South America Gear Market Size

South America Gear Market Analysis

The South America Gear Market size is estimated at USD 32.59 billion in 2025, and is expected to reach USD 40.01 billion by 2030, at a CAGR of 4.19% during the forecast period (2025-2030).

- Over the medium term, increasing vehicle production across South American countries and the complexity of modern vehicles, including electric and hybrid models, necessitates advanced gear systems for efficient power transmission.

- On the other hand, South America suffers from inadequate infrastructure, including poor road networks, substandard ports, and insufficient logistics capabilities. These issues increase transportation costs and delays, which could act as restaint for the growth of market.

- Nevertheless, continuous innovations in gear design and manufacturing processes enhance performance and efficiency, making modern gears more appealing across various industries. The integration of smart technologies into manufacturing processes further drives demand for high-quality gear systems.

- Brazil is likely one of the largest consumer of gears in South American region owing to increase industrialiation, hence country is likely to continue its dominance during the forecast period,

South America Gear Market Trends

The Oilfield Equipment Segment to Witness Growth

- Oilfield equipment significantly drives the South American gear market, playing diverse roles across the oil and gas value chain. The upstream exploration and production (E&P) sector emerges as the primary consumer of these gears, which are vital for equipment such as drilling rigs, mud pumps, drawworks, and wellhead systems. Demand for these gears in the upstream sector is influenced by global oil and gas prices, advancements in exploration technologies (like seismic imaging and horizontal drilling), and a growing focus on deepwater and ultra-deepwater exploration.

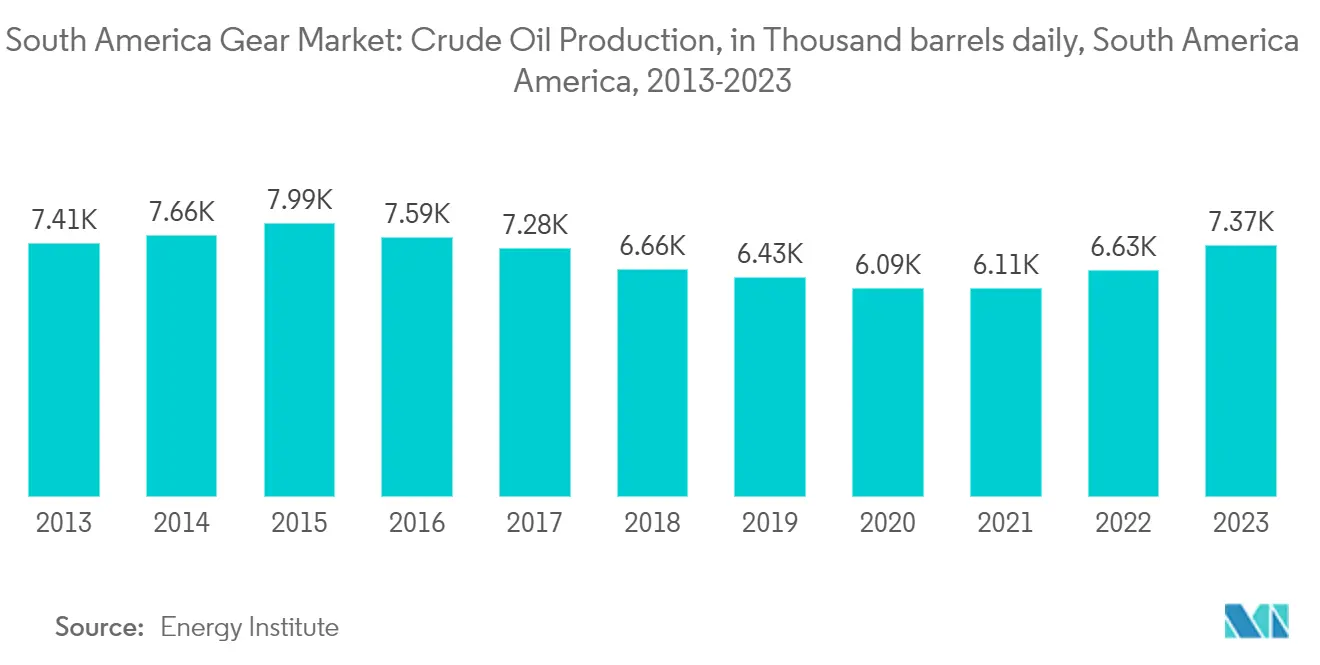

- Recently, crude oil production has surged, fueled by rising demand from the expanding economies of Brazil, Colombia, and Argentina. Additionally, in light of sanctions on Russia, oil production has intensified to meet this growing demand.

- According to the Energy Institute's Statistical Review of World Energy, South America's crude oil production jumped by 11.2% from 2022 to 2023, highlighting a robust upward trend. This production increase subsequently drives up equipment demand, bolstering the industry's gear requirements.

- Argentina, endowed with vast resources, holds significant oil and gas reserves, particularly in the famed Vaca Muerta shale formation. Often compared to the U.S.'s Permian Basin, Vaca Muerta ranks among the world's largest shale reserves. While Argentina has historically been a net energy exporter, recent economic challenges, coupled with underinvestment and regulatory obstacles, have limited this potential.

- In light of rising global energy demands, major oil companies are intensifying shale oil production in Argentina. For example, in November 2024, YPF, a leading Argentinian oil and gas firm, unveiled plans to elevate its shale oil output by 30% to 40% in 2025, zeroing in on the Vaca Muerta formation.

- Moreover, Pampa Energia, another prominent Argentinian player, is poised to invest up to USD 1.5 billion in developing its unconventional oil reserves in Vaca Muerta. The company is allocating USD 700 million to its Rincon de Aranda block in 2025, with intentions to ramp up the investment to USD 1.5 billion by 2027. This bold move aims to boost its oil production tenfold, eyeing a target of 50 kb/d. Given these expansive oil production pursuits, a surge in demand for specialized oilfield equipment is on the horizon.

- Moreover, Argentina's oil exploration and production are thriving, largely propelled by advancements in its shale formations. As companies venture into these unconventional and deepwater projects, the appetite for oilfield equipment, especially drilling tools, has surged.

- With these promising developments, the oilfield equipment segment is set for growth, driving the overall expansion of the gear market.

Brazil to Dominate the Market

- Brazil's automotive industry, along with sectors like mining, power, and construction, is driving a significant surge in gear demand. With Brazil's ongoing investments in technology and infrastructure, the market is becoming increasingly attractive for gear manufacturers looking to expand and cater to these growing sectors.

- In Brazil, where hydropower constituted about 60% of the nation's electricity generation in 2023, gears are pivotal. They play a vital role in hydro turbines, transforming the kinetic energy of flowing water into mechanical energy. Data from the Statistical Review of World Energy highlights the significance: Brazil's hydroelectricity generation hit 428.7 terawatt hours in 2023, a 15% increase since 2017.

- With a surge in mining activities, there's an escalating demand for sophisticated gear technologies and equipment. In a strategic move, Marubeni and Hitachi Construction Machinery unveiled a joint venture, ZAMine Service Brasil, in September 2024. This venture, focusing on mining equipment sales and maintenance, aims to capitalize on Brazil's growing appetite for mining equipment, further propelling the gear market's expansion across South America.

- In a bid to revitalize its construction sector, Brazil's government rolled out several initiatives in May 2024. At the heart of these efforts is the New Growth Acceleration Program, set to inject an estimated USD 340.6 billion into critical areas like social infrastructure, transportation, energy, and housing. With Brazil eyeing ambitious megaprojects — from monumental bridges and highways to vast energy initiatives — the nation not only stands to transform its infrastructure but also heralds a rising demand for equipment, especially gears.

- Given these developments, Brazil is poised to lead the gear market during the forecast period.

South America Gear Industry Overview

The South America Gear market is semi-consolidated. Some of the major companies in the market (in no particular order) include Companhia Industrial de Peças (CIP), Carraro Group, Sumitomo Drive Technologies, Zanini Renk, GNA Gears, and among others

South America Gear Market Leaders

-

Carrao Group

-

Zanini Renk

-

Companhia Industrial de Peças (CIP)

-

Sumitomo Drive Technologies

-

GNA Gears

- *Disclaimer: Major Players sorted in no particular order

South America Gear Market News

- August 2024: Vestas, a global frontrunner in wind turbine manufacturing, is channeling approximately USD 23.6 million into its factory expansion in Ceará, Brazil. This move aims to produce the cutting-edge V163 wind turbine model, boasting a market-leading capacity of 4.5 megawatts. In wind turbines, gears within a gearbox amplify the rotational speed of the turbine blades. This development is poised to bolster the gear market's growth in the coming years.

- February 2024: In a move to bolster its foothold in Argentina, Toyota unveiled a USD 50 million investment plan to kickstart production of the Hiace utility vehicle in Zárate, Buenos Aires province. This initiative, set to create 100 direct and indirect jobs, aims to position Argentina as a pivotal hub for the production and export of commercial vehicles across the region. Gears, essential mechanical components in vehicles, play a crucial role in transmitting power and rotation. They are integral to a car's engine, facilitating changes in speed, torque, and direction. Given these developments, the vehicle manufacturing surge in South America is poised to have a pronounced influence on the region's gear market during the forecast period.

South America Gear Industry Segmentation

Gears are components with interlocking teeth that transmit torque and motion between rotating shafts. Gears are typically metal or plastic and come in various shapes and sizes. Gears are fundamental in machinery, from clocks and vehicles to industrial equipment, where they adjust speed, torque, and direction of movement. Their precision and durability make them essential in everyday devices and complex mechanical systems.

The South America America gear market is segmented by gear type, application, and geography. By gear type, the market is segmented into spur gear, helical gear, planetary gear, rack and pinion gear, worm gear, bevel gear, and other gear types. By application, the market is segmented into oilfield equipment, mining equipment, industrial machinery, power plants, construction machinery, and other applications. The report also covers the market size and forecasts for the gear market across major countries in the region.

For each segment, the market sizing and forecasts have been done based on revenue (USD).

| Gear Type | Spur Gear |

| Helical Gear | |

| Planetary Gear | |

| Reck and Pinion Gear | |

| Worm Gear | |

| Bevel gear | |

| Other Gear Type | |

| Application | Oilfield Euipment |

| Mining Equipment | |

| Industrial Machinery | |

| Construction Machinery | |

| Other Applications | |

| Geography | Brazil |

| Argentina | |

| Colombia | |

| Rest of the South America |

| Spur Gear |

| Helical Gear |

| Planetary Gear |

| Reck and Pinion Gear |

| Worm Gear |

| Bevel gear |

| Other Gear Type |

| Oilfield Euipment |

| Mining Equipment |

| Industrial Machinery |

| Construction Machinery |

| Other Applications |

| Brazil |

| Argentina |

| Colombia |

| Rest of the South America |

South America Gear Market Research FAQs

How big is the South America Gear Market?

The South America Gear Market size is expected to reach USD 32.59 billion in 2025 and grow at a CAGR of 4.19% to reach USD 40.01 billion by 2030.

What is the current South America Gear Market size?

In 2025, the South America Gear Market size is expected to reach USD 32.59 billion.

Who are the key players in South America Gear Market?

Carrao Group, Zanini Renk, Companhia Industrial de Peças (CIP), Sumitomo Drive Technologies and GNA Gears are the major companies operating in the South America Gear Market.

What years does this South America Gear Market cover, and what was the market size in 2024?

In 2024, the South America Gear Market size was estimated at USD 31.22 billion. The report covers the South America Gear Market historical market size for years: 2019, 2020, 2021, 2022, 2023 and 2024. The report also forecasts the South America Gear Market size for years: 2025, 2026, 2027, 2028, 2029 and 2030.

South America Gear Industry Report

Statistics for the 2025 South America Gear market share, size and revenue growth rate, created by Mordor Intelligence™ Industry Reports. South America Gear analysis includes a market forecast outlook for 2025 to 2030 and historical overview. Get a sample of this industry analysis as a free report PDF download.