Pet Care Market Size and Share

Pet Care Market Analysis by Mordor Intelligence

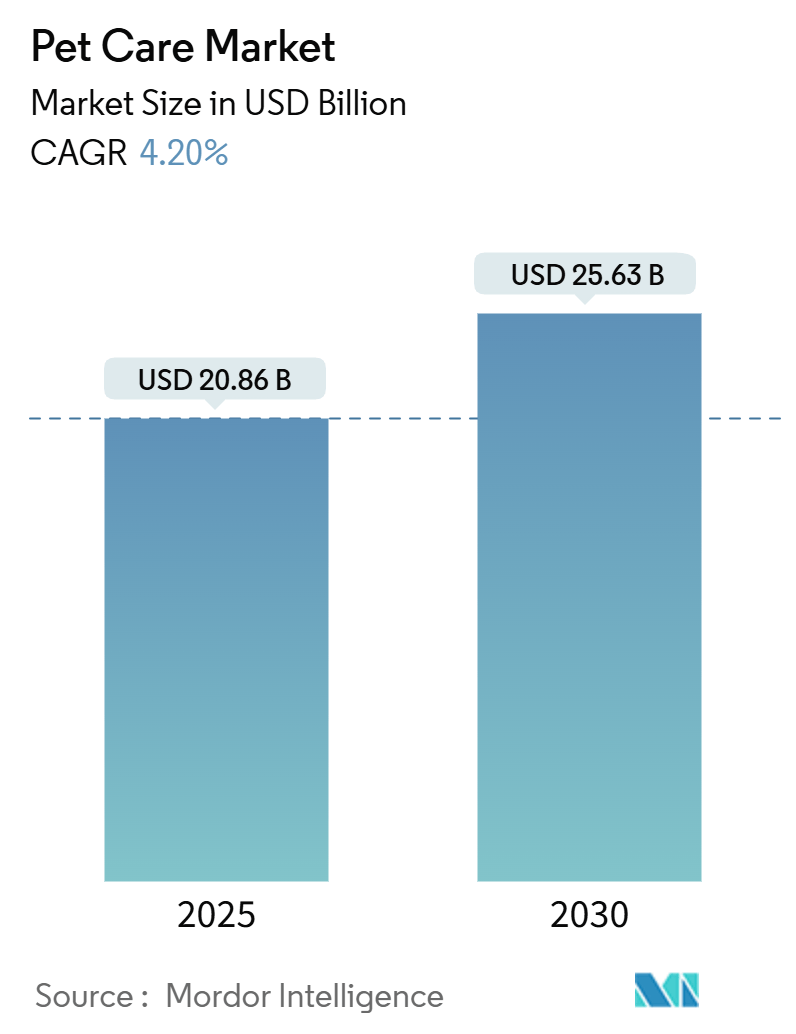

The Pet Care Market size is estimated at USD 20.86 billion in 2025 and is anticipated to reach USD 25.63 billion by 2030, at a CAGR of 4.20% during the forecast period. Growth stems from the deepening human-animal bond, premiumization across every product tier, and sustained gains in global pet ownership. Premium spending on food, treats, health products, and technology is rising as owners increasingly treat pets as family members. High-margin functional nutrition, digital wellness tools, and subscription services are broadening revenue streams, while omnichannel retail strategies are enlarging addressable audiences. Competitive intensity is strong but largely benefits scale players that can fund innovation and marketing. New entrants are succeeding in niche sub-segments by focusing on condition-specific nutrition and tech-enabled health solutions, keeping the overall pet care market dynamic and innovative.

Key Report Takeaways

- By product category, pet food led with 39.2% revenue share in 2024; functional and fresh formats are advancing at a 12.8% CAGR to 2030.

- By pet type, dogs held 45.8% of the pet care market share in 2024; cats are expanding at a 5.8% CAGR through 2030.

- By distribution channel, offline retail accounted for 61% of 2024 revenue, while online retail is growing at a 15% CAGR by 2030.

- By geography, North America controlled 42% of 2024 revenue and is poised to grow at an 8.9% CAGR through 2030.

- Mars Incorporated, Nestlé SA (Purina), and Colgate-Palmolive Company (Hill’s Pet Nutrition) collectively owned more than half of global revenue in 2024.

Global Pet Care Market Trends and Insights

Drivers Impact Analysis

| Driver | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Rising global pet ownership among Millennials and Gen Z | +0.7% | North America, Asia-Pacific | Medium term (2-4 years) |

| Humanization of pets driving premium spend | +1.2% | North America, Europe | Long term (≥ 4 years) |

| E-commerce and DTC subscriptions are expanding access | +0.8% | Developed regions worldwide | Medium term (2-4 years) |

| Advances in nutrition science enabling functional diets | +0.5% | North America, Europe, developed Asia-Pacific | Long term (≥ 4 years) |

| Regulatory harmonization lowering compliance friction | +0.6% | United States, European Union | Medium term (2-4 years) |

| Expansion of tele-health ecosystems linked to smart devices | +0.4% | North America, Europe | Short term (≤ 2 years) |

Source: Mordor Intelligence

Rising Global Pet Ownership Among Millennials and Gen Z

Younger generations now represent the largest share of pet owners, with Gen Z and Millennials accounting for 30% and 25% of households, respectively. Ownership among Gen Z jumped 43.5% from 2023 to 2024, adding 18.8 million new households[1]Source: American Pet Products Association, “Industry Trends & Stats,” americanpetproducts.org. These consumers are digital-native and value convenience, which drives online penetration to 39% for pet food purchases. The long-expected delay in traditional family formation suggests a durable revenue stream for the pet care market.

Humanization of Pets Driving Premium Spend

Ninety-five percent of owners consider pets family members, shifting decision-making from rational price assessments toward emotional quality priorities. Functional and wellness-oriented pet foods routinely sell at 20–30% premiums versus standard fare. Luxury services are flourishing, with grooming peaks observed around seasonal events, including de-shedding brush demand. Personalized nutrition platforms that formulate diets by breed, age, and health profile are capturing high margins and demonstrating resilience even in inflationary periods.

Regulatory Harmonization Lowering Cross-Border Compliance Friction

Convergence between U.S. and European pet food standards is cutting reformulation costs for multinational producers. The proposed PURR Act seeks to streamline U.S. oversight, mirroring EU frameworks and enabling faster time-to-market for innovative products. Lower compliance burdens particularly benefit specialized formulas that previously required region-specific changes, opening overseas distribution opportunities for small and medium enterprises.

E-commerce and DTC Subscriptions Expanding Access

Online channels are forecast to handle 54% of pet product expenditure by 2025. Nearly half of owners now subscribe to auto-replenishment programs, citing convenience and stock certainty. Chewy.com and Amazon.com together hold 85.4% of online pet food sales, according to PetFood Industry. Data-driven personalization and loyalty incentives boost customer lifetime value, prompting brick-and-mortar chains to roll out omnichannel features such as click-and-collect and in-store experience zones.

Restraints Impact Analysis

| Restraint | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Inflation-driven price sensitivity for premium SKUs | -0.9% | Global, higher in developing markets | Short term (≤ 2 years) |

| Stringent product-safety regulations raising costs | -0.7% | North America, Europe | Medium term (2-4 years) |

| Protein-sourcing sustainability scrutiny | -0.8% | Europe, North America | Long term (≥ 4 years) |

| Climate-linked supply-chain fragility | -0.6% | Ingredient-exporting regions | Medium term (2-4 years) |

Source: Mordor Intelligence

Inflation-Driven Price Sensitivity for Premium SKUs

Inflation raised budget concerns for 63% of owners in 2024, pressuring discretionary spending. Some purchasers are mixing premium raw food with standard kibble to manage costs. Manufacturers launched value-tier extensions and smaller packs, but these tactics compress margins. Premium categories remain more resilient than mid-range offerings, causing a barbell demand profile that favors both high-end and economy lines.

Stringent Product-Safety Regulations Raising Compliance Costs

Enhanced traceability, contaminant testing, and manufacturing validation requirements elevate fixed costs. Smaller firms struggle with regulatory complexity, leading to consolidation as larger players leverage established quality systems. Novel-ingredient products face heightened data demands, slowing the cadence of innovation in emerging categories.

Segment Analysis

By Pet Type: Dogs Maintain Lead, Cats Accelerate

The dog segment captured 45.8% of the pet care market share in 2024. Owners of dogs spend at least USD 1,200 annually on food in Canada alone, and premium formulas targeting joint and digestive health remain core growth drivers. Urbanization and smaller living spaces challenge large-breed adoption. Training treats, outdoor accessories, and digital trackers further reinforce the segment’s relevance in the broader pet care market.

Cat ownership is rising at a 5.8% CAGR for 2025-2030, with notable gains among Gen Z and Millennial men. Product innovation centers on hydration-focused wet food, portion-controlled kibble, and enrichment treats. Litter subscription services and vertical playground furniture illustrate how manufacturers are addressing indoor living realities. While the segment commands less share, its growth trajectory and lower service penetration offer expansion headroom within the pet care market.

Note: Segment share of all individual segments available upon report purchase

By Product Type: Nutrition Drives Innovation

Pet food delivered 39.2% of 2024 revenue and is forecast to compound at 11.8% annually to 2030. Dry kibble retains volume leadership, yet wet food approaches are advancing fastest. Functional ingredients such as omega-3s, collagen, and probiotics have migrated from human to pet applications, sharpening product differentiation. Condition-specific lines for obesity, renal health, and cognition allow brands to capture premium price points and build direct relationships through customized plans.

By Distribution Channel: Omnichannel Strategies Prevail

Offline retail held 61% of 2024 sales because of tactile shopping and immediate fulfillment. Pet specialty chains offer in-store advice, grooming, and training classes that deepen engagement. Mass merchants and grocery stores broaden their reach, although rising operating costs challenge profitability. Many chains now use mobile apps for curbside pickup, bridging physical and digital touchpoints.

Online retail is growing 15% per year until 2030. Subscriptions account for nearly 70% of Chewy's sales, illustrating how auto-ship programs lock in repeat business[2]Source: American Veterinary Medical Association, “More Pet Owners Are Shopping Online,” avma.org. Younger demographics favor digital convenience, and loyalty ecosystems combine discounts with vet portals and tele-triage. Retailers with unified inventory, consistent pricing, and seamless returns are best positioned to capture incremental shares of the pet care market.

Note: Segment share of all individual segments available upon report purchase

Geography Analysis

North America generated 42% of 2024 global revenue and displays the highest regional CAGR at 8.7% for 2025-2030. U.S. households spent an average of USD 1,733 per animal in 2024, with food and treats taking a 43.3% share of wallets[3]Source: Nicole Kerwin, “Pet Food Trends Embraced at Global Pet Expo 2025,” Pet Food Processing, petfoodprocessing.net . Veterinary services and insurance are broadening spending categories. Canada shows similar patterns, while Mexico’s growing middle class is raising demand for commercial diets and parasite prevention, expanding the overall pet care market size.

Europe is the second-largest regional contributor. Germany’s market exceeded in 2024, and Italy posted double-digit value growth while volume remained stable. Sustainability expectations drive interest in organic, recyclable, and carbon-neutral products. Eastern Europe’s 8.8% sales rise reveals opportunity beyond traditional Western strongholds. E-commerce adoption is rapid in the UK and Nordic countries, though brick-and-mortar still accounts for most purchases in continental Europe.

Asia-Pacific is the fastest-expanding territory, led by China, Japan, Australia, and emerging economies such as India. Southeast Asian markets show 8% plus growth as multinational brands enter via modern retail and mobile commerce. Regional cultural diversity necessitates tailored marketing and flavor profiles, yet the underlying drivers of income gains and shifting lifestyles remain consistent across Asia’s pet care market.

Note: Segment share of all individual segments available upon report purchase

Competitive Landscape

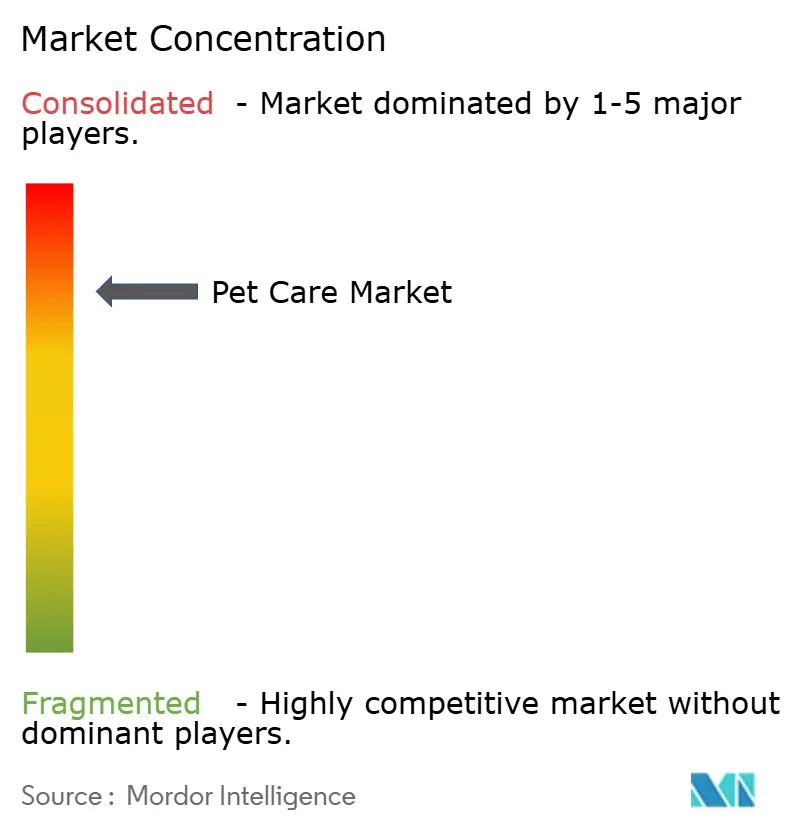

The top three suppliers, including Mars Incorporated, Nestlé SA (Purina), and Colgate-Palmolive Company (Hill’s Pet Nutrition), control the majority of the global market, contributing around 60% of the market share, confirming a highly concentrated structure. Scale yields advantages in sourcing, R&D, and advertising, which reinforce incumbency. These firms invest in expanding capacity, evidenced by Hill’s USD 450 million canned-food plant and Mars Petcare’s USD 1 billion digital innovation plan.

Acquisitive activity targets niche brands that bring either premium positioning or advanced capabilities. General Mills’ USD 1.45 billion purchase of Whitebridge Pet Brands adds presence in cat feeding and treats. Vetnique Labs’ acquisition of Lintbells underscores interest in supplements, a category with cross-border regulatory benefits and recurring purchase cycles.

Niche challengers differentiate through direct-to-consumer models, limited-ingredient recipes, or sustainability credentials. Smart-device producers link hardware to subscription health platforms, creating data-rich ecosystems. The strategic race now pairs nutrition science with digital engagement, and companies that master both stand to capture incremental share within the evolving pet care market.

Pet Care Industry Leaders

-

Mars Incorporated (Mars Petcare)

-

General Mills (Blue Buffalo)

-

The J.M. Smucker Co. (Big Heart)

-

Colgate-Palmolive Company (Hill’s Pet Nutrition)

-

Nestlé SA (Purina)

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- May 2025: General Mills promoted Dana McNabb to group president for North America Retail and Pet, underscoring pet category priority within a business that posted USD 20 billion net sales for fiscal 2024.

- May 2025: Mars Petcare rolled out AI dental-health tools through its GREENIES brand, part of a USD 1 billion digital investment.

- April 2025: Global Pet Expo hosted 1,000 exhibitors and 20,000 attendees, awarding innovations such as the VEA AI diagnostic assistant.

- November 2024: General Mills acquired Whitebridge Pet Brands for USD 1.45 billion, expanding its premium and feline portfolios.

Global Pet Care Market Report Scope

The pet care market involves products used in pet food and safety, nourishment, exercise, and medical attention. It also includes oral care, veterinary care, dietary supplements, pet grooming, pet fashion products, etc. The pet care market is segmented by pet type (dog, cat, fish, and other pet types), product type (pet food, pet care, and grooming products), distribution channel (offline retail stores and online stores), and geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The report offers the market size and forecasts in value (USD) for all the above segments.

| By Pet Type | Dog | ||

| Cat | |||

| Fish | |||

| Other Pet Type (Birds, Small Mammals, and Exotic Pets) | |||

| By Product Type | Pet Food | Dry | |

| Wet | |||

| Pet Care | Oral Care | ||

| Dietary Supplements | |||

| Veterinary Diets | |||

| Grooming and Hygiene Products | Shampoos and Conditioners | ||

| Combs and Brushes | |||

| Clippers and Scissors | |||

| Other Grooming Products | |||

| Accessories and Smart Devices | |||

| By Distribution Channel | Offline Retail Stores | ||

| Online Retail Stores | |||

| By Geography | North America | United States | |

| Canada | |||

| Mexico | |||

| Rest of North America | |||

| South America | Brazil | ||

| Argentina | |||

| Rest of South America | |||

| Europe | Germany | ||

| United Kingdom | |||

| France | |||

| Italy | |||

| Spain | |||

| Russia | |||

| Rest of Europe | |||

| Asia-Pacific | China | ||

| Japan | |||

| India | |||

| Australia | |||

| Rest of Asia-Pacific | |||

| Middle East and Africa | Saudi Arabia | ||

| South Africa | |||

| Rest of Middle East and Africa | |||

| Dog |

| Cat |

| Fish |

| Other Pet Type (Birds, Small Mammals, and Exotic Pets) |

| Pet Food | Dry |

| Wet | |

| Pet Care | Oral Care |

| Dietary Supplements | |

| Veterinary Diets | |

| Grooming and Hygiene Products | Shampoos and Conditioners |

| Combs and Brushes | |

| Clippers and Scissors | |

| Other Grooming Products | |

| Accessories and Smart Devices |

| Offline Retail Stores |

| Online Retail Stores |

| North America | United States |

| Canada | |

| Mexico | |

| Rest of North America | |

| South America | Brazil |

| Argentina | |

| Rest of South America | |

| Europe | Germany |

| United Kingdom | |

| France | |

| Italy | |

| Spain | |

| Russia | |

| Rest of Europe | |

| Asia-Pacific | China |

| Japan | |

| India | |

| Australia | |

| Rest of Asia-Pacific | |

| Middle East and Africa | Saudi Arabia |

| South Africa | |

| Rest of Middle East and Africa |

Key Questions Answered in the Report

What is the current value of the pet care market?

The pet care market is worth USD 20.86 billion in 2025.

How fast will the pet care market grow through 2030?

It is projected to expand at a 4.2% CAGR, reaching USD 25.63 billion in 2030.

Which region leads the pet care market?

North America holds 42% of 2024 revenue and is growing at an 8.7% CAGR.

Which product segment is growing the fastest?

Pet food, especially functional and fresh formats, is advancing at a 11.8% CAGR from 2025-2030.

How important is e-commerce in the pet care market?

Online channels are anticipated to account for 54% of all pet product spending by 2025, with leading sites leveraging subscription models for repeat purchases.

Who are the dominant companies in the pet care market?

Mars Incorporated, Nestlé SA (Purina), and Colgate-Palmolive (Hill’s) together control more than 60% of global revenue.