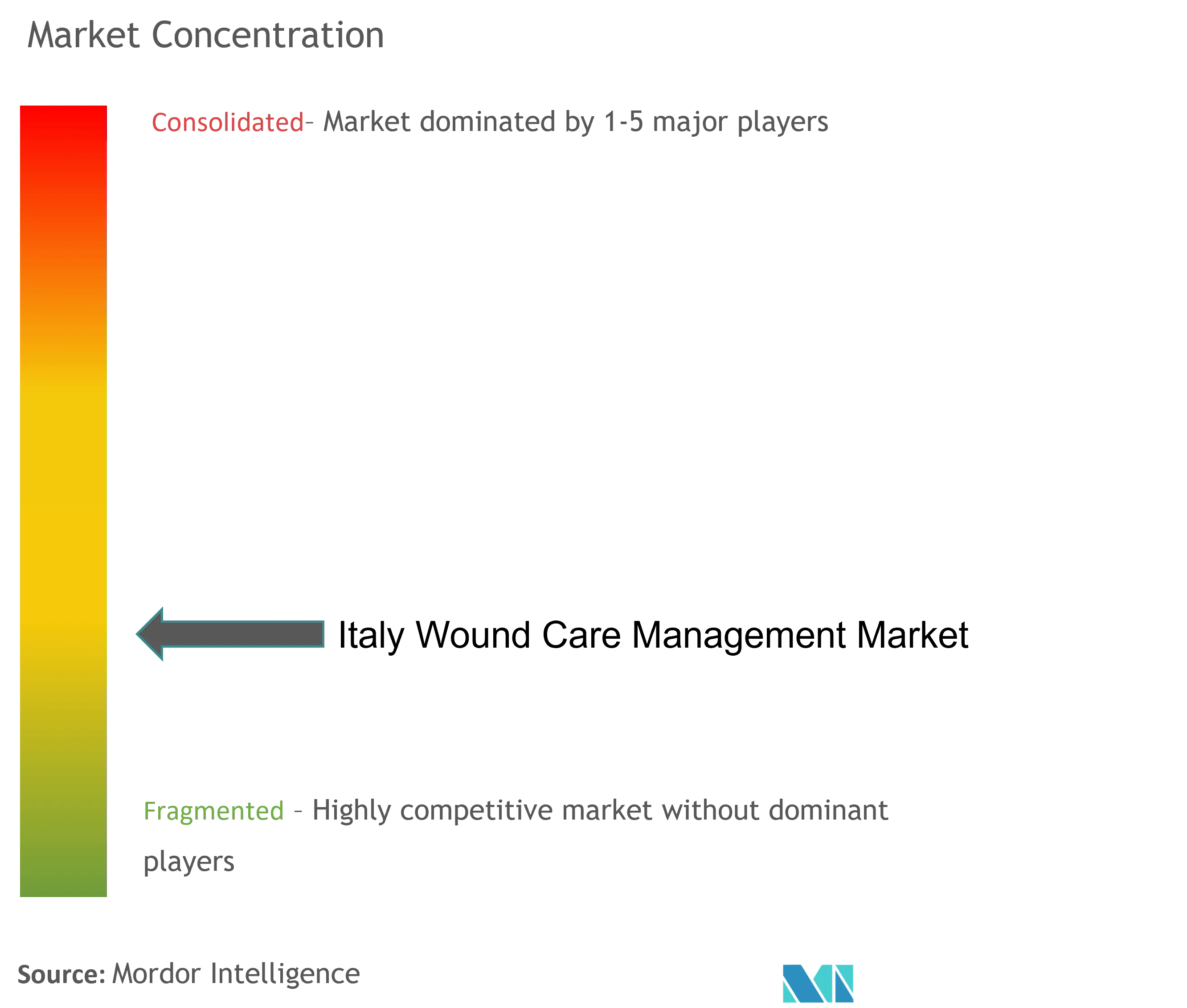

Global Leaders Dominate Italian Wound Care

The Italian wound care management market is characterized by the strong presence of multinational corporations that leverage their global research capabilities and extensive distribution networks. These companies typically operate across multiple healthcare segments, with wound care equipment being a strategic focus area within their broader portfolio. The market structure shows moderate to high consolidation, with the top players commanding significant market share through their established brands and comprehensive product offerings. The competitive dynamics are shaped by these large players' ability to invest in advanced technologies and maintain strong relationships with healthcare providers.

The market exhibits a mix of both diversified healthcare conglomerates and specialized wound care companies, creating a complex competitive landscape. Merger and acquisition activities are prevalent as companies seek to expand their technological capabilities and geographic reach. The presence of local players is limited, with most operating in niche segments or serving as distributors for global manufacturers. Companies are increasingly focusing on developing integrated wound care solutions that combine products with digital health capabilities, reflecting the industry's evolution toward more sophisticated treatment approaches.

Innovation and Integration Drive Market Success

Success in the Italian wound care management market increasingly depends on companies' ability to develop innovative products while maintaining strong relationships with healthcare providers. Market leaders are focusing on creating comprehensive wound care solutions that integrate advanced materials with digital technologies for better treatment outcomes. The relatively low threat of substitutes provides established players with stability, while regulatory compliance and quality standards create significant barriers for new entrants. Companies are also investing in educational initiatives for healthcare professionals to build brand loyalty and ensure proper product utilization.

For contenders looking to gain market share, specialization in specific wound care segments and focus on technological differentiation offer viable strategies. The concentration of end-users in healthcare institutions necessitates strong distribution networks and professional relationships. Future success will likely depend on companies' ability to adapt to evolving healthcare regulations while meeting the increasing demand for cost-effective solutions. The growing emphasis on wound prevention and early intervention creates opportunities for companies to expand their product portfolios and service offerings. Market players must also consider the increasing importance of sustainability and environmental considerations in product development and packaging.

Italian Wound Care Management Market Leaders

-

Paul Hartmann AG

-

Integra LifeSciences Corporation

-

Coloplast AS

-

Convatec Inc.

-

Smith + Nephew

- *Disclaimer: Major Players sorted in no particular order

Italian Wound Care Management Market News

- February 2024: Convatec, a leading global medical products and technologies company, launched Esteem Body with Leak Defense wound care products in Italy.

- March 2022: The Convatec Group acquired Triad Life Sciences Inc. to address clinical needs in surgical wounds, chronic wounds, and burns.

Italian Wound Care Management Industry Segmentation

As per the scope of the report, wound management products are used mainly to treat complex wounds. Wounds and injuries are common afflictions that affect many people. The Italian wound care market is segmented by product (wound care (dressings, wound care devices, topical agents, and other wound care products) and wound closure (suture, staplers, and other wound closure products)) and wound type (chronic wound (diabetic foot ulcer, pressure ulcer, arterial and venous ulcer, and other chronic wounds) and acute wound). The report offers the value (USD) for the above segments.

| By Product | Wound Care | Dressings | |

| Wound care Devices | |||

| Topical Agents | |||

| Other Wound Care Products | |||

| Wound Closure | Suture | ||

| Staplers | |||

| Other Wound Closure Products | |||

| By Wound Type | Chronic Wound | Diabetic Foot Ulcer | |

| Pressure Ulcer | |||

| Arterial and Venous Ulcer | |||

| Other Chronic Wounds | |||

| Acute Wound | |||

| Wound Care | Dressings |

| Wound care Devices | |

| Topical Agents | |

| Other Wound Care Products | |

| Wound Closure | Suture |

| Staplers | |

| Other Wound Closure Products |

| Chronic Wound | Diabetic Foot Ulcer |

| Pressure Ulcer | |

| Arterial and Venous Ulcer | |

| Other Chronic Wounds | |

| Acute Wound |

Italy Wound Care Management Market Research FAQs

How big is the Italy Wound Care Management Market?

The Italy Wound Care Management Market size is expected to reach USD 513.97 million in 2025 and grow at a CAGR of 5.06% to reach USD 657.85 million by 2030.

What is the current Italy Wound Care Management Market size?

In 2025, the Italy Wound Care Management Market size is expected to reach USD 513.97 million.

Who are the key players in Italy Wound Care Management Market?

Paul Hartmann AG, Integra LifeSciences Corporation, Coloplast AS, Convatec Inc. and Smith + Nephew are the major companies operating in the Italy Wound Care Management Market.

What years does this Italy Wound Care Management Market cover, and what was the market size in 2024?

In 2024, the Italy Wound Care Management Market size was estimated at USD 487.96 million. The report covers the Italy Wound Care Management Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the Italy Wound Care Management Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.