Canada Pharmaceutical Market Analysis by Mordor Intelligence

The Canada pharmaceutical market, valued at USD 34.91 billion in 2025 with an anticipated rise to USD 43.92 billion by 2030, is expanding along a measured 4.70% CAGR that aligns neatly with Ottawa’s explicit goal of reducing supply-chain reliance on foreign active pharmaceutical ingredients. While these headline figures capture the trajectory, executive focus is sharpening on what the new domestic biomanufacturing build-out really signals: capital allocation is quietly shifting from late-stage sales and marketing budgets to early-stage technology transfer and process-validation expertise, indicating that firms expect regulatory certainty around good manufacturing practice to tighten further.

Key Report Takeaways

• The Canada pharmaceutical market size is USD 34.91 billion in 2025 and is forecast to reach USD 43.92 billion by 2030, representing a steady 4.70 % CAGR that is materially underwritten by publicly funded biomanufacturing incentives.

• Ontario remains the single-largest provincial opportunity with 37.8 % market share in 2024, yet Alberta’s compound growth outpaces all peers, confirming that population migration is beginning to redraw commercial call-plan maps.

• Specialty medicines drive a growing share of drug expenditure even as generics account for more than three-quarters of prescriptions, a pattern that signals ongoing margin compression in primary-care portfolios.

• Only 16.1 % of the CAD 5.3 billion (USD 3.98 billion) biologic drug market is served by biosimilars, highlighting an untapped savings pool that could become pivotal if a universal pharmacare bill passes.

• Domestic mRNA manufacturing build-outs, led by a 100 million-dose-per-year facility in Laval, suggest that Canada is positioning itself as a North American hub for advanced-therapy fill-finish capacity.

Canada Pharmaceutical Market Trends and Insights

Driver Impact Analysis

| Driver | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Rising Geriatric Population | +1.1 % | Nationwide, with highest density in Atlantic Canada and Quebec | Long term (≥ 4 years) |

| Growing Burden of Chronic Diseases (Diabetes, Oncology) | +0.9 % | Urban corridors of Ontario, British Columbia, Alberta | Medium term (2-4 years) |

| Federal Biomanufacturing & Life-Sciences Strategy Incentives | +0.8 % | Quebec and Ontario industrial clusters | Short term (≤ 2 years) |

| Growing Demand for Innovative Drugs | +0.7 % | Pan-Canadian but most acute in tertiary care centers | Medium term (2-4 years) |

| Expansion of Specialty Pharmacy Networks for High-cost Biologics | +0.5 % | Major metropolitan areas | Short term (≤ 2 years) |

| Strong Research and Development Capabilities | +0.4 % | Toronto–Waterloo and Montréal innovation corridors | Long term (≥ 4 years) |

Source: Mordor Intelligence

Rising Geriatric Population: Demographic Inflection Point

The share of Canadians aged 65 and above is expected to climb from 18.9% in 2023 to as high as 32.3% by 2073, according to Statistics Canada[1]Statistics Canada, “Population Projections for Canada, Provinces and Territories, 2023 – 2073,” Statistics Canada, statcan.gc.ca. Embedded in that statistic is an operational reality: across many therapeutic areas, wholesalers are already adjusting inventory models toward smaller pack sizes that better match chronic-disease dosing regimens common among fixed-income seniors. This logistical recalibration hints that distributors increasingly regard medication adherence, rather than sheer volume throughput, as the next differentiator in a margin-squeezed environment.

Federal Biomanufacturing & Life Sciences Strategy: Reshaping Supply Chains

Since March 2020 the federal government has announced CAD 2.2 billion (USD 1.65 billion) in support for home-grown vaccine, biologic and advanced-therapy production, a commitment that accelerates a pivot away from the historical “formulate-and-finish” dependency on the United States and Europe[2]Innovation, Science and Economic Development Canada, “Federal Biomanufacturing and Life Sciences Strategy,” Innovation, Science and Economic Development Canada, ised-isde.canada.ca. An under-appreciated implication is the resultant rebalancing of clinical-trial geography: contract research organizations are already redeploying monitoring staff toward Quebec and Ontario to capitalize on the faster feedback loops that a local supply base enables for Phase I biologic batches.

Growing Demand for Innovative Drugs: Precision Medicine Acceleration

Oncology continues to act as the bellwether for precision medicine adoption. Health Canada’s approval of cemiplimab in combination with platinum chemotherapy reflects a regulator prepared to endorse combinations that improve survival while raising per-patient spend. Insurers, in turn, are piloting genomic-profiling reimbursement so they can triage high-cost immunotherapies to biomarker-defined populations. This triangulation between regulator, payer and diagnostics supplier suggests that companion-diagnostic value capture may soon rival the drug margin itself.

Growing Burden of Chronic Diseases: Specialty Treatment Surge

Diabetes prescriptions overtook antihypertensives as the most reimbursed class in public drug programs during 2023, illustrating how payer budgets increasingly tilt toward metabolic disorders. Behind the scenes, hospital formularies are beginning to negotiate outcome-based contracts for next-generation glucose-lowering agents—a sign that administrators are treating cardiometabolic control as an integrated quality metric rather than a siloed drug cost. That re-framing could ripple outward, compelling primary-care networks to adopt shared-savings models tied to hemoglobin A1c benchmarks.

Restraint Impact Analysis

| Restraint | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| High List Prices of Innovative Medicines | -0.60% | Greatest headwinds in provinces with capped public-plan budgets | Short term (≤ 2 years) |

| Lengthy Health-Canada Review & Listing Timelines | -0.50% | Particularly affects smaller provinces lacking parallel private-plan coverage | Medium term (2-4 years) |

| PMPRB Price Ceiling Tightening | -0.40% | National scope but highest exposure for multinational launch portfolios | Short term (≤ 2 years) |

| Limited Access to Pharmacy Channel | -0.30% | Rural and northern territories | Long term (≥ 4 years) |

Source: Mordor Intelligence

High List Prices of Innovative Medicines: Access Barriers

The Canadian Institute for Health Information notes that specialty drugs account for over 30 % of public-plan outlays while comprising a fraction of claims [3]Canadian Institute for Health Information, “Pan-Canadian Prescription Drug Data Landscape, 2025,” Canadian Institute for Health Information, cihi.ca. That skew has catalyzed discussion around national catastrophic coverage pools, with actuaries modeling scenarios in which a single entity reinsures private-plan exposure above a predefined threshold. If implemented, such pooling would compress price/volume negotiations into one annual auction cycle, diluting manufacturer leverage derived from fragmented deal flow and potentially moderating premium growth for middle-market employers.

Lengthy Health-Canada Review & Listing Timelines: Innovation Lag

Even with the introduction of a time-limited recommendation pathway in 2023, only a single oncology therapy reached formulary status within ten months—half the traditional 581-day window. Multinationals are responding by staging Canada as a “second-wave” launch market behind the United States, the European Union and, increasingly, Australia. The tacit risk is that clinical-trial enrollment may shift accordingly, depriving domestic research centers of early access to disruptive therapeutics and the spill-over economic benefits they confer.

Segment Analysis

Cardiovascular Dominance Faces Disruption in ATC / Therapeutic Class Segment

Cardiovascular drugs held 14.2% share in 2024, yet the antineoplastic and immunomodulating agents segment is projected to expand at 6.8% CAGR through 2030. A subtle but influential shift is underway: cardiologists are adopting polygenic-risk scoring to stratify statin initiation, effectively redefining “primary prevention” cohorts. That practice could curtail volume growth in lipid-lowering therapy while redirecting developmental capital toward inflammation-modulating cardio-oncology crossovers.

Note: Segment shares of all individual segments available upon report purchase

Generic Expansion Challenges Branded Dominance in Drug Type Segment

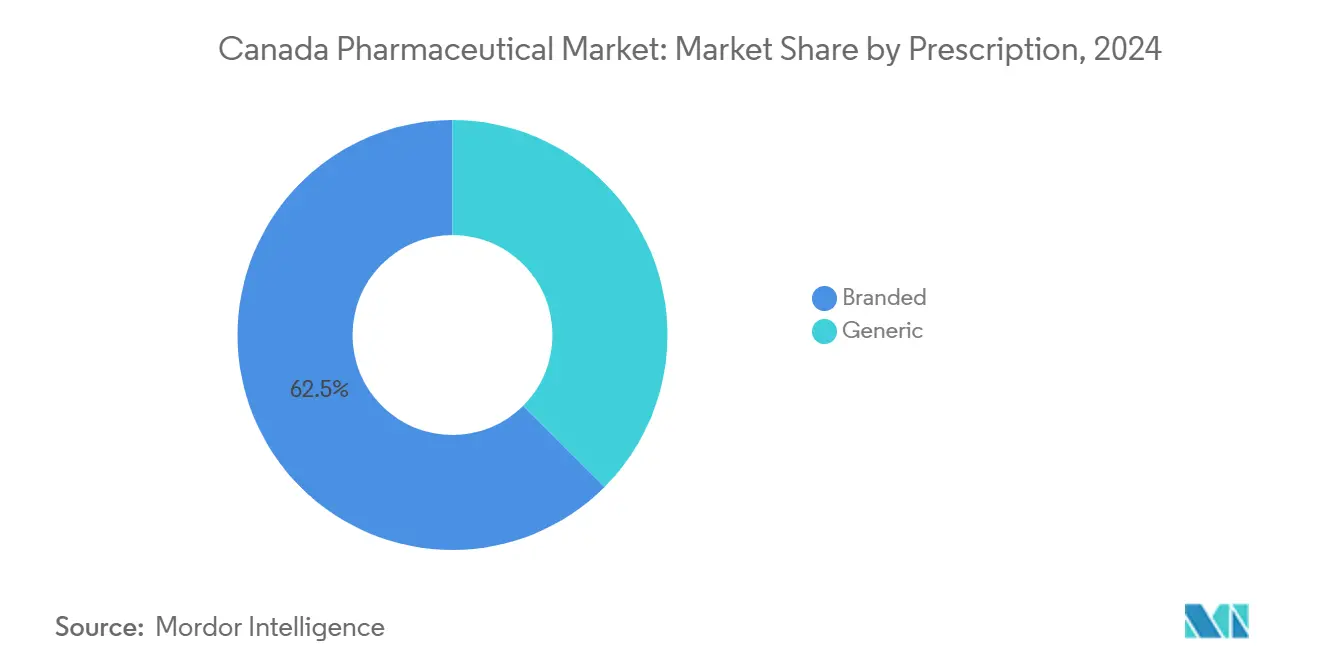

Branded prescriptions still command 62.5% of market value even though generics make up more than three-quarters of scripts dispensed. Executives note an emerging pattern: pharmacists vested with independent prescriptive authority are increasingly selecting generic molecules as first-line therapy, but retaining branded products for clinically complex cases. This bifurcation suggests that brand equity will depend less on direct-to-consumer advertising and more on differentiated real-world evidence that reinforces therapeutic superiority.

Note: Segment shares of all individual segments available upon report purchase

Digital Disruption Accelerates in Distribution Channel Segment

Retail pharmacies captured 72.1% market share in 2024. Yet online pharmacy revenue is forecast at a 7.9% CAGR between 2025 and 2030, a pace underscoring how telemedicine platforms are collapsing the boundary between consultation and fulfillment. One second-order effect: logistics providers are investing in cold-chain micro-warehousing close to urban centers so that temperature-sensitive biologics can meet same-day delivery windows demanded by virtual clinics—an infrastructural tweak with considerable capital-spending implications.

Geography Analysis

Ontario dominates the Canadian pharmaceutical landscape with spending above CAD 11 billion (USD 8.25 billion) a year, half of which is consumed by seniors. Provincial policy makers are reassessing whether income-based deductibles truly deliver equity, as evidence accrues that seniors juggle multiple therapies and therefore face compounding co-payments. If a national pharmacare scheme were to materialize, Ontario’s sizeable private-payer infrastructure might be redeployed toward supplemental benefits, effectively repositioning insurers as service integrators rather than primary drug financiers.

Alberta’s health outlays reached CAD 45 billion (USD 33.75 billion) in 2024, equating to CAD 9,370 (USD 7,028) per capita versus a national average of CAD 9,054 (USD 6,791). Behind the headline, administrators are piloting drug-cost off-ramps that include therapeutic interchange policies and biosimilar switching incentives. Those measures reflect an executive belief that bending the cost curve on pharmaceuticals may buy political latitude to invest in under-resourced rural hospitals—a trade-off that reshapes the strategic sales focus for specialty-care reps.

Quebec distinguishes itself with mandatory drug insurance that splits premium burden between government and citizens, a configuration that expands formulary breadth but caps price escalation via reference pricing. British Columbia’s aggressive biosimilar substitution policy signals a willingness to trade rapid uptake for short-term physician pushback. Manufacturers are thus prioritizing stakeholder-management resources in provinces where policy volatility can swing quarterly revenue run-rates.

Competitive Landscape

A moderately concentrated market features Pfizer, Novartis and Johnson & Johnson alongside domestic champion Apotex. Biosimilar penetration at only 16.1 % underscores white-space potential, but market entry timing must account for upcoming Patented Medicine Prices Review Board (PMPRB) ceiling tightening, which could clip launch-price headroom. Moderna’s 100 million-dose mRNA facility in Laval is already igniting interest from mid-cap biotechs seeking North American fill-finish partners, suggesting that domestic CMO capacity could soon trade at a premium. Meanwhile, private-equity ownership of Apotex unlocks capital for bolt-on acquisitions; early signals indicate a preference for complex-generic assets with vertical formulations expertise, a strategy that aims to mitigate commodity pricing pressure in oral solids.

Canada Pharmaceutical Industry Leaders

-

Pfizer Inc.

-

Apotex Inc.

-

Johnson & Johnson (Janssen)

-

Novartis AG

-

F. Hoffmann-La Roche AG

- *Disclaimer: Major Players sorted in no particular order

Recent Industry Developments

- February 2025: Health Canada released the “Pan-Canadian Prescription Drug Data Landscape,” confirming that Canadian list prices rank among the highest in the OECD and introducing draft legislation for a universal pharmacare framework.

- June 2024: Pfizer Canada announced a CAD 4.9 million (USD 3.68 million) research grant to McMaster University aimed at optimizing multiple-myeloma care pathways.

- May 2024: The Canadian Generic Pharmaceutical Association initiated a nationwide stakeholder-education campaign titled “Myth vs. Reality,” underscoring the budgetary relief generics generate.

Canada Pharmaceutical Market Report Scope

As per the scope of this report, pharmaceuticals are referred to as medications or medicinal drugs intended to prevent, diagnose, treat, or cure a disease. They may be prescription or non-prescription drugs. The Canadian pharmaceutical market is segmented by ATC/therapeutic class, drug type, distribution channel, and province. By ATC/therapeutics class, the market is segmented by alimentary tract and metabolism, blood and blood-forming organs, cardiovascular system, dermatologicals, genito-urinary system and sex hormones, systemic hormonal preparations, antiinfectives for systemic use, antineoplastic and immunomodulating agents, musculoskeletal system, nervous system, antiparasitic products, insecticides and repellents, respiratory system, sensory organs, and other ATC/therapeutic classes. By drug type, the market is segmented into prescription type and OTC drugs. The prescription type is further bifurcated into branded and generic. By distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. By province, the market is segmented into Ontario, Quebec, British Columbia, Alberta, and the Rest of Canada. The report offers the value (in USD billion) for the above segments.

| By ATC / Therapeutic Class | Alimentary Tract & Metabolism | ||

| Blood & Blood-forming Organs | |||

| Cardiovascular System | |||

| Dermatologicals | |||

| Genito-Urinary System & Sex Hormones | |||

| Systemic Hormonal Preparations | |||

| Antiinfectives for Systemic Use | |||

| Antineoplastic & Immunomodulating Agents | |||

| Musculoskeletal System | |||

| Nervous System | |||

| Antiparasitic Products, Insecticides & Repellents | |||

| Respiratory System | |||

| Sensory Organs | |||

| Other Therapeutic Classes | |||

| By Drug Type | Prescription | Branded | |

| Generic | |||

| OTC Drugs | |||

| By Distribution Channel | Hospital Pharmacies | ||

| Retail Pharmacies | |||

| Online Pharmacies | |||

| By Province | Ontario | ||

| Quebec | |||

| British Columbia | |||

| Alberta | |||

| Rest of Canada | |||

| Alimentary Tract & Metabolism |

| Blood & Blood-forming Organs |

| Cardiovascular System |

| Dermatologicals |

| Genito-Urinary System & Sex Hormones |

| Systemic Hormonal Preparations |

| Antiinfectives for Systemic Use |

| Antineoplastic & Immunomodulating Agents |

| Musculoskeletal System |

| Nervous System |

| Antiparasitic Products, Insecticides & Repellents |

| Respiratory System |

| Sensory Organs |

| Other Therapeutic Classes |

| Prescription | Branded |

| Generic | |

| OTC Drugs |

| Hospital Pharmacies |

| Retail Pharmacies |

| Online Pharmacies |

| Ontario |

| Quebec |

| British Columbia |

| Alberta |

| Rest of Canada |

Key Questions Answered in the Report

How large is the Canada pharmaceutical market in 2025?

The market size is estimated at USD 34.91 billion for 2025.

What is the projected Canada pharmaceutical market size in 2030?

It is forecast at USD 43.92 billion, underpinned by a 4.70 % CAGR.

Which province commands the largest market share?

Ontario leads with 37.8 % share, driven by population density and healthcare infrastructure.

How significant is the biosimilar segment today?

Biosimilars currently address roughly one-sixth of the biologic market, indicating ample headroom for cost-saving uptake.