Sweden DIY Home Improvement Market Analysis by Mordor Intelligence

The Swedish DIY home improvement market is valued at USD 15.23 billion in 2025 and is forecast to reach USD 19.23 billion by 2030, advancing at a 4.8% CAGR. This trajectory reflects a resilient consumer base benefiting from generous tax deductions, high digital literacy, and strong environmental policy signals. Demand concentrates on energy-saving retrofits, aesthetic upgrades, and smart-home integrations as households navigate volatile utility costs and a maturing housing stock. Retailers continue to balance large-format stores with sophisticated online platforms, while material cost swings push do-it-yourself consumers toward flexible, lower-budget projects. Competitive intensity remains moderate, presenting scope for niche specialists in eco-friendly products and simplified installation solutions.

Key Report Takeaways

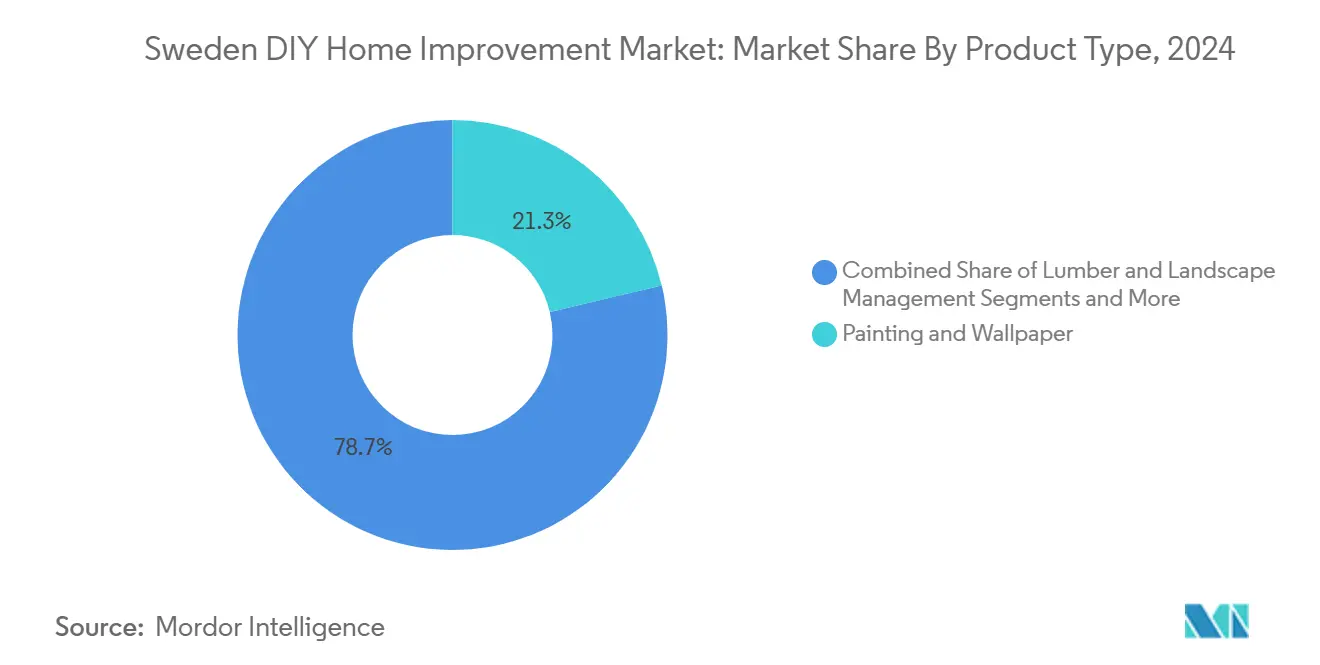

• By product type, painting & wallpaper led with 21.25% of Sweden DIY home improvement market share in 2024; lighting is projected to expand at a 7.4% CAGR through 2030.

• By distribution channel, DIY home-improvement stores held 62.25% of the Sweden DIY home improvement market size in 2024, while online channels are set to grow at 12.8% CAGR.

• By project type, maintenance & repair accounted for 36.61% share of the Sweden DIY home improvement market size in 2024, whereas energy-efficiency retrofits are rising at an 8.2% CAGR to 2030.

• By geography, Götaland contributed 45.5% revenue share in 2024; Norrland is on track for the fastest 7.56% CAGR in the Sweden DIY home improvement market.

• Bauhaus Sverige, Byggmax Group, Clas Ohlson, Hornbach, Beijer, and other top players collectively command a major share in the Sweden DIY home improvement market.

Sweden DIY Home Improvement Market Trends and Insights

Drivers Impact Analysis

| Driver | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Rising interest in home renovation and personalization | 1.2% | National, strongest in Götaland and Svealand | Medium term (2-4 years) |

| Expansion of DIY retail chains and omnichannel presence | 0.8% | National, with urban concentration | Short term (≤ 2 years) |

| Growth of e-commerce for home-improvement SKUs | 1.5% | National, accelerated in metropolitan areas | Short term (≤ 2 years) |

| Government ROT-avdrag tax incentive spurring semi-DIY renovations | 1.8% | National | Long term (≥ 4 years) |

| Energy-efficiency retrofit push amid high power prices | 2.1% | National, particularly Norrland | Medium term (2-4 years) |

Source: Mordor Intelligence

Rising Interest in Home Renovation and Personalization

Remote-work lifestyles and shifting household priorities are lifting renovation intent. In 2024, 49% of Swedes planned DIY projects over summer, and 23% budgeted for specialist help, underscoring a hybrid execution model. Improved finances for nearly 1 in 5 respondents translated into broader project scopes. The rise of remote work has intensified focus on home office spaces, storage solutions, and indoor air quality improvements, creating new product categories and driving demand for multifunctional furniture and smart home technologies. With housing absorbing 21.9% of consumer outlays in 2021, homeowners channel disposable income toward storage, indoor-air upgrades, and multifunctional furnishings [1]Source: Statistics Sweden, “Consumer Price Index and Construction Cost Index,” scb.se.

Expansion of DIY Retail Chains and Omnichannel Presence

Chains such as Hornbach invest in compact city stores—e.g., a USD 4.37 million unit in Trollhättan—to meet urban convenience expectations. Clas Ohlson grew to 241 stores and posted 4% sales growth in April 2025 despite FX headwinds, signaling appetite for deeper market penetration. IKEA’s micro-mobility delivery pilots using e-bikes and cargo trailers trim last-mile emissions and customer effort.

Growth of E-commerce for Home-Improvement SKUs

Sweden’s high broadband coverage and digital trust accelerate online DIY transactions. Ninety-two percent of IKEA customers combine web and store visits, illustrating omnichannel complementarity. Retailers respond with AR visualization, live video consults, and click-and-collect logistics that align with complex product decision cycles. The complexity of home improvement products requires sophisticated online-to-offline integration, with retailers investing heavily in augmented reality tools, virtual consultation services, and improved product visualization technologies.

Government ROT-avdrag Tax Incentive Spurring Semi-DIY Renovations

The ROT-avdrag system represents one of Europe's most generous home improvement tax incentives, fundamentally altering project economics and consumer behavior patterns while supporting employment in the construction and renovation sectors. Card-based payment rules formalize contractor activity, while a combined ceiling of USD 7,000 for ROT+RUT offsets encourages larger project packages. The deduction applies only to labor costs, not materials, creating price sensitivity around product selection and driving demand for premium DIY-friendly materials that reduce installation complexity.

Energy-Efficiency Retrofit Push Amid High Power Prices

Solar panels, batteries, and EV chargers qualify for tax rebates of 20–50% on equipment, triggering a bundled energy-saving upgrade. Electricity costs jumped 44.1% in October 2022, reinforcing payback economics for insulation, heat-pump, and smart-lighting installs. Boverket earmarked USD 74.4 million for rentals and proposes USD 93 million annually through 2025, catalyzing spill-over demand in owner-occupied housing[2]Source: International Energy Agency, “Sweden Buildings Energy Policies,” iea.org .

Restraints Impact Analysis

| Restraint | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Ageing population and DIY skill shortage | -1.4% | National, acute in rural areas | Long term (≥ 4 years) |

| Lumber and material price volatility | -0.9% | National, supply chain dependent | Short term (≤ 2 years) |

| Strict building-permit rules for small projects | -0.7% | National, stricter in urban municipalities | Medium term (2-4 years) |

| Insurance limits on homeowner electrical / plumbing work | -0.5% | National, standardized regulations | Long term (≥ 4 years) |

Source: Mordor Intelligence

Ageing Population and DIY Skill Shortage

An older median age and fading vocational skills limit complex project execution. Research shows seniors lean toward cosmetic fixes, while younger, sustainability-minded owners lack hands-on know-how, widening a capability gap. Roughly 27,000 DIY injuries a year, mainly among middle-aged men, raise safety concerns that retailers must address with training workshops and intuitive product kits [3] Source: If Skadeförsäkring, “Home Improvement Injury Statistics 2024,” if.se.

Lumber and Material Price Volatility

Material cost instability represents a persistent challenge for Swedish DIY market growth, with price fluctuations creating planning difficulties for both consumers and retailers while affecting project timing and scope decisions. Retailers hedge by diversifying suppliers and adopting dynamic shelf pricing. The price swings create consumer hesitation around project timing and scope, with many homeowners delaying renovations during peak cost periods or substituting materials based on price rather than performance characteristics.

Segment Analysis

By Product Type: Painting Drives Volume, Lighting Powers Growth

Painting & Wallpaper accounted for 21.25% of Sweden DIY home improvement market share in 2024, benefitting from ROT-eligible labor and affordable supplies. The segment’s accessible skill requirements and immediate visual payoff sustain repeat purchases. Tools, building materials, and kitchens follow, while flooring and electrical jobs skew toward hybrid install models requiring certified specialists for compliance.

Lighting grows fastest at a 7.4% CAGR because LEDs, smart switches, and motion sensors dovetail with tax-supported energy packages. The green-tech deduction covering 50% of storage batteries creates cross-category pull-through for integrated lighting-energy systems[3]. Plumbing lags under strict insurance rules mandating professional touchpoints, and lumber faces cyclical swings tied to commodity markets.

Note: Segment shares of all individual segments are available upon report purchase

By Distribution Channel: Traditional Stores Dominate, Digital Disruption Accelerates

DIY home-improvement stores delivered 62.25% of the Sweden DIY home improvement market size in 2024, anchored by wide assortments, consultative sales, and same-day pickup for urgent fixes. These outlets optimize project baskets by clustering materials under one roof.

Online platforms, expanding at 12.8% CAGR, capture research-savvy consumers who compare prices and book delivery in a single session. IKEA’s user data confirm that shoppers fluidly navigate between mobile apps, 3-D room planners, and showrooms. Specialty outlets retain value among electricians and trades requiring niche SKUs, while small rural hardware shops pivot to just-in-time community supply roles.

By Project Type: Maintenance Leads Market, Energy Retrofits Drive Future Growth

Maintenance & Repair represented 36.61% of the Sweden DIY home improvement market size in 2024, reflecting the country’s aging Million Homes Programme stock and severe winters. The ROT-avdrag lowers barriers for preventative upkeep, shifting behavior from reactive to scheduled interventions.

Energy-Efficiency Retrofits, climbing at an 8.2% CAGR, reshape priorities as households chase lower utility bills and carbon targets. Boverket’s rule demanding at least 20% performance gain propels comprehensive packages—insulation, heat pumps, and triple-glazed windows—rather than piecemeal fixes. Garden and outdoor works flourish every summer but remain weather-sensitive.

Note: Segment shares of all individual segments are available upon report purchase

By End-User: Houses Lead Market, Apartments Show Growth Potential

Owner-occupied houses held 47.72% share in 2024 owing to larger floorplates, exterior access, and fewer co-operative restrictions. Detached homes typically combine decking, façade, and landscape jobs, raising basket sizes and cross-selling ratios for retailers.

Owner-occupied apartments are set for 6.2% CAGR through 2030 as urban professionals channel earnings into interior makeovers and space-saving solutions. Sweden’s bostadsrätt model lets units upgrade kitchens or bathrooms individually, spurring demand for modular systems that avoid structural alteration. Rented dwellings lag, but new efficiency standards push landlords toward professional retrofits that still pull DIY-grade materials through trade counters.

Geography Analysis

Götaland generated 45.5% of 2024 revenue, underpinned by Stockholm’s USD 63,612 GRDP per capita and USD 24,738 household disposable income. Mature dwellings drive steady renovation cycles, while dense retail networks hold prices in check. Forestry-rich Skåne, with land at USD 18,600 per hectare, mirrors strong property wealth that feeds remodeling budgets.

Svealand balances urban Stockholm apartment work with rural cabin upkeep, sustaining diverse product demand. Uppsala’s 4% GRDP growth underscores economic momentum that filters into improvement spending. Construction investment remains elevated, encouraging retailers to deepen omnichannel penetration across the region’s mixed topography.

Norrland posts the swiftest 7.56% CAGR as mining booms entice a skilled workforce northward. Cold winters amplify the payoff from insulation and window upgrades, while sparse settlement patterns boost e-commerce penetration. Logistics hurdles persist, but seasonal bulk ordering and regional warehouses mitigate availability gaps.

Competitive Landscape

The Sweden DIY home improvement market features mid-level concentration with top national chains and regional cooperatives sharing shelves. Bauhaus, Byggmax, Clas Ohlson, Hornbach, Beijer, and Jula vie through price, assortment breadth, and loyalty ecosystems. None exceeds a double-digit share, leaving room for agile newcomers tackling smart-home niches or circular-economy ranges.

Most incumbents pursue omnichannel parity: click-reserve-collect services, AR-guided store navigation, and delivery slot selection synced with installation windows. Clas Ohlson’s USD 26 million stake in online grocer Mathem exemplifies adjacency bets that extend last-mile reach and data capture. Investments lean toward back-end efficiency—RFID inventory, AI demand forecasting—rather than disruptive store closures, preserving the tactile shopping element critical for color, texture, and fit decisions.

White-space lies in elderly-friendly kits, pre-configured solar-battery-EV bundles, and bio-based building materials. Retailers experimenting with subscription tool rentals and on-site coaching aim to bridge the skills gap among younger urban dwellers while capturing recurring revenue.

Sweden DIY Home Improvement Industry Leaders

-

Bauhaus Sverige

-

Byggmax Group

-

Clas Ohlson

-

Beijer Byggmaterial

-

Hornbach Sverige

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- March 2025: Rusta opened three new stores in Eksjö, Sölvesborg, and Ljusdal, Sweden, raising its total to 223 across four countries. The expansion is part of a revised plan to open 50–80 stores over three years, solidifying its leadership in the Nordic discount retail market.

- February 2025: Mio, a leading Swedish home improvement retailer, announced comprehensive restructuring and expansion plans to enhance market position and operational efficiency.

Sweden DIY Home Improvement Market Report Scope

The word "do-it-yourself" (DIY) refers to the process of creating, updating, or repairing anything without the help of professionals or specialists. The report includes a comprehensive background analysis of the DIY home improvement market. It also includes a market overview, market size estimation for key segments and emerging trends, market dynamics and insights, and key statistics. The market is segmented by product type, which includes lumber and landscape management, decor and indoor garden, kitchen, painting and wallpaper, tools and hardware, building materials, lighting, plumbing and equipment, flooring, repair and replacement, and electrical work, and by distribution channel including DIY home improvement stores, specialty stores, online, and others. The report offers market size and forecasts for the Swedish DIY home improvement market in terms of revenue (USD) for all the above segments.

| By Product Type | Lumber & Landscape Management |

| Decor & Indoor Garden | |

| Kitchen | |

| Painting & Wallpaper | |

| Tools & Hardware | |

| Building Materials | |

| Lighting | |

| Plumbing & Equipment | |

| Flooring Repair & Replacement | |

| Electrical Work | |

| By Distribution Channel | DIY Home-Improvement Stores |

| Specialty Stores | |

| Online | |

| Others | |

| By Project Type | Aesthetic Up-grades |

| Energy-Efficiency Retrofits | |

| Maintenance and Repair | |

| Garden and Outdoor Projects | |

| By End-User | Owner-Occupied Houses |

| Owner-Occupied Apartments | |

| Rented Dwellings | |

| By Region (Sweden) | Gotaland |

| Svealand | |

| Norrland |

| Lumber & Landscape Management |

| Decor & Indoor Garden |

| Kitchen |

| Painting & Wallpaper |

| Tools & Hardware |

| Building Materials |

| Lighting |

| Plumbing & Equipment |

| Flooring Repair & Replacement |

| Electrical Work |

| DIY Home-Improvement Stores |

| Specialty Stores |

| Online |

| Others |

| Aesthetic Up-grades |

| Energy-Efficiency Retrofits |

| Maintenance and Repair |

| Garden and Outdoor Projects |

| Owner-Occupied Houses |

| Owner-Occupied Apartments |

| Rented Dwellings |

| Gotaland |

| Svealand |

| Norrland |

Key Questions Answered in the Report

What is the current Sweden DIY home improvement market size?

The Sweden DIY home improvement market size stands at USD 15.23 billion in 2025 and is projected to reach USD 19.23 billion by 2030.

How fast is the Sweden DIY home improvement market growing?

The market is expanding at a 4.8% CAGR through 2030, supported by tax incentives and energy-efficiency mandates.

Which product segment holds the largest share?

Painting & Wallpaper leads with 21.25% Sweden DIY home improvement market share in 2024.

Why are energy-efficiency retrofits important in Sweden?

High power prices and government rebates drive an 8.2% CAGR for energy-saving upgrades, outpacing other project types.

How significant is e-commerce in Swedish DIY retail?

Online channels are growing at 12.8% CAGR as tech-savvy consumers integrate digital research with store visits.

Who are the key players in the Sweden DIY home improvement industry?

Bauhaus Sverige, Byggmax, Clas Ohlson, Hornbach, Beijer, and Jula headline a fragmented market where no single player exceeds a double-digit share.